In certain quarters, “scientific” quarters, the Chinese haven’t just done a fantastic job managing their own outbreak of COVID-19, the Communist government has produced a pandemic response model for the entire world to envy. After all, according to the WHO’s most recent data (up to December 15, 2021), only 5,697 of the nation’s citizens have died of (with?) corona since the whole thing began. Outside the WHO and partisan political circles, of course, no one believes these numbers; nor should they since that tally is evidently fake. While case counts and cumulative death statistics are made to flatter China’s pandemic performance, the economic statistics tell a far different story – even though these have been questioned for even longer than the COVID figures.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

| In certain quarters, “scientific” quarters, the Chinese haven’t just done a fantastic job managing their own outbreak of COVID-19, the Communist government has produced a pandemic response model for the entire world to envy. After all, according to the WHO’s most recent data (up to December 15, 2021), only 5,697 of the nation’s citizens have died of (with?) corona since the whole thing began.

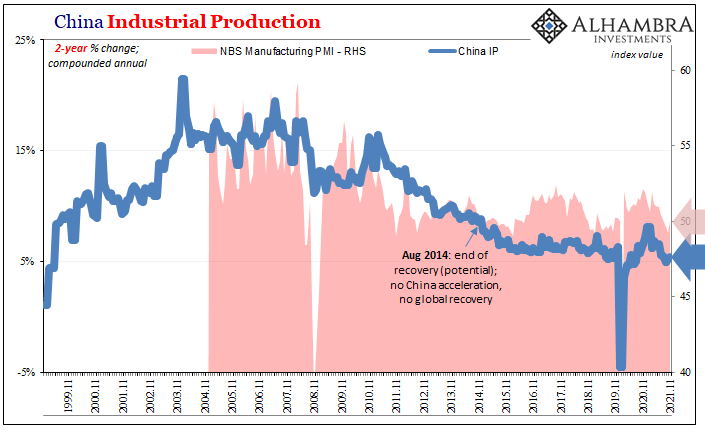

Outside the WHO and partisan political circles, of course, no one believes these numbers; nor should they since that tally is evidently fake. While case counts and cumulative death statistics are made to flatter China’s pandemic performance, the economic statistics tell a far different story – even though these have been questioned for even longer than the COVID figures. Those doubts as to the possible “real” economic picture these accounts present are likewise about the government padding the stats. In this case, unlike the pandemic data, if this year’s estimates indeed have been padded then we have no need to further decipher as to how much. Taking them at face value will be more than sufficient. Why? They are that bad. Consistently. Thus, in terms of China’s Big Three – Industrial Production (IP), Retail Sales (RS), and Fixed Asset Investment (FAI) – if this is what the “managed” numbers look like, we can use them as they are as a kind of best case for the Chinese economy. If the best possible case is this continuously terrible… Quick to blame corona itself, that would only make sense in isolated cases. Either regions or more realistically in time. What I mean is, sure, there have been a few months (like August this year) since January 2020 when Chinese authorities have clamped down hard. By doing so, there has been some arguable level of economic disruption. Every month, though? For almost two years? |

|

COVID has become the go-to excuse, China’s government as guilty as every Western “analyst” of doing this. In light of another truly bad retail sales estimate for November 2021, among the Big Three released last night, the NBS (National Bureau of Statistics) spokesman, Fu Jiaqi, carefully cited that one thing before equally carefully avoiding scrutiny of any other possible explanations:

And those “other factors” were? In the media outside of China, you’ll hear about pollution mandates and the availability of electricity. Like the coronavirus defense, however, none of them actually explain especially the entire year of 2021 (all eleven of its months so far, anyway) and its ongoing, unbroken struggle. Growth scare. By the numbers: starting with IP, output increased by 3.8% year-over-year for the Chinese industrial colossus when once 8% growth had been considered a catastrophe (this August 2014). Even pre-COVID, there were no 4% months, at least not until the globally synchronizing recession showed up around Summer 2019. Now, in the throes of what everyone says is a robust, inflationary growth situation, the key sector of the one economy the whole world is dependent upon for that inflationary growth potential can’t even meet the bottom-levels of the previous deflationary recession at any point. |

|

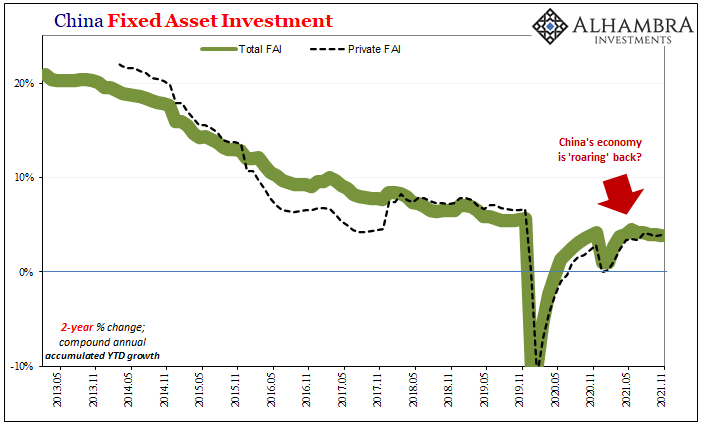

| FAI rose just 5.2% year-over-year on an accumulated basis (that is, comparing total FAI spending in the eleven months of 2021 to FAI spending in the same eleven months of 2020). Already among the lowest in history, too, taking account of some leftover base effects in even that figure, the 2-year change also below 4%.

Private FAI, which has been the mode of socio-economic advance since the early 90’s, is again on the wane from an already-lesser recent top. Accumulated private FAI was up 7.7% in November, but just 3.9% on a compounded annual basis when compared to private FAI accumulated in 2019. Furthermore, as we’ve been saying for more than a year, Xi Jinping isn’t firing up the fiscal “stimulus” despite all these seriously awful statistics. |

|

| State-owned FAI on an accumulated basis has been fading far faster than the private side; just 3% up to last month. |

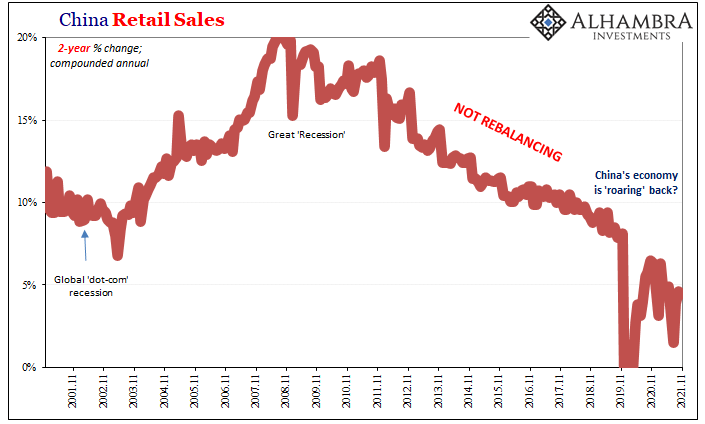

Finally, those retail sales estimates Mr. Fu tried to talk up (or was it down?) in his forced Q&A. As we had pointed out also for years, RS growth had never been below 8% (apart from one statistical quirk ages ago) and hadn’t actually been anywhere close, at least not until that same deflationary summer of 2019. Even then, never below 7%.

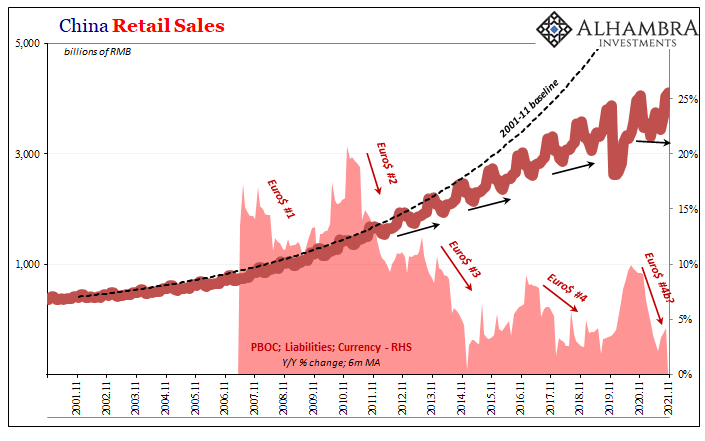

For November 2021, the year-over-year change was a tiny 3.9%; just a 4.4% annual compounded rate on a 2-year comparison. Using the latter data, retail sales have been less than 5% each of the last eight months, and below 6.5% every single month since the first months of COVID recession which for China began right at the start of January 2020.

Does China’s overly eager authoritarian response to various additional outbreaks to the pandemic really explain these figures? All of them one after another? For each and every month since, really, that summer in 2019?

Of course not. The Chinese appear to be using COVID as a ruse, a way to disguise how authorities from the top on down have let the economy fall closer to its more natural, eurodollar-defiled state. What is this Evergrande fiasco otherwise? Xi Jinping is purposefully to manage the decline of the real estate sector (hopefully, he believes, before it blows up) which would certainly account for some of the apparently permanent downshift in Chinese growth (as would the lack of global recovery).

People there as well as here are more likely to be untroubled if the Communists and the Western media say corona is the cause of some “temporary” weakness – that obviously isn’t temporary.

In order to keep deaths so low, to keep up the ruse, anyway, they claim to be coming down hard on the economy.

There’s no comparing the difference in messaging: temporary and minor softness understandable even commendable during a global pandemic context rather than permanently slower below a level once thought not long ago to have been impossibly slow and awful to which COVID has merely added another layer of misery and decay.

In the grand scheme of the 19th Party Congress’s mandated recognition – “quality” growth in place of quantities of economic advance the Communists realized were never coming back – the coronavirus has been especially timely, a stroke of master fortune, politically speaking. And since hardly any Chinese have died from it, by their own account, the government’s handling does appear superb if in all the wrong, deceit-filled ways.

The one set of statistics clearly faked; the other probably so but even so what they show us is enough anyway. For each of them, none of this is really about COVID.

For poor, clueless Jay Powell, like 2019 he’s going to chase his own pseudo-statistic, the US unemployment rate, regardless of either the coronavirus or what China’s managed-yet-awful economic data shows. Small wonder the global curves; everything is fake!

Tags: Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter