Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI. And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After the dreadful experience of the Great Inflation, and the dreadful performance of Economics during it, a few scholars went back to take a second look. One of the most cited contrary studies was published in 1995 by Todd Clark of the Federal Reserve’s branch in Kansas City (Economic Review; vol. 80, issue Q III, 25-39).

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Central Banks, Consumer Prices, currencies, Deflation, disinflation, economy, Featured, Federal Reserve, Federal Reserve/Monetary Policy, inflation, Markets, Money Supply, newsletter, producer prices

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.

And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After the dreadful experience of the Great Inflation, and the dreadful performance of Economics during it, a few scholars went back to take a second look.

One of the most cited contrary studies was published in 1995 by Todd Clark of the Federal Reserve’s branch in Kansas City (Economic Review; vol. 80, issue Q III, 25-39). Using econometric evidence, Clark found that, no, on balance there wasn’t much from which we could use the PPI to predict the CPI.

In fact, his work showed that models omitting the PPI performed better than those having including this set of numbers (there is more than one piece of the PPI, and Clark tested several).

If you think about it a little further, you don’t really need to run regressions. Producer price costs are but a single factor in the overall economic picture and thus only one input for many potential outcomes. As Clark wrote twenty-six years ago:

The simple analysis treats input materials prices as the primary determinant of production cost, and it presumes the markup of price over cost is constant. More generally, however, production cost depends on elements other than input materials. And the markup of price over cost may vary.

Several subsequent studies have tried to refute Clark’s findings, though their own were, shall we say, at best more complicated than anyone may have realized.

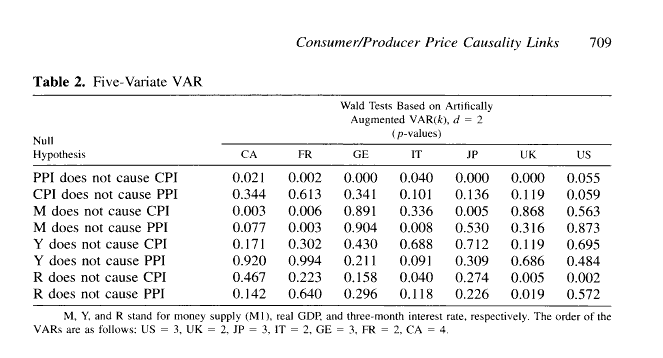

One of these was published in 2002 by a trio of researchers who sought to discount Mr. Clark by including several variables he hadn’t. Since the general topic is really the processes of inflation, the ’02 group tested monetary indications as potentially causative factors; and did so for seven different countries.

But their version of monetary indications may not have been what they actually were, though uncontroversial at the time:

We therefore considered a five-variate VAR, including the money supply (M1), real gross domestic product (GDP), and the three-month interest…The inclusion of these variables aims at capturing the transmission mechanism of monetary policy.

But did they actually measure monetary policy? Perhaps, instead, even using something like M1 (setting aside our serious objections to it) what regressions and variables had captured had been monetary conditions overall which were then linked, without support, to central bank policies; as everyone did back then, and, frustratingly, still does today. Money and monetary policies are used interchangeably.

What if change in the monetary system regardless of the Fed or any NCB’s (later ECB) had determined economic outcomes including prices across various parts of the supply chain?

Even the conclusion leaves open the possibility though the paper’s authors never considered it.

The absence of this causality link [CPI to PPI] when one allows for the transmission of monetary policy may imply that monetary authorities react to inflationary pressures so that the CPI impact on the PPI is eliminated through the inclusion of monetary variables.

Yes, but, again, policy or actual money variables everyone conflates with central bank activities?

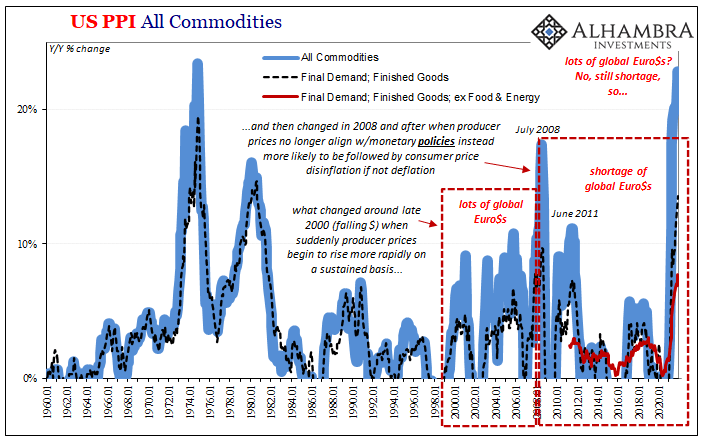

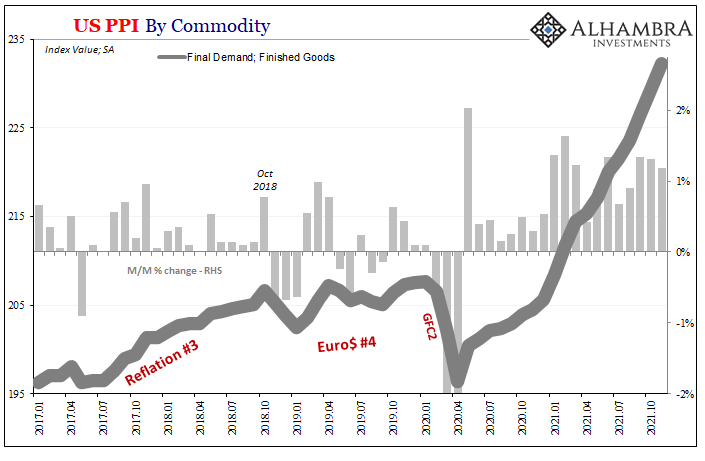

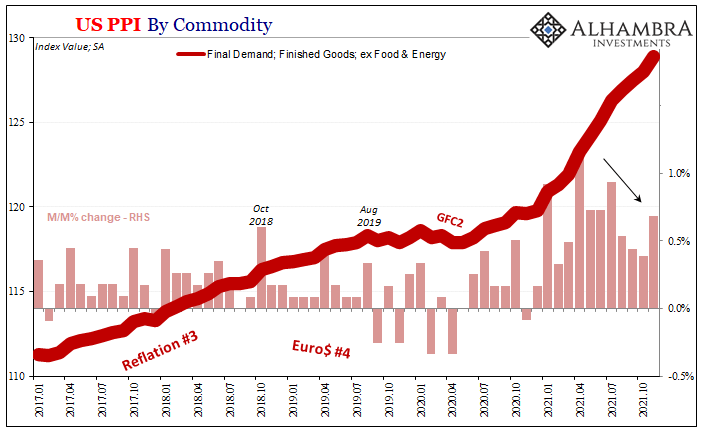

Either way, the 21st century’s experience with producer leading consumer prices is, at best, tortuous. Something seems to have changed.

From the dawn of it to around, oh, July 2008, US PPI numbers were relatively high while CPI estimates weren’t nearly so. Both were higher than they had been in the nineties, but on the one hand it didn’t seem to argue for the supply chain hypothesis (Clark), not in full anyway.

On the other, the economy (globally) seemed quite able to handle the sudden and sustained if historically mild rise in prices across-the-board – the same period when, remember, the US$’s exchange value had been falling and Ben Bernanke was stunned by the apparent external growth in money (which then led him to later and erroneously theorize a global savings glut rather than admit to the eurodollar’s maximum ascent).

But, the apex of the PPI in the 2000’s was July 2008, when immediately thereafter both PPI and CPI alike turned downward (outright deflation) despite that 2002 paper’s assertion how with a lag of two quarters and factoring for money policy which by the middle of 2008 had come to be thought of as “highly accommodative.”

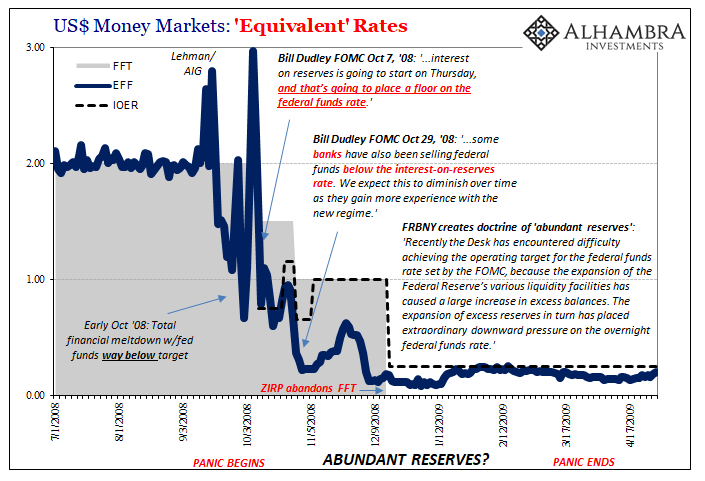

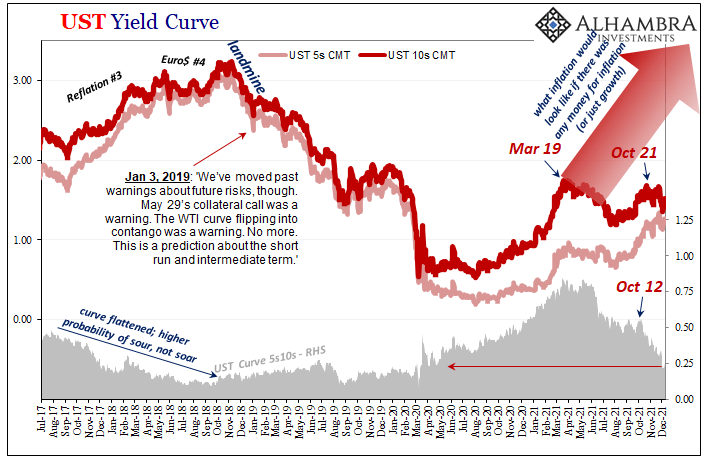

Not policy, actual money; late 2007 was when monetary policy and actual monetary conditions parted company, to put it mildly. By all “predictive” accounts, consumer prices should have accelerated much farther well into 2009 – certainly what the ECB was thinking with its rate hike that very July 2008 – but they didn’t. Quite the opposite, actually.

Clark was right; as may have the 2002 paper had its authors been able to separate money from monetary policy.

If there isn’t the monetary expansion for any prices at any level of the supply chain, then input costs as they may relate to consumer prices aren’t so straightforward. In fact, we may even expect them to be upside-down.

In other words, with no money behind producer prices or consumer prices (say, instead, something like a supply shock), then far faster producer prices might contribute, as they sure seemed to in later 2008, to the other way for consumer prices.

Quite simply, as Clark was testifying more than a quarter-century ago, while money may make things simple without money it gets complicated real quick; in this other case, producer prices end up destroying margins, defeating labor, and leading to businesses who can’t pass along consumer prices and eventually suffer reverses as profitability shrinks.

It’s the same general outline of the supply chain hypothesis, producer prices causing consumer prices, though corrected by sign for the monetary times and the wider economic misfortunes experienced by them.

Sure, but what’s the evidence for it? I’m certainly not going to spend my time running regressions, bivariate, five-variate or any other, because I don’t believe it’s necessary. We need only look to the recent past along with what we can say for actual money conditions (not policy) coming into the visible future.

That breakdown in the middle of 2008 sure seems dispositive.

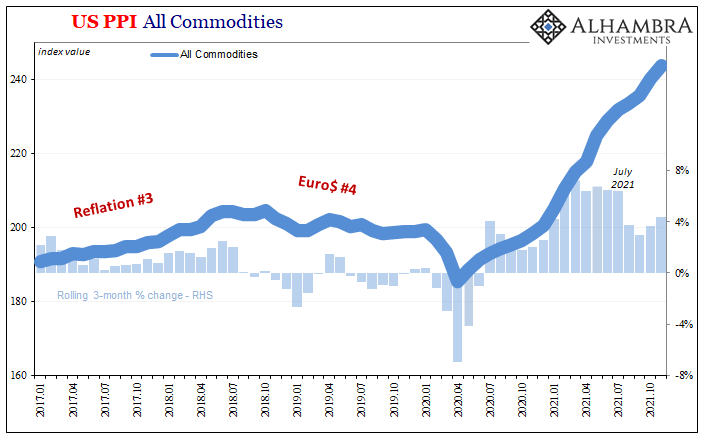

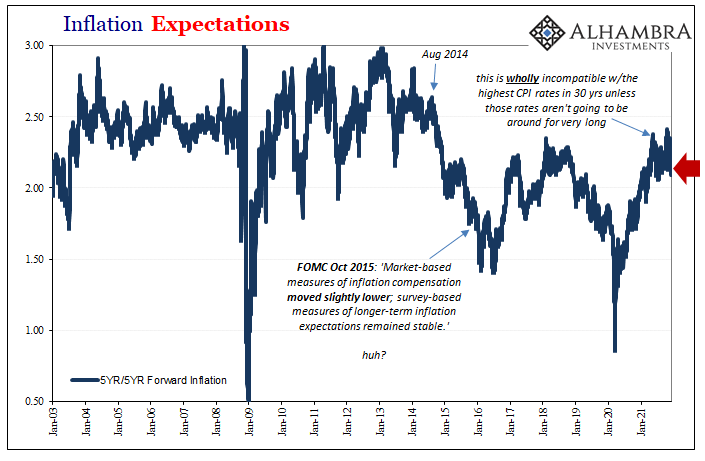

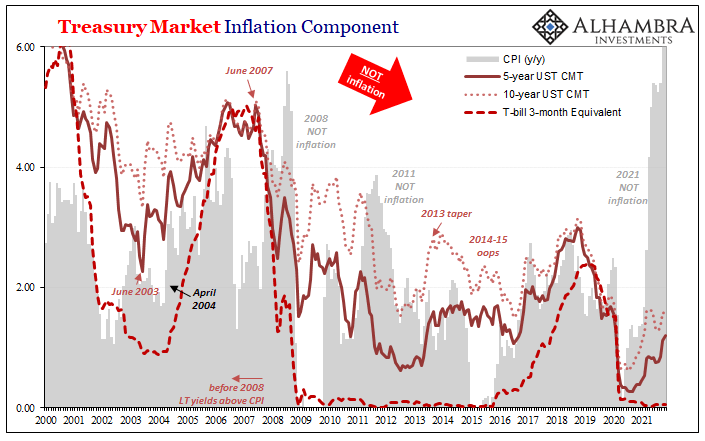

In other words, no matter how high the PPI goes, and it has gone skyward lately, inflation expectations like bond and money curves only grow more and more pessimistic – as in, not inflation.

What seems to be two very different and opposing sets of data, high PPI’s plus less-high CPI’s on the one side, the global bond market decidedly on the other, will perform a real-world test for us as the world closes out 2021 and begins 2022. Just like 2008, and unlike Economists, we already have data for our monetary variable in hand (tight and getting tighter).

With that data, we expect these changes in the PPI to still “cause” future changes in the CPI in the same way they had before in 2008 or 2011 – once more, the sign reversed – unlike the earlier decade of the 2000’s where there had been constant money flow around the world to keep the influence modestly positive.

With money and credit flowing, businesses have shown they are able to more easily absorb input costs because general economic conditions allow them to, whereas when money and credit don’t flow input costs can become (simplifying several steps) a serious deflationary problem (among others).

Tags: Bonds,central-banks,Consumer Prices,currencies,Deflation,disinflation,economy,Featured,Federal Reserve/Monetary Policy,federal-reserve,inflation,Markets,Money Supply,newsletter,producer prices