Stimulus talks drag on; US November CPI will be today’s data highlight; US Treasury wraps up a big week of auctions today with bln of 30-year bonds on offer The November budget statement will hold some interest; weekly jobless claims will be closely watched; Brazil left rates unchanged at 2.0% but made some important hawkish changes to its forward guidance; Peru is expected to keep rates steady at 0.5% Brexit negotiations have been extended again; two-day EU summit begins; ECB is widely expected to add more stimulus; UK data was mostly weaker in October Japan estimates the latest stimulus package will boost GDP by JPY20.1 trln; China will start collecting extra duties on Australian wine starting tomorrow; default risk in the Chinese corporate sector remains a

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Stimulus talks drag on; US November CPI will be today’s data highlight; US Treasury wraps up a big week of auctions today with $24 bln of 30-year bonds on offer

- The November budget statement will hold some interest; weekly jobless claims will be closely watched; Brazil left rates unchanged at 2.0% but made some important hawkish changes to its forward guidance; Peru is expected to keep rates steady at 0.5%

- Brexit negotiations have been extended again; two-day EU summit begins; ECB is widely expected to add more stimulus; UK data was mostly weaker in October

- Japan estimates the latest stimulus package will boost GDP by JPY20.1 trln; China will start collecting extra duties on Australian wine starting tomorrow; default risk in the Chinese corporate sector remains a salient concern

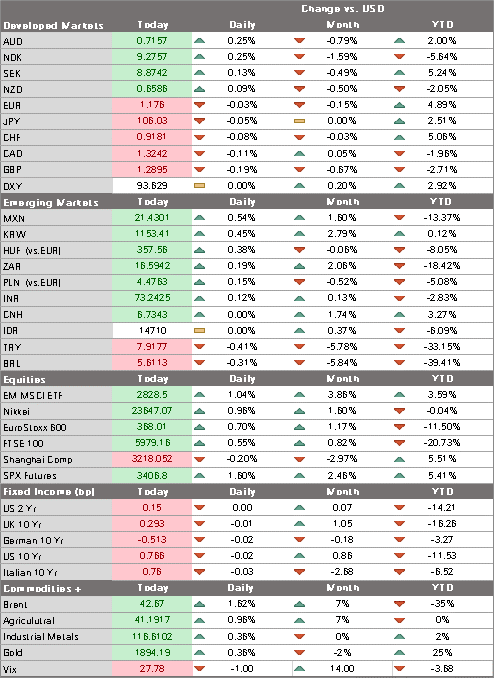

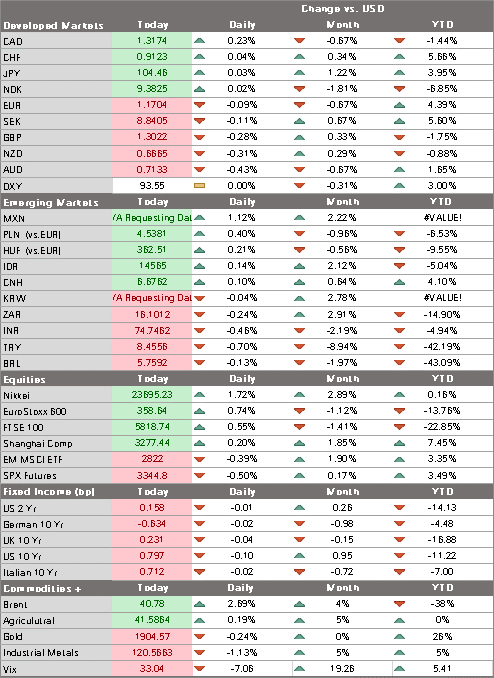

The dollar rally is running out of steam. After three straight up days, DXY is down today as the 91 area is providing stiff resistance. Once the event risk clears up totally, we believe dollar weakness will intensify and we continue to target the February 2018 low near 88.253 for DXY. The euro is holding up near $1.21 after yesterday’s sell-off (see below), while sterling continues to soften on Brexit uncertainty and is testing support near $1.33. USD/JPY is still holding above 104, which is surprising given the event risk this week. We still look for a clean break below 104 and an eventual test of the November low near 103.20.

AMERICAS

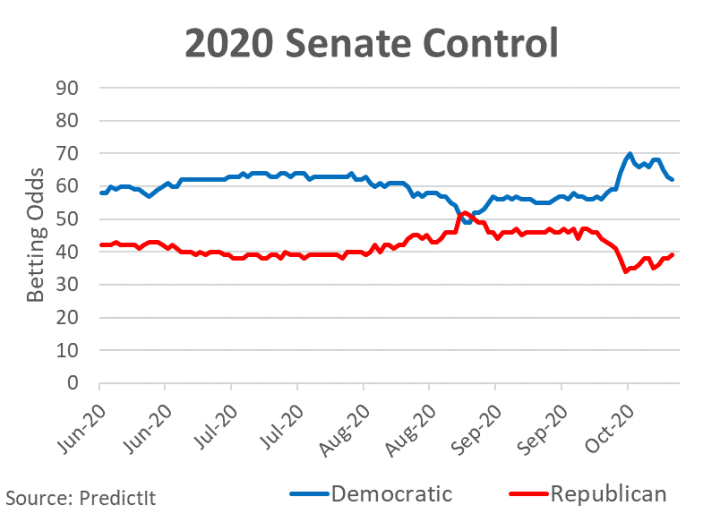

Stimulus talks drag on. As a result, the House of Representatives passed a one-week continuing resolution by a 343-67 margin to keep the government funded and allow more time for negotiations. That resolution now goes to the Senate and it expected to pass there easily. The omnibus spending bill is not the real issue here, but rather the pandemic relief bill that will likely be attached to it.

Democratic Senator Coons said he and his colleagues will release a compromise proposal on liability protections in an effort to break the deadlock. Coons said it would contain a six-month moratorium on all coronavirus-related lawsuits and also provide employers that are sued enhanced abilities to defend themselves. The other major sticking point is aid to state and local governments. However, another potential problem area has cropped up. Mnuchin’s plan includes a one-time $600 payment to individuals but cuts the weekly supplemental weekly jobless benefits. This differs from the bipartisan proposal that includes $300 weekly supplemental benefits but leaves out the one-time payment.

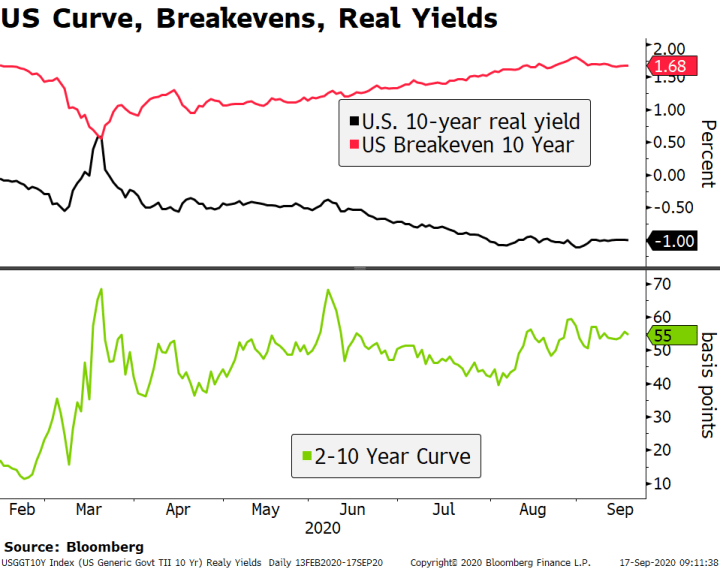

US November CPI will be today’s data highlight. Headline inflation is expected to fall a tick to 1.1% y/y while core is expected to fall a tick to 1.5% y/y. PPI will be reported Friday. Headline is expected to rise a couple of ticks to 0.7% y/y while core is expected to rise a few ticks to 1.5% y/y. Given the softening labor market, we simply cannot get too concerned about inflation risks. We believe wage pressures remain the single biggest factor behind broader price pressures and with nearly 10 mln jobs still lost and nearly 20 mln collecting unemployment benefits, those pressures are just not very likely near-term.

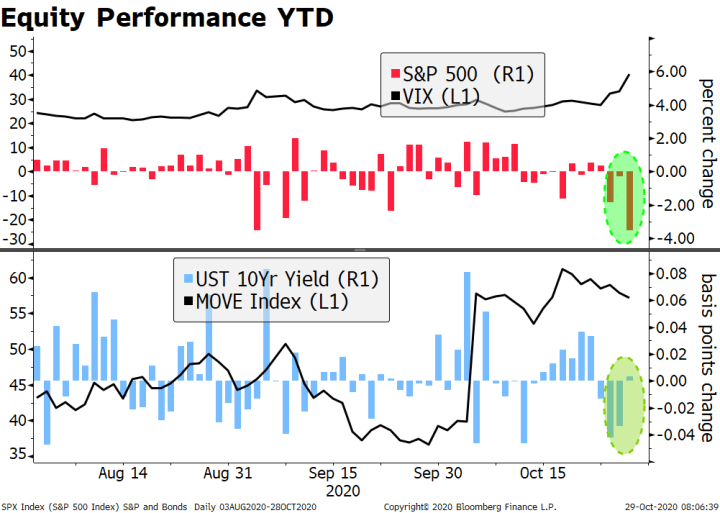

The US Treasury wraps up a big week of auctions today with $24 bln of 30-year bonds on offer. Yesterday, it sold $38 bln of 10-year notes and on Tuesday sold $56 bln of 3-year notes. The auction metrics so far have been somewhat mixed, but indirect bidders have been big participants and that suggests strong foreign demand. When all is said and done, the Treasury should be happy that the market was able to absorb the near record $118 bln issuance this week at low yields and causing little market turbulence.

The November budget statement will hold some interest. A deficit of -$199 bln is expected vs. -$284 bln in October. If so, the 12-month total would fall slightly to -$3.27 trln. Upward pressure on the deficit will be maintained next year, however. Not only will the next stimulus package add to outlays, but the sluggish recovery will weigh on receipts. The Congressional Budget Office’s most recent forecasts see deficits of -$1.81 trln and -$1.336 trln for FY21 and for FY22, respectively. Coming off a -$3.311 trln deficit for FY20, we see upside risks to these forecasts.

In light of the disappointing November jobs data, weekly jobless claims will be closely watched. Regular initial claims are expected at 725k vs. 712k the previous week, while regular continuing claims are expected at 5.21 mln vs. 5.52 mln the previous week. Despite the marginal improvements being seen in recent claims data, it’s clear that the labor market remains under stress and it’s only getting worse as lockdowns widen and deepen. November real earnings will also be reported.

Brazil central bank left rates unchanged at 2.0% as expected but made some important hawkish changes to its forward guidance. The bank maintained much of the forward guidance language from the August meeting, saying it doesn’t intend to raise rates soon because the conditions for the “unusually strong monetary stimulus” are still being met. However, it admitted that “inflation expectations reversed their declining trend,” and that they may soon change its forwards guidance. Indeed, the bank increased its 2021 inflation forecast (under the baseline scenario) from 3.1% to 3.4%. The recent appreciation of the real, if continued, could take some of the edge off of the inflationary risk, but in the end it’s largely a political matter. There is still a huge risk premium imbedded in Brazil’s local markets curve to account for the fiscal uncertainty, and we don’t see that changing anytime soon.

Peru central bank is expected to keep rates steady at 0.5%. Inflation was 2.1% y/y in October, the highest since June 2019 and in the upper half of the 1-3% target range. Still, the bank is unlikely to be too concerned about price pressures and is instead focusing on keep monetary policy loose. We see no change in rates for the foreseeable future. Indeed, the central bank should strive to maintain stability even as political uncertainty remains high.

EUROPE/MIDDLE EAST/AFRICA

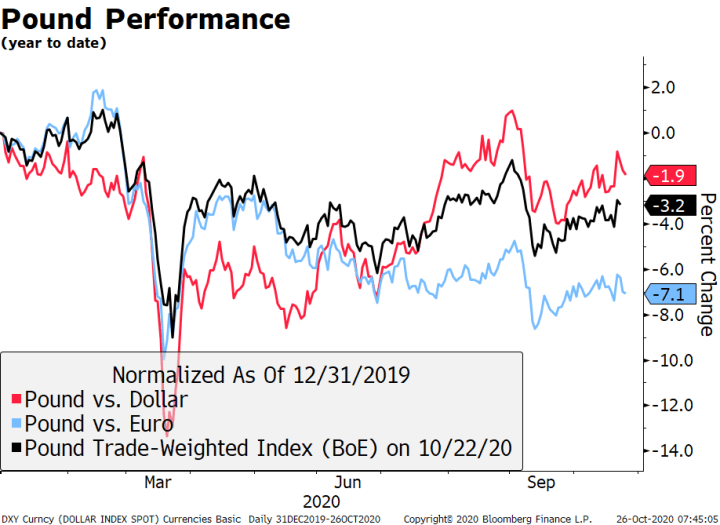

Brexit negotiations have been extended. Again. Prime Minister Johnson and EC President von der Leyen agreed at their dinner meeting last night to continue talks until Sunday. UK official noted that very large gaps still remain between the two sides and added that it’s unclear whether those differences can be bridged. Understandably, the pound gave up some of yesterday’s gains and risk reversals continue to reflect high demand for sterling downside hedge demand.

The two-day EU summit begins. With no closure yet on Brexit, the attendees will focus on other pressing topics such as the long-term budget and recovery fund. In light of Poland and Hungary dropping their veto threat, EU leaders can proceed with approving the landmark agreement. Turkey is also likely to be on the menu, as a sanctions threat looms over its maritime claims in the eastern Mediterranean. There will also likely be discussions surrounding the EU’s climate goals, which call for a strict goal of cutting emissions by 2030.

The European Central Bank is widely expected to add more stimulus. New macro forecasts will be released and are likely to support the further easing. We look for an increase in PEPP of at least EUR500bln as well as an extension out to end-2021 or even into 2022 vs. June 2021 currently. What else could the ECB do? We think it’s likely to offer another round of TLTROs at even better terms. However, we do not think the ECB will take rates more negative. See our preview here. Ahead of the decision, France reported October IP rose 1.6% m/m vs. 0.4% expected and a revised 1.6% (was 1.4%) in September. The eurozone IP reading will be reported Monday and the country readings point to a firm reading then.

The euro came off hard yesterday. We did not see anything fundamental that warrants this bit of euro weakness. Rather, it seems like a technical move due to position squaring ahead of the ECB decision. We are assuming they will jawbone a little tomorrow but really, there’s not much they can do to directly impact the exchange rate. That said, we see risks that the ECB overdelivers to try and get in front of the strong euro a bit.

UK data was mostly weaker in October. GDP rose 0.4% m/m vs. flat expected and 1.1% in September, while IP rose 1.3% m/m vs. 0.3% expected and 0.5% in September. Construction rose 1.0% m/m vs. 1.1% expected and 2.9% in September, while services rose 0.2% m/m vs. 0.3% expected and 1.0% in September. Clearly, the economy is losing momentum and that’s even before the latest round of lockdowns. No wonder Chancellor Sunik added more fiscal stimulus and the BOE added more monetary stimulus this fall. More is likely to be required from both in 2021.

ASIA

Japan’s Cabinet Office estimates that the latest stimulus package will boost GDP by JPY20.1 trln. This is equivalent to 3.6% of GDP, with JPY16.5 trln coming direct central government spending and the rest from regional governments and the private sector. It also sees the bulk of the impact coming through the end of March 2022. Most (including us) are skeptical of these estimates, which would put the impact above both the first extra budget (JPY3.3% of GDP) and the second (2.0% of GDP). Elsewhere, November PPI fell -2.2% y/y vs. -2.1% in October, as expected. Recent inflation data suggest deflationary pressures are building and so this third extra budget may not be the last.

China said it will start collecting extra duties on Australian wine starting tomorrow. Anti-dumping duties on wine were introduced last month and came on top of existing trade restrictions on Australian timber, barley, and lobster. There have been no restrictions yet on iron ore, Australia’s top export to China. That sector is booming and for now should offset much of the overall pain being felt in agriculture. Indeed, the Aussie continues to gain, trading at a new cycle high today near .7500 and on track to test the January 2018 high near .8135.

Default risk in the Chinese corporate sector remains a salient concern. The chipmaker Tsinghua Unigroup has again failed to make payment on $2.5 bln of offshore bonds, following a default in the company’s local currency bonds last month.

Tags: Articles,Daily News,Featured,newsletter