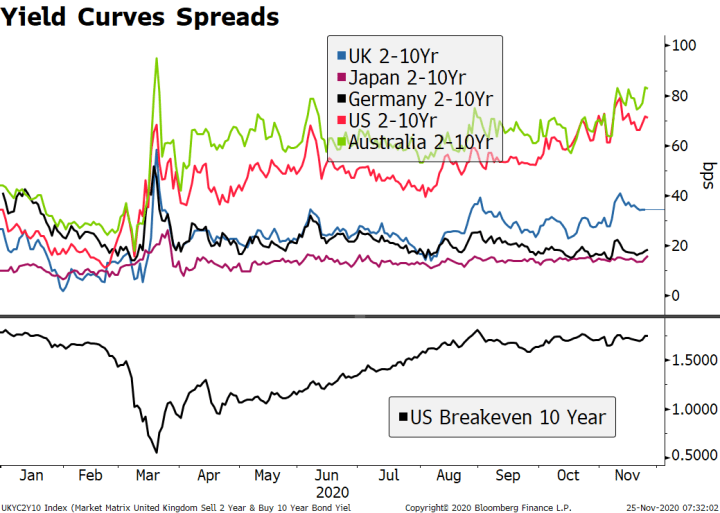

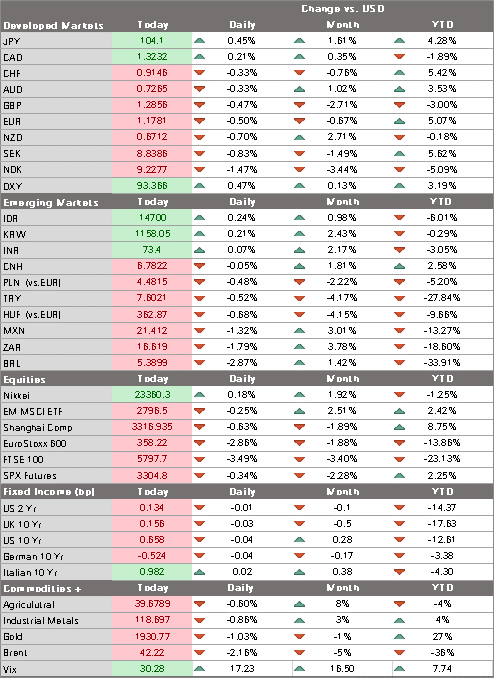

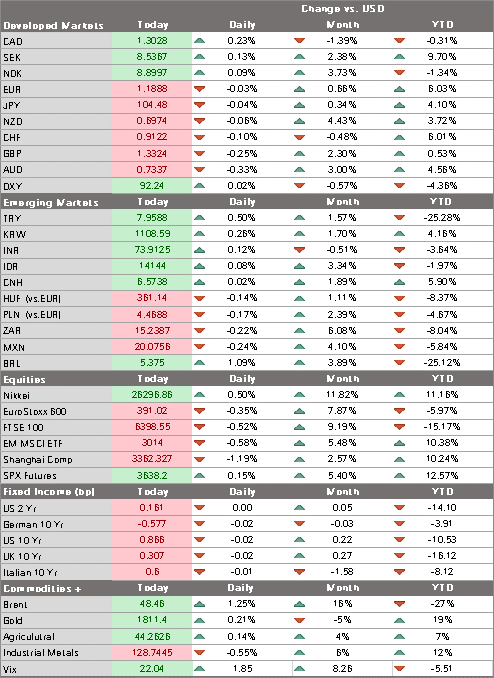

The divergence in developed markets yield curves continues; the dollar is consolidating ahead of the US holiday FOMC minutes will be released; weekly jobless claims data will be released a day early; October personal income and spending will be reported; Banco de Mexico releases its quarterly inflation report UK Chancellor Sunak’s spending review will lay out his plans for next year; South Africa reported higher than expected October CPI Japan’s Cabinet Office maintained its “severe” assessment of the economy; RBNZ gave an upbeat outlook in its FSR, further lowering odds of negative rates; cryptocurrencies remain in the spotlight as bitcoin trades at record highs above ,000 The divergence in developed markets yield curves continues. The US and Australian

Topics:

Win Thin considers the following as important: 6a.) Bitcoin&Blockchain, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

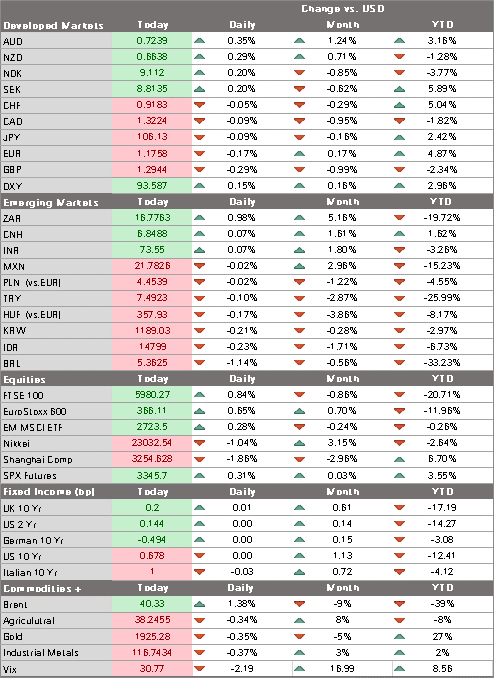

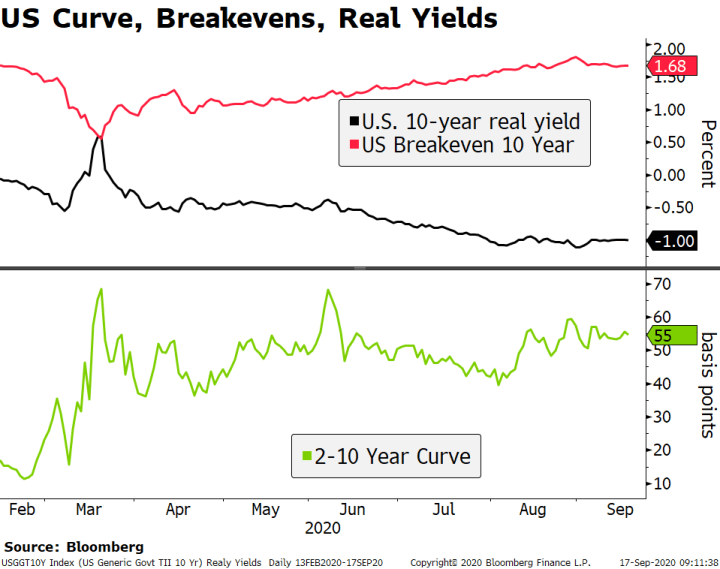

The divergence in developed markets yield curves continues. The US and Australian curves, for example, have been on a steady steepening trend since August.In contrast, curves in Europe, UK, and Japan have maintained their flatter shape throughout the period. That said, longer-dated inflation breakeven rates haven’t moved much in the US – at least not yet. The dollar is consolidating ahead of the US holiday. We believe its short-covering bounce has run its course and look for weakness to resume. DXY has given up all of its short-covering gains and traded at a new low for this move below 92 earlier today. It is on track to test the September 1 low near 91.746. The euro also traded at a new cycler high near $1.1930 and is on track to test its September 1 high near $1.2010. Sterling is having trouble this week breaking above the $1.34 area but is still likely to test its September 1 high near $1.3480. USD/JPY feels heavy and we look for a break back below 104 as part of a catch-up move. |

Yield Curves Spreads, 2020 |

| ALTERNATIVE ASSETS AND COMMODITIES

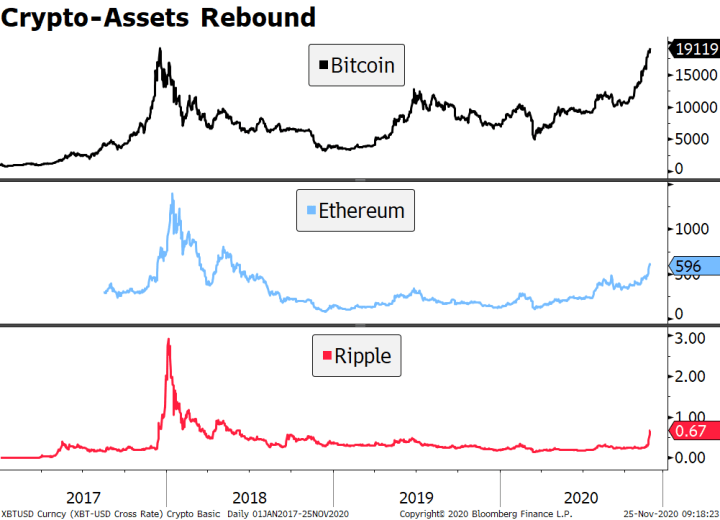

Cryptocurrencies remain in the spotlight as bitcoin trades at record highs above $19,000. The coin is up 165% on the year, helping drive a broad rally across the asset class. Other coins such as Ethereum and Ripple have also seen spectacular gains. There are numerous drivers behind the recent rally including: currency debasement concerns, inflation, alternative store of value, growing institutional participation, ample global liquidity conditions, search for diversification, growing interest in decentralized finance, and several technical factors. |

|

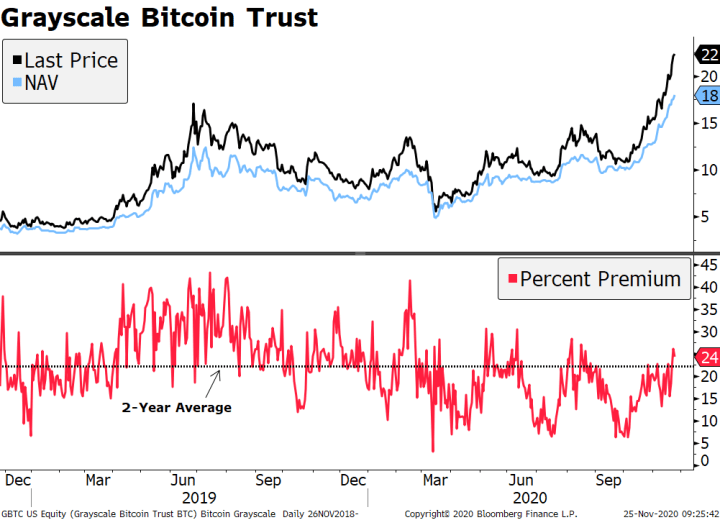

| Also of note, the entire ancillary complex of cryptocurrencies, blockchains, and digital currencies has been doing very well. This includes publicly listed miners, specialized companies and financial institutions, and other means to get exposure to the sector. For example, the popular Grayscale Bitcoin Trust, listed on Nasdaq, is trading at a remarkable 24.3% premium. This is not unusual for the trust, with its 2-year premium average around 22%. The reasons is that many investors unable or unwilling to buy cryptocurrencies directly are limited to these types of instruments or trading CME futures. |  |

| AMERICAS

FOMC minutes will be released. At that meeting, the Fed remained on autopilot but the minutes may give some clues about the December 16 meeting. New staff forecasts will be released then and we believe the Fed is growing increasingly concerned with the lack of fiscal stimulus. As such, there is growing speculation that the Fed’s QE composition will be tweaked next month in an effort to push long yields lower. There are no scheduled Fed speakers for the rest of this week. Weekly jobless claims data will be released a day early. Regular weekly initial jobless claims are expected at 730k vs. 742k the previous week. Last week saw the first rise in regular initial claims since early October and it was for the BLS survey week. This suggests a soft NFP reading, and consensus currently sees 500k vs. 638k in October. With lockdowns widening, we think this is just the start of renewed stress in the labor market. Regular continuing claims are expected at 6.0 mln vs. 6.372 mln the previous week. Given the 1-week lag for this series, it will be for the BLS survey week. Adding in the combined 13.5 mln PUA and PEUC continuing claims means that nearly 20 mln are currently receiving some form of unemployment benefits. In related news, October personal income and spending will be reported. Income is expected to fall -0.1%m/m vs. 0.9% in September, while spending is expected to rise 0.4% vs. 1.4% in September. If so, income will have fallen in four of the past six months. With PUA and PEUC expiring, the drop in income will accelerate as many will lose emergency unemployment benefits at year-end (barring a new stimulus package that extends them). This severe loss of income will weight on consumption and spending in Q1. Please see our recent piece “Benefits Cliff” Warns of Downside US Risks for a deeper look at the US labor market. Today also sees October advance goods trade (-$80.0 bln expected), wholesale and retail inventories, durable goods orders (0.9% m/m expected), new homes sales (1.5% m/m expected), and a Q3 GDP revision (33.1% SAAR expected). Banco de Mexico releases its quarterly inflation report. Yesterday, mid-November inflation came in lower than expected at 3.43% y/y and moved back within the 2-4% target range. The bank unexpectedly paused the easing cycle at this month’s meeting but the CPI data coupled with a firmer peso could lead to a cut at the December 17 meeting. Minutes from that meeting will be released tomorrow and could shed some more light on the bank’s rationale for pausing. |

|

EUROPE/MIDDLE EAST/AFRICA

UK Chancellor Sunak’s spending review will lay out his plans for next year. He said over the weekend that “You will not see austerity next week” and pledged spending increases to ease “enormous stress and strain” on the economy. Plans will be based on new growth and deficit forecasts from the Office for Budget Responsibility, which Sunak called “sobering.” Last week, October public sector net borrowing (ex-banking) came in at GBP22.3 bln vs. GBP30 bln expected, bringing the total for the first seven months of the fiscal year rose to a whopping GBP214.9 bln. Sunak’s presentation will likely show that it’s going to get even worse. Taxes are typically not covered in a spending review, but the worsening state of publica finances may lead Sunak to hint at how he may eventually raise them.

South Africa reported higher than expected October CPI. Headline inflation accelerated to 3.3% y/y vs. expectations of a steady 3.0% reading. While this is the highest reading since March, inflation remains near the bottom of the 3-6% target range. SARB just left rates steady at 3.5% last week but it was a close call as the vote went 3-2. Even more surprising is that the SARB’s model suggests 50 bp of tightening in 2021 and another 75-100 bp in 2022. This seems highly unlikely. Next policy meeting is January 21. A lot can happen between now and then but if the recovery remains sluggish, the MPC could pivot to a rate cut then.

ASIA

Japan’s Cabinet Office maintained its “severe” assessment of the economy. It has kept this assessment for the fifth straight month, noting some improvement in production but some deterioration in capital expenditure. This comes as Japan moves toward tighter restrictions in the face of record virus numbers in the major cities six months after the end of the national state of emergency. For instance,

Tokyo residents will reduce trips outdoors while bars, restaurants and karaoke parlors will close early

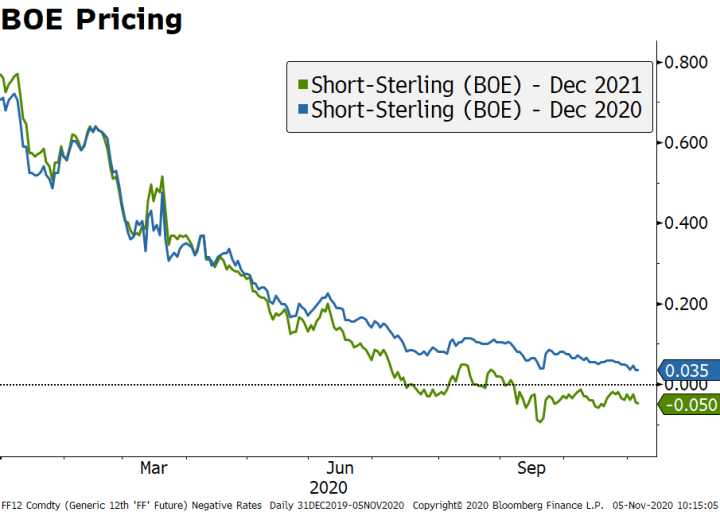

The RBNZ gave an upbeat outlook in its Financial Stability Report, further lowering odds of negative rates. The bank said the economy “has been relatively resilient to the economic shock from the pandemic so far.” Governor Orr noted that “The relatively resilient economic outturn means that the New Zealand financial system has not been tested as severely as it could have been. The banking system has maintained strong buffers of capital and liquidity, and the insurance sector remains well capitalized.” Echoing recent concerns from Finance Minister Robertson, the bank warned that high leverage in the housing sector poses risks if house prices fall sharply or unemployment rises. Deputy Governor Bascand said “This is why the Reserve Bank intends to re-impose LVR restrictions to guard against continued growth in high-risk lending and ensure that banks remain resilient to a future housing market downturn.”

Tags: Articles,Daily News,Featured,newsletter