Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on auctions as the sole process for the public to acquire notes and bonds. That’s not really how it works, though. There’s a lot that goes on in between, stuff that gets misunderstood and misconstrued because for half a century Economics as a discipline hasn’t paid any real attention to what really goes on in the monetary system.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Collateral, collateral bottleneck, collateral shortage, currencies, economy, EuroDollar, eurodollar system, Featured, Federal Reserve/Monetary Policy, global dollar shortage, Markets, money dealer, newsletter, paul mozer, Repo, salomon brothers, securities dealer, too many treasuries, treasury auction, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on auctions as the sole process for the public to acquire notes and bonds.

That’s not really how it works, though. There’s a lot that goes on in between, stuff that gets misunderstood and misconstrued because for half a century Economics as a discipline hasn’t paid any real attention to what really goes on in the monetary system.

Even by the early nineties, things had already changed rapidly and radically. Salomon Brothers, in one characteristic episode, had caused a significant stir for reasons that thirty years later aren’t well (or at all) understood – at least when using the textbook approach to finance and money. Solly, as the dealer used to be known, was getting dirty. I wrote at length (no surprise) about this five years ago:

What happened in late 1990 and 1991 is still a matter of conjecture, even on the government side. What is not in doubt is that Solly’s chief government securities trader, Paul Mozer, was openly flaunting US Treasury rules about the federal government’s debt auctions. Treasury had never restricted how much any particular dealer could bid for debt at auction, but would from time to time make individual and ad hoc efforts to ensure orderly and “fair” operation.

Not only that, this Mozer guy made no effort whatsoever to hide what he was doing, too; what no one could figure out was why he was doing it, and, to the point Warren Buffett had to be brought in to rescue Solly, why Mozer kept doing it even after being repeatedly warned by Treasury officials and regulators.

The LA Times afterward called it an “inept little scam” because from the mainstream it looked like the cheat would have only generated illicit peanuts for Salomon. Risk the whole business for what seemed to be so very little upside?

As it turned out, auction improprieties by that point in history had become widespread and common; not just in UST securities but more so in those being sold off as agency mortgage bonds (MBS). Seriously, it was really bad:

In total, the joint investigation, which included the SEC and Treasury, but also OCC, FRBNY, the NYSE and NASD, found ninety-eight dealers, again, nearly all that were investigated were involved in flagrantly overbidding for agency securities.

Not just overbidding, to hide these improper activities it had become common practice for dealers far and wide to keep two, even three different sets of books for their bidding practices. Auctioned-off securities were, by the early nineties, big enough business to go rogue (is it rogue, though, if literally everyone is doing it?).

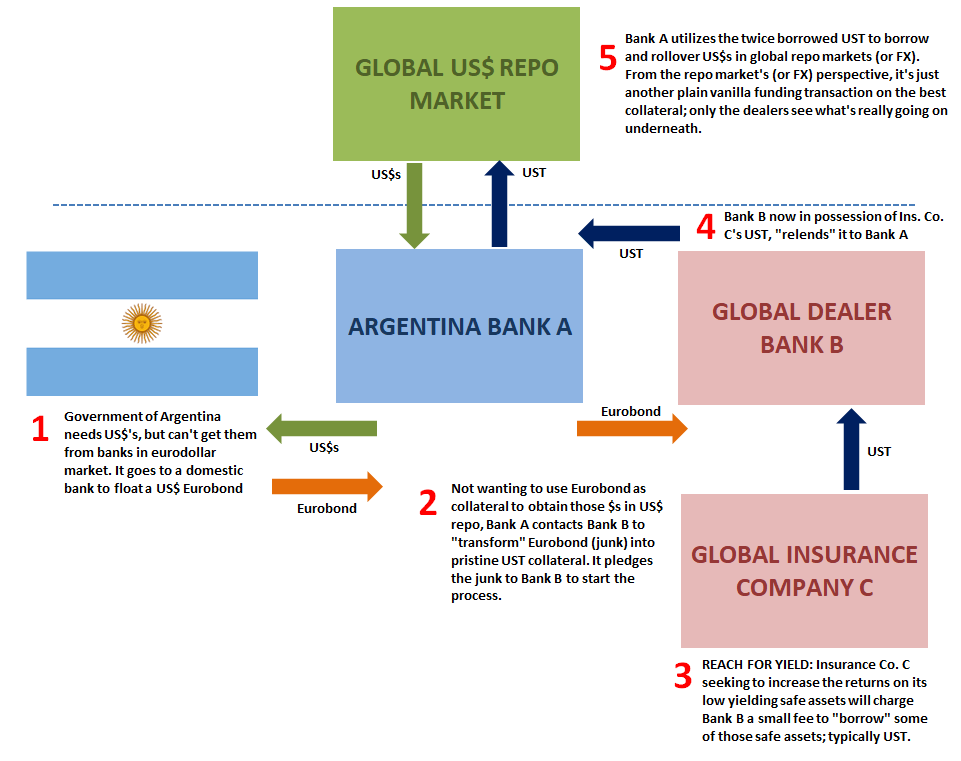

No inept little scam, this was all a very different four-letter word: repo.

A bond, note or bill just auctioned is the most liquid because it contains the most direct and quantifiable characteristics; once a security is replaced by the next auction in the series, that security becomes highly liquid OTR and the previous fades into trading obscurity (off-the-run). In short, the frenzy over OTR is repo at a time when collateral wasn’t as widely available and the limited OTR’s were quite limited.

In 1990, 1991, and 1992, Treasury began to impose position limits on auctioned securities in addition to conducting more regular audits (requiring more detailed position reports) of related dealer practices.

Up until November 2000, however, these hadn’t applied to bids coming in from outside the country. FIMA (foreign and international monetary authority) offers had grown substantially throughout the prior decade – like the early nineties dealer auction shenanigans, another huge clue about how the monetary and financial systems had changed long ago and where (offshore) those changes were becoming much more of a focus.

Just not any focus for regulators and central bankers (same thing, really) who thought – and told the public – they could control the financial system and global economy by moving the increasingly irrelevant federal funds rate around a quarter point here or there.

As the eurodollar system was throwing off “dollars” all around the world, the necessary component behind both globalization as well as the “random good luck” of the Great “Moderation”, many of these made their way virtually into the hands of FIMA’s. Quite naturally, overseas reserve managers looked for ways to invest them and UST’s offered quite decent low-risk returns.

As an accommodation, both primary dealers as well as the New York Federal Reserve branch had offered FIMA holders the option to place bids for newly auctioned (OTR) securities through each. This class, called indirect bidders, had seen substantial growth in participation as, again, the dollar system rapidly expanded (unnoticed by the Greenspan “put”).

Previous to this November 2000 Treasuy announcement (publishing new rules which became effective in February 2001), indirect FIMA bids had been treated as fully non-competitive. These are the simplest form of buying at any UST auction; a non-competitive bid means that the bidder just wants whatever security is being auctioned at whatever price/terms the auction ends up producing.

Give me the stuff, I’ll pay whatever!

| Therefore, all non-competitive bids get filled first; they’re easy. Were dealers in the US and perhaps more so outside of the country pressuring overseas FIMA’s to gain a larger share of OTR’s through their favored status as non-competitive bids (and then “borrowing” the UST’s from these central banks and monetary authorities being persuaded to buy them), therefore guaranteed to be filled thereby circumventing auction limits?

The specific answer to that question is beyond the scope of this particular review; suffice to say, for now, such pressure must have existed otherwise FIMA’s wouldn’t have cared much OTR versus OFR in the same way dealers obviously did (and do). Somewhat of a moot point going forward, from February 1, 2001, onward Treasury imposed position limits on non-competitive, indirect FIMA bids, too. Ghosts of Solly? |

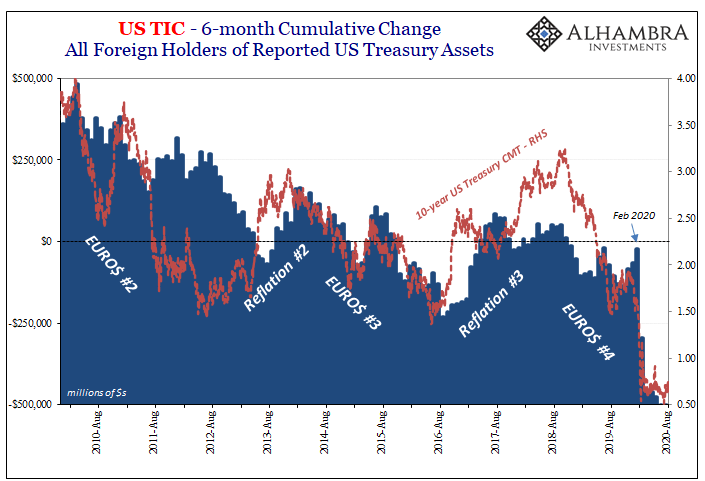

US TIC, 2010-2020 |

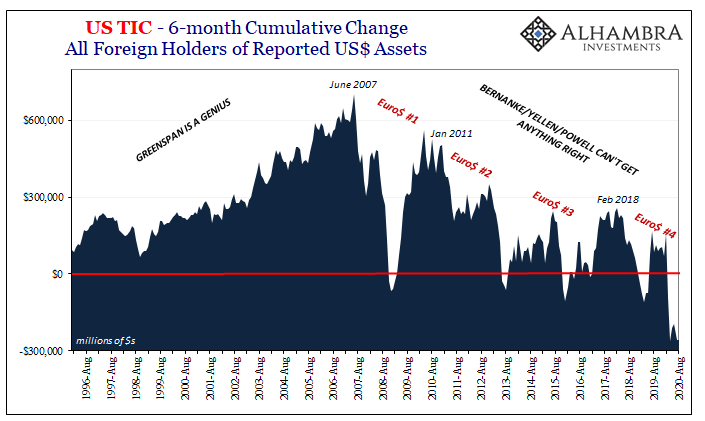

| Because there was such foreign demand for Treasury securities, it had been widely assumed there would always be foreign demand for Treasury securities. Furthermore, it came to be just accepted as an article of faith that without this foreign demand for Treasury securities the US government would be screwed given its ridiculously profligate ways and (otherwise lack of) means that only became more ridiculously, insanely profligate over time.

This mistake, however, has been openly exposed over the last several years since the beginning of 2018; though it came to be first challenged when around 2013 and 2014 overseas FIMA’s began to sell (on net) their UST holdings. The less foreign governments buy, it was said, the more trouble in the Treasury market starting with auctions (fewer indirect bids). |

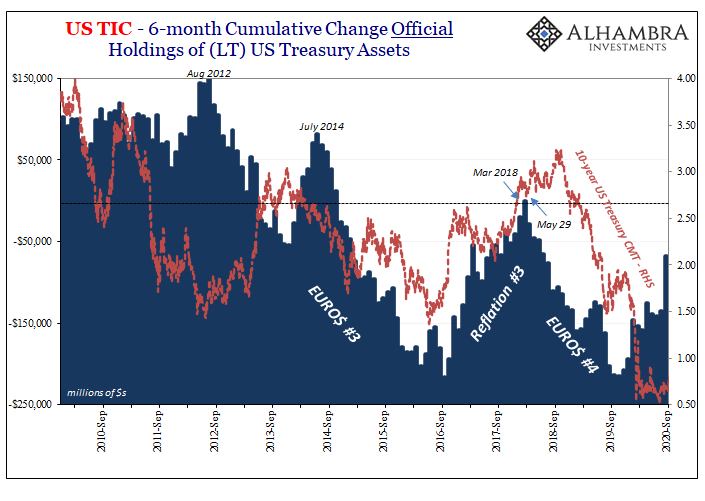

US TIC, 2010-2020 |

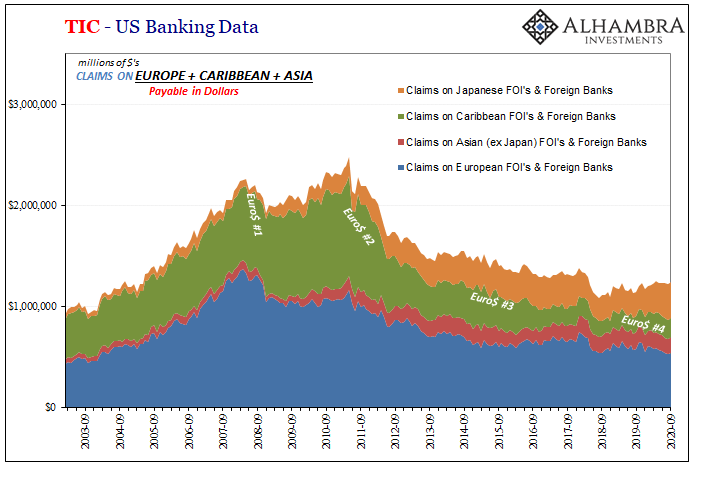

| If overseas monetary authorities and reserve managers are outright selling, as they’ve been pretty regularly for about seven years now (above), at the very least they’re not going to be buying up as much of what’s auctioned. The way these Treasury auctions work, it would fall to the primary dealers (what are called “direct” bidders; those, like Solly had, who bid at auction for their own house account) to make up any deficit left behind as FIMA’s really have retreated from UST’s.

That’s what a money dealer really is and ought to be; exactly what we want them to be! They are what used to be called securities firms or commercial banks, specific kinds of financial institutions which intermediate primary and secondary securities markets. |

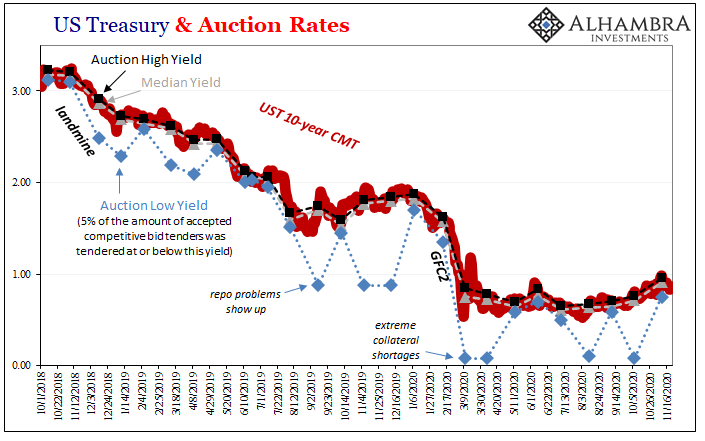

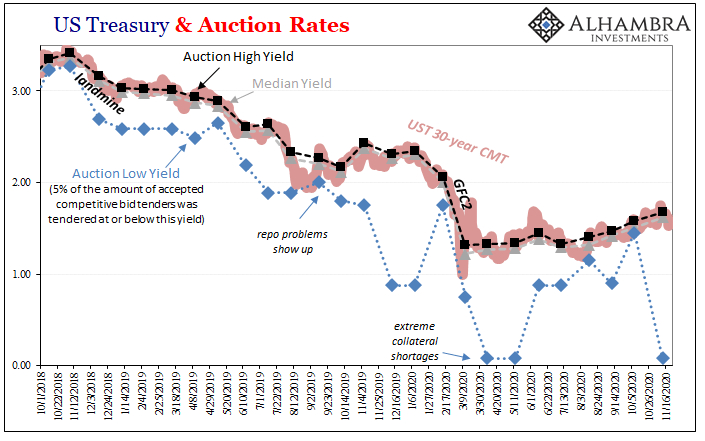

US Treasury & Auction Rates, 2018-2020 |

| They stand between the issuer and the public, making judgements and taking risks so that these absolutely vital (not just UST) financial space and the auctions in them operate without a hitch.

Dealers buy up what’s auctioned off, or what’s left at auction after everyone else gets theirs, and warehouse the securities (in their house accounts) in order to parcel them off by selling smaller lots to the public over time. This is, believe it or not, where proprietary trading really came from; dealers hedging the risks (including liquidity risks) they took on while recently-auctioned securities were being warehoused sometimes made money on those hedges. But this could become a problem if hedging (or prop trading profits) isn’t available, or more unavailable on reasonable terms, as well as if funding channels suddenly clog. This is what we were told had started happening beginning in early 2018. Simultaneously, foreigners returned (after an unusually brief hiatus, Reflation #3) to selling UST’s because, it was said, inflation and bigger deficits (tax reform of December 2017). Without foreign buyers, again, Treasuries were supposedly toast. And because dealers are obligated, by law, to buy up whatever is left at UST auctions, stuffing their house warehouse accounts with so much “unwanted” paper, this supposedly meant trouble for them because it was likewise clogging up repo markets (which had originally developed as a method to fund warehousing activities) with “too many” Treasuries. Despite the gloss of plausibility, this explanation never made a lick of sense. |

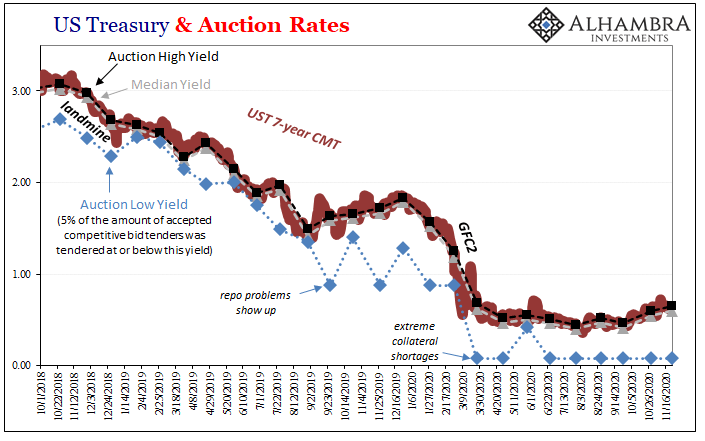

US Treasury & Auction Rates, 2018-2020 |

After the non-competitive bids get deducted, sorted, and wait to be filled, Treasury then conducts a Dutch tender for the remaining offer. Dealers bid for it, up to position limits, submitting competitive figures for what they think they’ll be able to profit from – for their own house accounts in the sense of their bank book (holding the securities) betting on the price going higher; for what their brokerage network is telling them they can sell off to the public at even higher prices; or for reasons that have more to do with survival (stockpiling OTR repo collateral in their house account), their own or, like Solly in the early nineties, intending to profit off the survival risks of others (anticipating hefty fees by lending out OTR repo collateral acquired for their house account to other financial firms very likely to be desperate for this exact OTR stuff). Decades later, the basis behind the “inept little scam” has only grown bigger and become more existential (see: collateral bottleneck). Thus, if the “too many” Treasuries theory was anywhere close to correct, we would’ve witnessed the price of competitive bids drop through the floor. In other words, if dealers were getting stuck with UST paper they otherwise didn’t want, believing this auction stuff nothing more than a huge headache, possibly a dangerous problem (the incorrect version of what was going on in repo), then competitive auction bids would have repeatedly reflected such dealer disdain as dealers would have required lower and lower prices (higher yields) to compensate them for so much alleged pain. |

US Treasury & Auction Rates, 2018-2020 |

| Never happened. Not once (above) in any market or auction.

Instead, dealers kept bidding and bidding and bidding, safe in the knowledge that there were huge profits, at the very least tremendously valuable benefits (as own collateral), to absorbing whatever OTR paper they could legally acquire. After all, not all non-competitive bids are submitted by members of the public or FIMA’s. Dealers submit them for their house accounts, too, to make sure they get their hands on often the absolute limit. And then bid competitively for the rest. Foreigners don’t really matter that much. |

US TIC, 1996-2020 |

| FIMA and indirect bids actually take away from the opportunity for dealers to wrestle badly-wanted securities from other competitors. One key reason why is that when foreigners are selling their UST’s, thus refraining for the same level of UST auction participation, that’s “tight money” stuff which rather than being a danger to the UST market proves to be the reason for heightened demand in it (especially OTR).

Dealers know what neither the Fed nor all the so-called money/mainstream repo “experts” seem to be able to: that when the global dollar shortage shows up, leaving FIMA’s to have to liquidate or somehow mobilize their “reserve” assets, it’s really good business to be in the UST auction business even as indirects disappear in it. Profit potential on top of survivor potential. A global dollar shortage is the best time to be holding the best, most negotiable of all repo collateral (see: March 2020). The story of Solly was really a story of modern (and global) money with repo and repo collateral increasingly at the center of it; at the center of repo is the best collateral, meaning OTR. Thus, at the middle of everything is Treasury auctions. The first financial crisis in 2007-09 was, in many crucial respects, a repo collateral shortage leading to that first global dollar shortage. Rather than fixing it, central bankers and regulators (same thing) spent more than a decade covering it up (mostly because they had to cover up this gross negligence due to self-imposed ignorance). They hadn’t learned a damn thing from Paul Mozer and the Salomon Brothers episode. The scam was never inept, it is authorities who continue to be decades afterward. They didn’t learn anything from 2008, either. And that, more than anything, is why dealers continue to see value and profits in bidding up for whatever might be leftover at each and every (now record) US Treasury auction. No one-off dollar shortage, the whole world has been left to adjust to the ongoing headache. |

TIC - US Banking Data, 2003-2020 |

Tags: Bonds,collateral,collateral bottleneck,collateral shortage,currencies,economy,EuroDollar,eurodollar system,Featured,Federal Reserve/Monetary Policy,global dollar shortage,Markets,money dealer,newsletter,paul mozer,repo,salomon brothers,securities dealer,too many treasuries,treasury auction,U.S. Treasuries