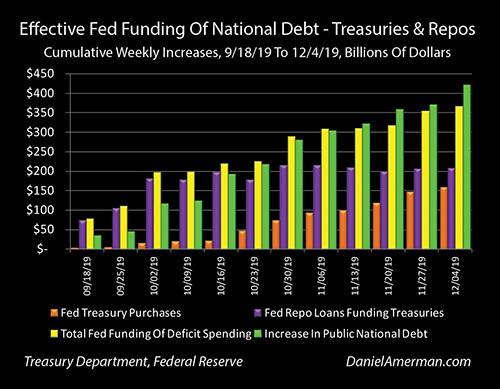

By Daniel R. Amerman, CFA As can be seen in the graph above, for the last 12 weeks there has been a stunning visual correlation between the yellow bars of the total weekly funding of deficits by the Federal Reserve, and the green bars of the weekly deficit spending by the United States government. Total deficit spending, the extent to which monies spent by the federal government exceeded taxes collected, was a staggering 2 billion in just the last 12 weeks. In total, 7 billion of the funding for this increase in the national debt was provided at very low interest rates, via the mechanism of the Federal Reserve simply creating the money needed to fund the government spending. Neither the Treasury Department nor the Federal Reserve will admit to what is

Topics:

Mark O'Byrne considers the following as important: 6a) Gold & Bitcoin, 6a.) GoldCore, Daily Market Update, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

| By Daniel R. Amerman, CFA

As can be seen in the graph above, for the last 12 weeks there has been a stunning visual correlation between the yellow bars of the total weekly funding of deficits by the Federal Reserve, and the green bars of the weekly deficit spending by the United States government. Total deficit spending, the extent to which monies spent by the federal government exceeded taxes collected, was a staggering $422 billion in just the last 12 weeks. In total, $367 billion of the funding for this increase in the national debt was provided at very low interest rates, via the mechanism of the Federal Reserve simply creating the money needed to fund the government spending. Neither the Treasury Department nor the Federal Reserve will admit to what is happening. The Fed is using two separate programs to accomplish this, with a sufficient degree of complexity that it becomes difficult for average citizen to follow where the money is coming in from and what it is being used for. In this step by step analysis, we will put together the week by week numbers from the Fed and the Treasury, uncover what is being hidden behind a veil of complexity, and show the simple truth – about 90% of recent federal government deficit spending has effectively been funded at below market rates by simply creating the new money. Full article via Danielamerman.com via GATA.org |

Effective Fed Funding of National Debt, 2019 |

Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold |

Tags: Daily Market Update,Featured,newsletter