The difference between physical gold investing and ETF investing was stark in the first quarter 2021 according to the World Gold Council’s Gold Demand Trends data released last week. Before focusing in on investment demand below a few notes on overall gold demand in the first quarter. Total gold demand in the first quarter of 2021 was down 4%. However, because gold production and gold demand (jewellery, bar and coin etc.) are decentralized around the globe, and no...

Read More »Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency. The concept of pegging a digital currency to an...

Read More »Is ESG Investment the Future of Gold & Silver?

‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked. High ranking companies get more money from investors than low...

Read More »Is The Bull Market Over For Gold?

Gold has not made new highs in many months. Gold peaked last year at US$2067 on August 6. The 7 month down leg of more than 18% as been deep enough and long enough that some commentators are now saying that the bull market has now turned to a bear market for gold. Losing faith is understandable because falling prices feel bad. But this week we want to show that current prices may not reflect reality. We will review the story of Archegos Capital Management which...

Read More »ETF Gold Demand Soars while Consumer Demand Slows

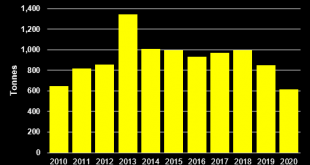

ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped. What’s in store for gold demand fundamentals for 2021? Increased consumer demand in China and India will help support the gold price in 2021. There is little doubt that investment demand – especially into Exchange Traded...

Read More »Central Banks Will Still Do “Whatever It Takes”!

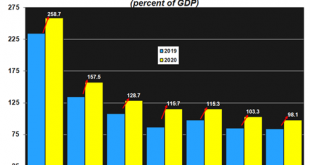

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

Read More »How High is Too High for Rising Government Bond Yields?

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1. Since then the silver price has slid about 5% from that high. Chairman Powell testified to Congress on Tuesday stating that...

Read More »Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine...

Read More »$1.9 Trillion American Rescue Plan Positive for Gold

The Massive $1.9 Trillion American Rescue Plan is Just the Start Massive $1.9 Tr. American rescue plan to affect markets Yellen takes over at US Treasury, what to expect More spending initiatives to come How all this is positive for gold and silver prices The Biden Administration’s policies are positive for gold and silver prices. The $1.9 trillion – American Rescue Plan released on January 14 is just the beginning of spending initiatives. The plan is chocked full...

Read More »Gold & Silver Charts Point to Higher Prices & Chris Vermeulen

Chris Vermeulen of TheTechnicalTraders.com joins Dave Russell of GoldCore TV. Chris discusses the chart patterns that the long term gold and silver charts are presenting and what he believe that this means for gold, silver and platinum for 2021. Chris is an expert technical analyst and also understands the fundamentals of the precious metals markets and how it acts as financial insurance for your portfolio. Click the video below to watch. [embedded content] You can...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org