Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.” Leaving aside that our financial system is not robust—the interest rate is collapsing, and the debt is growing exponentially—we do not have capitalism. We have licensure of most professions, and regulation of nearly every productive activity. We have government-owned roads, airports, harbors, radio spectrum, trains, and schools. This last item is Plank #10 from the Communist

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, Capitalism, central planning, Crony capitalism, Cronyism, fascism, Featured, Federal Reserve, newsletter, Volcker

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Dear Mr. Taft:

I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying:

“Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.”

Leaving aside that our financial system is not robust—the interest rate is collapsing, and the debt is growing exponentially—we do not have capitalism. We have licensure of most professions, and regulation of nearly every productive activity. We have government-owned roads, airports, harbors, radio spectrum, trains, and schools. This last item is Plank #10 from the Communist Manifesto. We have a vast array of subsidies, both corporate and consumer. And of course massive taxes to pay for it all. This year tax freedom day was April 16—over one quarter of the year is spent working just for the government.

Yet this massive rake is not enough to pay for the massive cost of the government. In FY2019, the federal government added $1.2T to its debt. I should say this is only the component of its debt that it acknowledges. A private company would be forced to include accrued liabilities, which would result in even larger total liabilities and an even-larger deficit.

It would not be possible to borrow so much, if we had a gold standard. The interest rate would skyrocket. So the government looted the gold of the people, and made it illegal to own gold (re-legalizing it, only after it was no longer part of the monetary system). We have a central bank (Plank #5) to manage the interest rate. Under the Fed’s tender ministrations, interest has been falling for four decades.

John Maynard Keynes said to drive interest rates to zero to kill the savers, and overthrow the capitalist order. Politicians of course love the idea because the lower the interest rate, the more they can borrow to finance their welfare schemes.

Either way, both the cause and the effect of the falling interest rate regime are not-capitalist. The cause is central planning of credit, largely entrusted to the Federal Reserve. The effect is to feed ever-increasing quantities of the people’s wealth into the hungry maw of the government. And to enrich crony banks and corporations.

You ask rhetorically, “Are we in fact witnessing the twilight years of capitalism?” We are clearly in the twilight years of something. However, that something is not capitalism. It a crony system of nominally private ownership but under increasing government control. In other words, incipient fascism. In the vision of Benito Mussolini—who coined the term fascism—there was private property. However, he clarified the nature of this property:

“The Fascist State organizes the nation, but it leaves the individual adequate elbow room. It has curtailed useless or harmful liberties while preserving those which are essential.”

Today, nearly everyone agrees that we should have irredeemable currency and a central bank to manage it. And thus, the right to opt out by withdrawing gold coin from the banks enjoyed by Americans until 1933 was deemed to be “useless or harmful”. The saver was disenfranchised. His interest rate preference is no longer respected, and is another “useless or harmful liberty.” Thus, the interest rate can be driven down nearly to zero (or beyond zero in Switzerland, Germany, and a number of other countries).

You say:

“Even as capitalism has powered one of the longest and most sustained economic recoveries, as well as one of the most durable bull markets in our lifetimes, with the S&P 500 trading near all-time highs?”

One of the seeds for the boom that began a decade ago—it’s not exactly a recovery—were planted by President Bush in December 2008. He said:

“I’ve abandoned free-market principles to save the free-market system…to make sure the economy doesn’t collapse.”

And we had bailouts, quantitative easing, pork barrel spending, and no one should forget when the accounting rules were changed in March 2009, so that if a bank held an asset worth $900,000 it could keep it on the books as $1,000,000.

With respect, none of this is capitalism.

It is true, we have an incredible bull market. Everyone loves a bull market. But let’s get back to Keynes for a moment. As I noted above, he wanted to push the interest rate to zero, and he was explicit about unleashing destruction. He noted that:

“The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

The reason why they are unable to diagnose it, is that the price of the bond is the inverse of the interest rate. Falling interest means rising bond prices. And arbitrage pushes up other asset prices. Most do not focus on the collapse in yields—interest rates, equity dividend yields, real estate cap rates, etc. The collapse in yields is a subtle phenomenon. Most people

prefer to focus on the much more obvious rise in asset prices. Who could be against a bull market?

It is not capitalism that you are describing, when you say:

“Leverage was the tool used to jack up what had been sustainable growth to unsustainable levels.”

In a free market, no one would lend so much or at such dirt-cheap interest rates. This is on the Fed, which somehow people have come to think is part of capitalism.

I believe I have made my point that we don’t have capitalism today, or anything even close. But you say one other thing to which I want to respond:

“… Donald Trump, who promised in 2016 to deliver better standards of living for the middle class … through his own version of ‘Ayn Rand capitalism,’ powered by a $1 trillion tax cut and one of the most sweeping across-the-board deregulatory initiatives we have ever seen.”

First, his deregulation is a myth. It is true that under President Trump, the Federal Register is smaller than under President Obama (or Bush). However, the Federal Register is the book of new regulations. This means Trump is adding new regulations at a slower rate than Obama added them.

Second, a sweeping tax cut with no change to spending is a shift from taxing to borrowing. And Trump did not even keep spending flat, he increased it significantly. The problem with our system is not that it promotes what you call “growth at any and all costs”. The problem is that we call borrowing to consume “growth”! Would anyone make the mistake of calling it family growth if a couple racks up $25,000 on their credit cards to go on a gambling binge to Las Vegas? We should not make that mistake when Uncle Sam does it. Yet, borrowing to consume adds to GDP.

Finally I must say that if you read Rand’s novel Atlas Shrugged, you see a big difference between her hero John Galt who refuses the job of Economic Dictator, and Donald Trump who directed the Fed to lower interest rates.

Anyone interested in “Ayn Rand Capitalism” should read her short book Capitalism: The Unknown Ideal. In essence, there should be a complete separation of economy and state. She argues against antitrust, for example (Trump threatened antitrust action against Amazon). She included an essay by Alan Greenspan. Long before he took the job of Federal Reserve Chairman (i.e. Economic Dictator), Greenspan wrote cogently on the harm inflicted by a central bank.

Sincerely,

Keith Weiner, PhD

CEO Monetary Metals

Market Report

We apologize for publishing this Report late. We have been very busy developing the business.

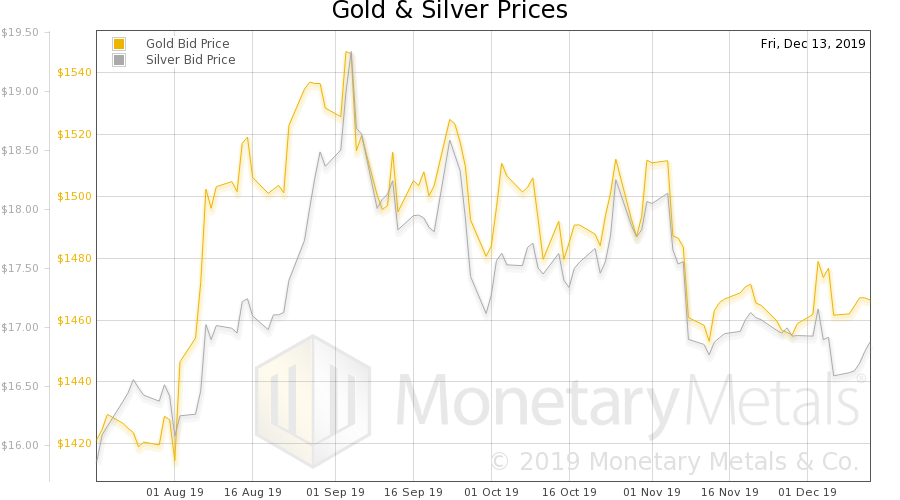

The price of gold moved up $16, and that of silver $0.39.

Almost two groceries leaked out of that store of value par excellence, bitcoin. But hey, stocks are up!

Former Fed Chairman Paul Volcker passed away this week, at the age of 92. The consensus among liberals and conservatives, Keynesians and Monetarists, free marketers and central planners is that Volcker beat inflation. While the various publications by and for these groups write their hagiographies, we find ourselves writing something more critical.

Ironically, for a man with a reputation for fighting inflation, Volcker helped persuade President Nixon to suspend temporarily the convertibility of the dollar into gold. He may be widely hailed as beating inflation, but severing the last link between the dollar and gold is widely condemned as unleashing it.

We have two things to say about the idea that a man—we are not picking on Volcker per se—beat inflation and stabilized a floating, irredeemable fiat currency. One, this is tantamount to saying he is a good central planner. A central planner is to an economy what a virus is to the body. A foreign particle that takes over and reprograms the cells with a destructive code.

We must get up to the rooftops to bellow that it’s not just a matter of finding the right man to make central planning work. There is no right man, and there is no right central plan. Even if the right quantity of dollars were static (it varies moment by moment like everything else in the economy), and even if the Fed could know what that right quantity is (it cannot), the mechanism by which it would change the quantity of dollars is all wrong. A free market is a process, not an end result such as a price or a quantity supplied. The central planner-even if he set the right price—would not create the same effect as the free market because he would not be creating the same cause.

The question is never which man should be Economic Dictator (to use the fictional title from the novel Atlas Shrugged). It is the existence of the institution itself.

Two, the very theory agreed by those liberals and conservatives, Keynesians and Monetarists, free marketers, and central planners—the Quantity Theory of Money—is wrong. Changing the quantity of dollars does not change inflation the way people suppose.

As Knut Wicksell observed in the 1890’s, but has been forgotten, the price level correlates to the interest rate, not the quantity of money (or dollars). That is, higher interest rates cause and are caused by higher prices. And Volcker, to fight rising prices, raised the interest rate. It is a ratchet mechanism.

However, there is a limit because the rising cycle is characterized by corporate borrowing to increase inventory of commodities. That is, they go deeper into debt to increase their hoarding of things which have declining marginal utility. Ultimately, the cost of borrowing exceeds the profits to be made hoarding commodities—i.e. waiting for prices to rise before selling one’s product. Then bankruptcies and liquidations begin. And the rising cycle is broken, initiating a falling cycle.

| We don’t want to get too deeply into Keith’s theory of interest and prices here. But we do want to note that whatever Volcker may have thought he was doing, and what people even today four decades later believe he did, it just does not work that way.

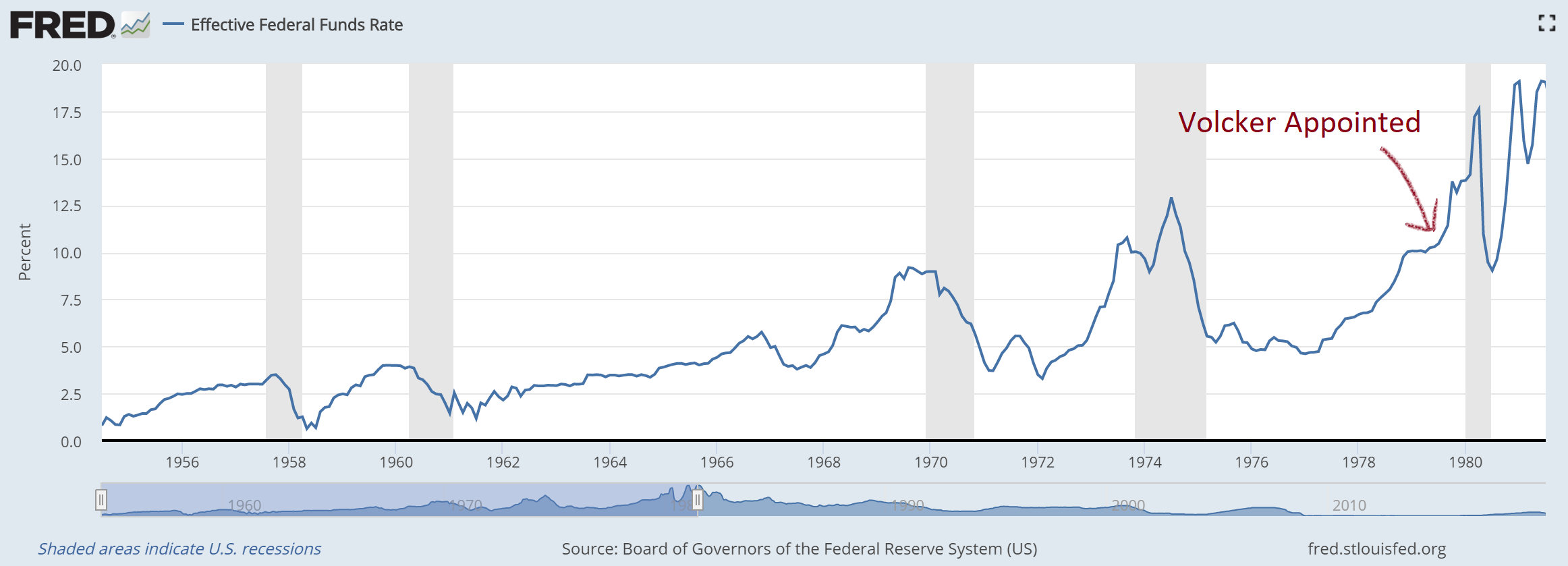

The Fed centrally plans the single most important price in the economic universe: the price of credit. Specifically, overnight credit. This is an awesome power (which no one should possess). However, there is a limit to this power. The price of long-term credit is subject to market forces, and they interact with the force applied by the Fed to create a dynamic. This dynamic is characterized by positive feedback. That is, the system tends to run and run in one direction for decades. When Volcker was appointed in 1979, the trend of rising interest and rising prices had been going on since the end of WWII. Here is a graph of the Fed Funds Rate, the rate dictated by the Fed. It begins in 1954 (the earliest data the St Louis Fed provides in this series). The rate is a consistently rising trend, with one exception. The Fed pulls it back, once it has triggered a recession. Each time the pullback ends on a higher low (the opposite of the trend today, with lower highs before each recession). We assume most readers know that consumer prices were rising relentlessly during this period. By the time Volcker got into power, this trend had been running for so long that it would have been inconceivable for it to reverse. Much less to reverse on its own. To make it stop, the Fed would have to do something. |

Effective Federal Funds Rate, 1956-1980 |

Like the doctors who let the blood of their patients, based on the current medical science thinking of their day, the Volcker Fed pushed up the interest rate further. The time of managing the interest rate was over (you can see how well their management worked in the chart above). Based on the current monetary science thinking, now the Fed would manage the general price level. Or at least the quantity of dollars which is held by said monetary science thinking to be causal of the general price level.

Invalid theories can persist a long time. Sometimes, shortly after bloodletting, the patient would recover. His body finally eradicated the influenza virus or staphylococcus bacteria. People—especially the doctor and the patient—thought that the bloodletting worked.

Have you ever noticed that on many elevators, whether you press the Door Close button, or whether you don’t press it, the doors close in about three to five seconds? Did you know that experiments show that when rats are addicted to cocaine, they will keep pressing a bar to get another dose of drug even after researchers have removed the drug?

Volcker immediately began pushing rates up. He relented when a nasty recession occurred. We assume that some doctors would cease bloodletting, if the patient became pale. In any event, he resumed and raised rates again.

In this case, we can’t really say that that the corpus economicus got better. This part is not analogous to the body defeating an infection. A closer analogy would be that the giant Wrecking-Ball-of-the-Economy had wreaked its damage on the north side of the street and began to swing to the south side. When it begins destruction on this side, nothing repairs the damage on the other side.

The north side, of course, is rising interest and prices. The problems of that era were well-known then, and are still well-known now.

The south side is falling interest and prices (or soft prices, if ever-increasing mandated useless ingredients prevent them from falling). Manufacturers struggle to make enough margin to service their debts, much less cover their cost of capital. People now speak of the “post-industrial” economy and a “post-manufacturing” world. Of course, this doesn’t mean that we don’t make things any more. Would you please excuse us as we finish typing this on a computer connected to the Internet, leave our office and trust the motion-sensor light to turn off, take the elevator down, get in a car, and drive to a restaurant that cooks meat in a kitchen with sophisticated equipment?

All of those things have to be made. What people mean by this phrase “post-industrial” is that industry is not where the value is. They are right, sadly, that the value is in finance and especially where capital gains may be made. Industry struggles to earn scant profit margins… quick, somebody lower the interest rate!

The problems of Keynes’ falling interest rate world are not well understand. Keynes smirked that not one in a million is able to diagnose the problem. It was true then, and it’s still true now. We hope that our Report helps more people grasp the enormity (and simplicity, in a sense) of the problem.

Gold and Silver PricesLet’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

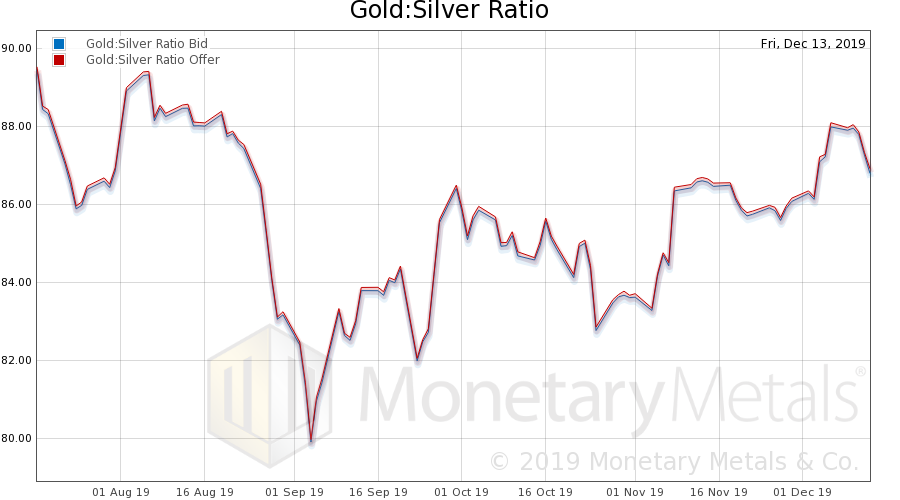

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped this week. |

Gold to Silver Ratio(see more posts on gold silver ratio, ) |

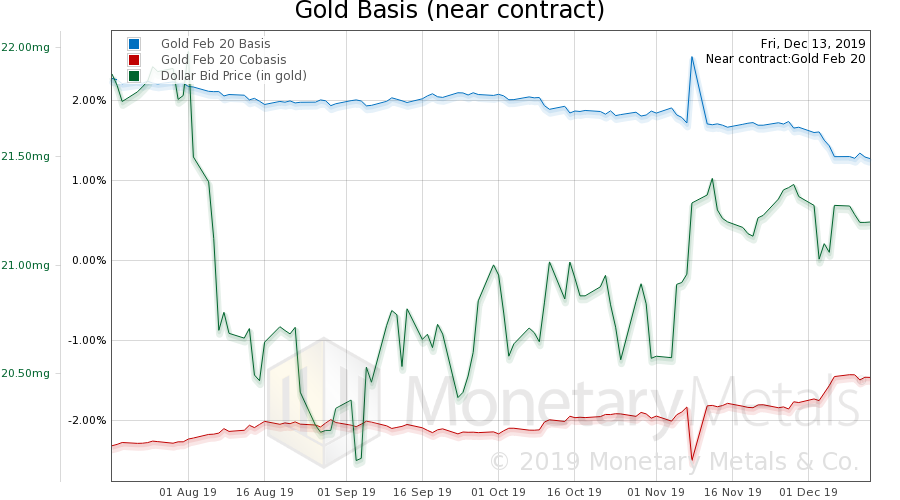

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. There was little change in the scarcity of gold (i.e. cobasis) thus week, though the price was up a few bucks. The Monetary Metals Gold Fundamental Price, was up $3 this week, to $1, 470. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

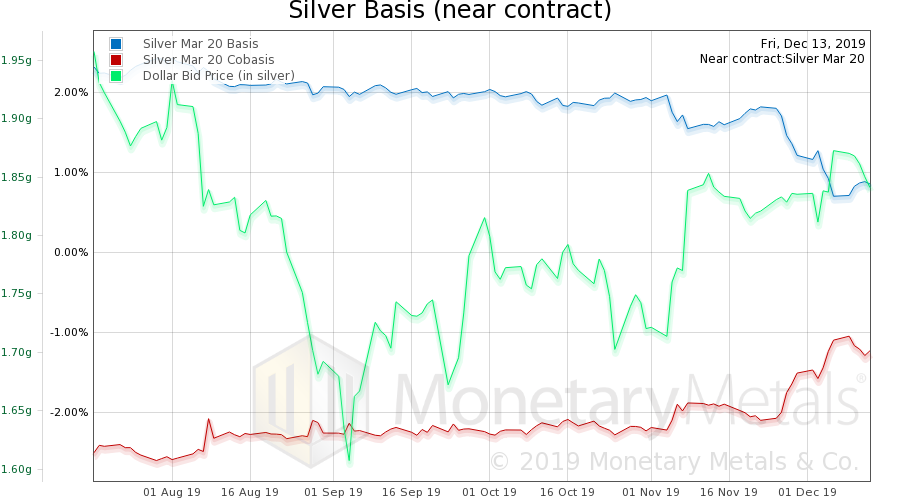

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The silver price rose by a greater percentage, and we see a little decrease in its scarcity. The Monetary Metals Silver Fundamental Price rose a bit, to $16.92. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,Capitalism,central planning,Crony capitalism,Cronyism,fascism,Featured,federal-reserve,newsletter,Volcker