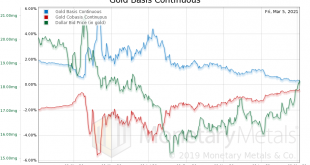

Before we talk about Fedcoins, let’s look at the old school non-digital, non-blockchain, coin. Gold. And silver. Since January 4, the price has dropped about $244. And the price of silver has fallen about $4. Are these buying opportunities? Or the end of the brief gold bull market of 2020 (i.e. Covid)? It helps to return to the idea that gold is the unit of measure of value. Not as a rhetorical device to sell gold, but because it gives a clearer picture. If one...

Read More »Central Banks Will Still Do “Whatever It Takes”!

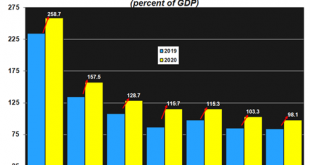

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

Read More »Episode 14: Unexpected Insights On Fractional Reserve Banking

Our previous episode on “money printing” veered into fractional reserve banking at a few points, so this week John Flaherty and Monetary Metals CEO Keith Weiner dive into that topic. In this episode, you’ll discover: 4 traits that determine legitimate credit, versus counterfeit credit What many alarmists incorrectly presume about this system The concept of ‘ceiling’ vs an absolute multiplier How nearly everyone today suffers confusion between money and credit A...

Read More »The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things. Part fear-mongering over the many “risks” of bitcoin, part pleading for governments to step in and...

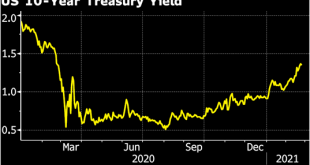

Read More »How High is Too High for Rising Government Bond Yields?

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1. Since then the silver price has slid about 5% from that high. Chairman Powell testified to Congress on Tuesday stating that...

Read More »Episode 13: The Pressing Problem With “Money Printing”

The phrase “money printing” conjures images of a giant printing press spitting out sheets of hundred dollar bills somewhere in the basement of the Fed. But is that what’s actually happening lately? Absolutely not. Join John Flaherty and Monetary Metals CEO Keith Weiner for a conversation that will likely make you say “WOW!” or “Whaaat?” or maybe even “Oh, NOW I get it…” [embedded content] Episode Transcript John: Hello again and welcome to the Gold Exchange podcast....

Read More »Episode 12: The Yield Purchasing Power Paradigm

Most people think in terms of purchasing power: how much can one’s cash buy? In this week’s episode, CEO Keith Weiner & John Flaherty discuss an alternate perspective. Instead of spending your capital, what if you invested it to earn a return? What can that return buy? Along the way you’ll learn: The concept of yield purchasing power & its impact on investing decisions How the Fed keeps us stuck in the purchasing power paradigm The perverse incentives...

Read More »Gold Price Forecast – LBMA Survey Published

The LBMA (London Bullion Market Association) annual forecast survey published last week shows that forecasters expect the average gold price to rise 11.5% in 2021 to US$1973.8 (forecasters’ average) from the actual average gold price in 2020 of US$1769.6, and for the silver price to rise 38.7% in 2021 to US$28.50 from the actual annual average of US$20.55 in 2020. These expected averages show silver might gain three times more percentage than that of gold in 2021....

Read More »Episode 11: The Common Ground Between Bitcoin & Gold

Is there common ground the among proponents of gold and bitcoin? John Flaherty and CEO Keith Weiner take on that question in this episode. They also discuss: What bitcoin has been able to accomplish that gold hasn’t What gold and bitcoin have in common A billionaire’s comments regarding a bitcoin bubble Why ‘engineered money’ may give people pause [embedded content] Episode Transcript John Flaherty: Hello and welcome again to The Gold Exchange podcast. I’m John...

Read More »Monetary Metals Renews Financing to Investopedia’s Best Online Gold Dealer

Scottsdale, Ariz, February 5, 2021—Monetary Metals® announces the renewal and expansion of its gold, silver & platinum leases to Money Metals Exchange, to finance the Idaho-based business’ bullion inventory. Money Metals Exchange (no relationship to Monetary Metals) was recently named “Best Overall Online Gold Dealer” for 2021 by Investopedia. Monetary Metals has a disruptive model, obtaining precious metals from investors and leasing it to qualified companies...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org