The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well.April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a government, with a parliamentary vote due to take place on July 23. To be elected, Sánchez will need an absolute majority (176 out of 350 seats). If he fails, the Socialist will need to secure a simple majority (more votes in favour than against) at the second investiture vote 48 hours later, on July 25. If he fails again, the country could be facing fresh general elections

Topics:

Nadia Gharbi considers the following as important: Macroview, Spanish bonds, Spanish economy, Spanish growth, Spanish politics

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well.

April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a government, with a parliamentary vote due to take place on July 23. To be elected, Sánchez will need an absolute majority (176 out of 350 seats). If he fails, the Socialist will need to secure a simple majority (more votes in favour than against) at the second investiture vote 48 hours later, on July 25. If he fails again, the country could be facing fresh general elections in autumn.

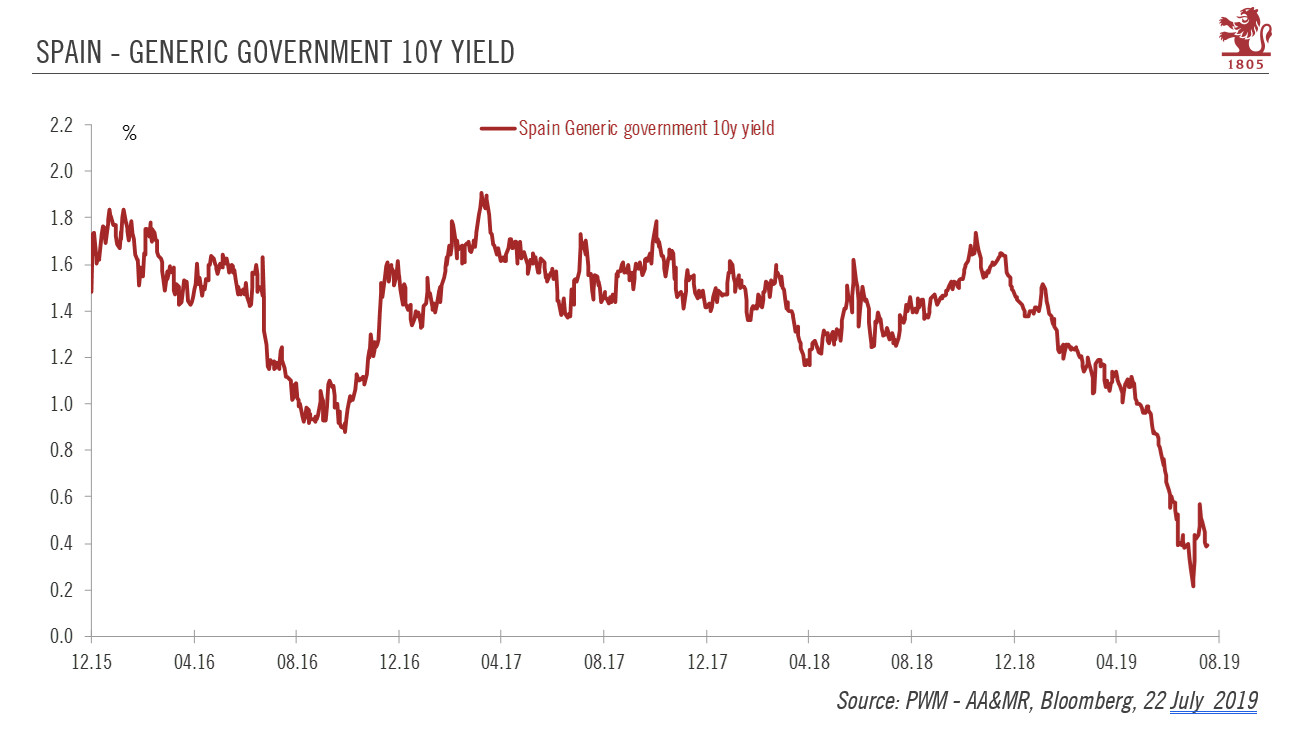

So far, market reaction has been relatively muted to political noise in Spain. The increasingly dovish tone of Mario Draghi at the ECB and the prospect of more ECB stimulus have led to a sharp decrease in Spanish bond yields (see chart). ECB easing should cap volatility in case of continued political uncertainty.

Overall, despite the prolonged period of political uncertainty, our constructive view on the Spanish economy remains unchanged. There are signs that the economy is decelerating, albeit from a very strong pace. Our forecast is for Spanish GDP to grow 2.3% this year, meaning it will remain the fastest growing of the four largest euro area economies.