Momentum in core inflation remains modest and unlikely to spiral out of control in the near term.After a solid reading of 0.35% m-o-m in January – which scared some market participants – core consumer price inflation (CPI) proved tamer in February and again in March, posting a more moderate 0.18% m-o-m gain in both months. (That is not too far from the average since 2010 of 0.15% m-o-m). Due to base effects, the y-o-y reading rose to 2.1% from 1.8%.The relatively monotone core inflation reading, combined with ongoing tepidness in wage growth and well-anchored inflation expectations, confirm that US inflationary pressures are still unlikely to spiral out of control in the near term, despite the very tight labour market and the solid economy. A risk to that view is further escalation of

Topics:

Thomas Costerg considers the following as important: Macroview, US CPI inflation, US inflation forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Momentum in core inflation remains modest and unlikely to spiral out of control in the near term.

After a solid reading of 0.35% m-o-m in January – which scared some market participants – core consumer price inflation (CPI) proved tamer in February and again in March, posting a more moderate 0.18% m-o-m gain in both months. (That is not too far from the average since 2010 of 0.15% m-o-m). Due to base effects, the y-o-y reading rose to 2.1% from 1.8%.

The relatively monotone core inflation reading, combined with ongoing tepidness in wage growth and well-anchored inflation expectations, confirm that US inflationary pressures are still unlikely to spiral out of control in the near term, despite the very tight labour market and the solid economy. A risk to that view is further escalation of tariff disputes that lead to higher imported prices (for clothing and electronics, for example), but this is not our central scenario.

From a Federal Reserve perspective, the second 0.18% core CPI reading in a row is likely to be viewed as “business as usual” and should not alter its now-engrained routine of one quarter-point rate hike per quarter. All things being equal, we think it would take core inflation to rise meaningfully above 2.5% y-o-y for this routine to change, but this remains very unlikely this year.

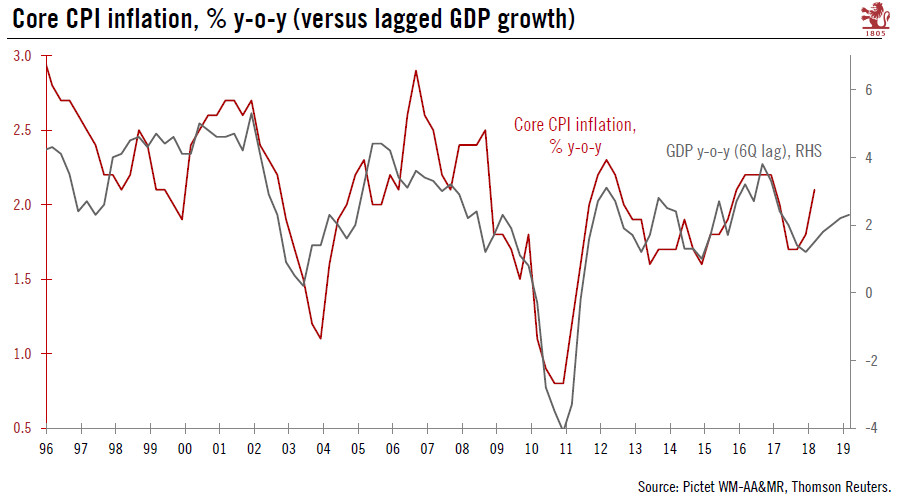

Our US inflation forecasts are unchanged. In particular, we are keeping our 2018 annual core personal consumption expenditure (PCE) inflation forecast unaltered at 1.9%, still a touch above the current Bloomberg consensus of 1.8%. Our inflation scenario is mostly premised on the lagged impact of GDP growth, which proves a better relationship rather than with the (low) US unemployment rate.