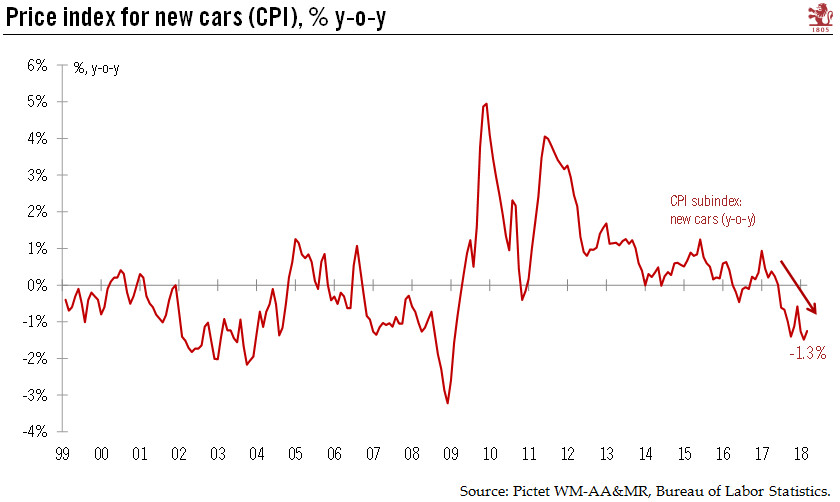

Pricing pressure on new cars suggests demand is weakening.March CPI inflation was relatively muted. Core inflation rose a relatively moderate 0.18% m-o-m, the same as in February, and below January’s 0.35% m-o-m rise. What this shows is that while core inflation is gradually improving – echoing the improvement in the US economy – fears of inflation getting out of hand are still proving unfounded.An interesting, and somewhat more alarming, aspect of the report is to be found in the sub-index for new car prices, which showed ongoing softness. This sub-index was flat m-o-m in March, after -0.5% m-o-m in February and -0.1% in January; the March y-o-y reading fell by 1.25% (see graph). Meanwhile, we know that car sales rose to 17.4mn in March, from 17.0mn in February and 17.1mn in January.

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Pricing pressure on new cars suggests demand is weakening.

March CPI inflation was relatively muted. Core inflation rose a relatively moderate 0.18% m-o-m, the same as in February, and below January’s 0.35% m-o-m rise. What this shows is that while core inflation is gradually improving – echoing the improvement in the US economy – fears of inflation getting out of hand are still proving unfounded.

An interesting, and somewhat more alarming, aspect of the report is to be found in the sub-index for new car prices, which showed ongoing softness. This sub-index was flat m-o-m in March, after -0.5% m-o-m in February and -0.1% in January; the March y-o-y reading fell by 1.25% (see graph). Meanwhile, we know that car sales rose to 17.4mn in March, from 17.0mn in February and 17.1mn in January. Rising car sales combined with falling prices seems to indicate that car dealers have been offering higher discounts to get cars out the door. This is not necessarily a good sign for car demand, especially now that financing costs (leasing rates) are rising as the Federal Reserve continues to tighten monetary policy.

Car sales rebounded strongly after a particularly damaging hurricane season last year. Hopefully, household incomes will rise this year as the labour market continues to improve, in turn helping to support car sales as the hurricane effect wanes. This is why we think it is too early to be pessimistic. Still, how the pricing of new cars evolves will be a key litmus test of the state of the US consumer in the months ahead.