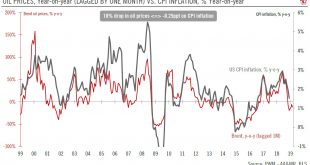

Latest data released confirm our expectations of modest US inflation this year.CPI inflation in January moderated to 1.6% y-o-y, from 1.9% in December (and versus 2.4% on average over the past twelve months).The biggest driver of this moderation was the sharp drop in global oil prices; given recent oil movements, we estimate that headline inflation could slide towards 1% y-o-y in coming months.Excluding energy and food, core CPI inflation remained at 2.2% y-o-y in January.There are signs...

Read More »Underlying US inflation remains moderate

While trade tariffs could impact prices at some point, inflation looks unlikely to spiral out of control.Leaving aside energy prices (up 24% y-o-y), core CPI inflation in the US remained moderate in June rising 0.16% m-o-m, which pushed the y-o-y reading slightly up, to 2.3% from 2.2% in May. A print of 2.3% y-o-y, while above the one-year average of 1.9%, is a relatively tame reading in light of the very low US unemployment rate of 4.0%. By contrast, core CPI inflation peaked at 2.9% y-o-y...

Read More »US inflation worries prove unfounded

Momentum in core inflation remains modest and unlikely to spiral out of control in the near term.After a solid reading of 0.35% m-o-m in January – which scared some market participants – core consumer price inflation (CPI) proved tamer in February and again in March, posting a more moderate 0.18% m-o-m gain in both months. (That is not too far from the average since 2010 of 0.15% m-o-m). Due to base effects, the y-o-y reading rose to 2.1% from 1.8%.The relatively monotone core inflation...

Read More »US CPI update: Costlier T-shirts

But the underlying pick-up in inflation in January was not as severe as it seems.January core CPI inflation was firm, as the index rose 0.35% month-on-month (m-o-m). The year-on-year print was unchanged at 1.8%.Was inflation that bad? Probably not. The sharp increase in apparel prices (1.7% m-o-m, the biggest monthly increase since February 1990) appears particularly suspicious and may fall back again next month. Some notoriously volatile sub-indices, such as leased cars, provided a further...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org