Summary: Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month. Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year highs. The MSCI Emerging Equity Index moved higher every month this year through August. It slipped a little more than 0.5% in September but is up 4% in the first half of this month. Aren’t interest rates low, despite trend or better growth in the US, EU and Japan? The BRICs are expanding. The IMF revised

Topics:

Marc Chandler considers the following as important: $CNY, EUR, Featured, FX Trends, GBP, JPY, newsletter, NZD, SPY, TLT, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Summary:

Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital.

Have we forgotten what Minski taught again?

Political considerations may dominate ahead of the ECB meeting later this month.

Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year highs. The MSCI Emerging Equity Index moved higher every month this year through August. It slipped a little more than 0.5% in September but is up 4% in the first half of this month.

Aren’t interest rates low, despite trend or better growth in the US, EU and Japan? The BRICs are expanding. The IMF revised up its global growth forecasts. Although lowflation remains a significant concern for central bankers, deflationary forces appear to have been arrested. There are an estimated $3 trillion of debt still offering negative interest rates. The US benchmark 10-year yield has turned back from the 2.40% area as it has done a few other times over the past six months.

The 10-year German Bund yield is capped at 50 bp. It did spend some time above there in July and August and flirted with it again in late September and early October, but it is now testing the lower end of its recent range near 40 bp. A trendline is drawn off the last time the Bund yield was below zero, October 2016, and off this year’s April, June and September lows comes in now near 33 bp.

The persistent dollar strength seen from the middle of 2014 through the start of the is the year, faded this year. The dollar’s strength was a factor cited behind the recent disappointing inflation readings. Although the foreign exchange market has not been a major source of stress for officials, there does seem to be some effort to talk it down when it has strayed above $1.20.

We suspect that infatuation with the so-called cyber currencies, which have little in common with what we know as money, and even fiat money at that, is partly driven by the same underlying factor as other financial assets. There is too much capital relative to the demand by industry and much of the surplus capital that is not simply wasted gets circulated in financial assets.

Moreover, companies used to be the net borrower of capital, and now they are net suppliers. US, Japanese, and European corporates are sitting with an estimated $7-$8 trillion of cash and cash equivalents on their balance sheets. Since the early 2000s, when US laws were changed to exempt share buybacks from stock manipulation rules, US companies have bought by an estimated $7 trillion of their shares.

One of the developments this year has been the stepped-up corporate buybacks of their debt. According to Bloomberg data, through the end of September, S&P 500 companies have bought back nearly $180 bln of their bonds after a little more than $87 bln all of the last year.

Leave aside the lessons that Minsky taught, and many of us had to re-learn during the Great Financial Crisis, that financial stability itself leads to its opposite, through financial engineering, leverage, and mispricing of risk. Leave aside that the spread between the Russell 1000 Value Index and the Russell 1000 Growth Index is the widest since the end of the tech bubble in 2000. The immediate problem is that the rewards of the market economy and appreciating asset prices benefit the few, and, in various forms and numerous ways, the response has become a potent political force.

United StatesIndeed with the arguable exception of the UK, which publishes its latest CPI, retail sales, and employment reports, politics dominate the agenda next week and in the run-up to the ECB meeting on October 26. The market has gone as far toward pricing in a December rate hike as seem prudent at this juncture. It peaked as we surmised after the September employment report. Six Fed officials speak in the week ahead. Yellen and Dudley’s comments are the most important, but investors should not expect more insight into the December meeting, and we would pencil in zero chance of a November hike. In terms of politics, Europe dominates the first part of the week, and Asia the second part. The US political drama runs throughout. Executive orders to stop subsidizing insurance companies under the Affordable Care Act given the failure of Republicans to “reform and replace” it creates the potential for greater disruption. Several states are apparently poised to challenge the President’s order in the judiciary. Tax reform may be running aground after Trump said last week that he would make some adjustments shortly to the framework offered last month. There has been a significant resistance to abolishing the state and local tax (SALT) deduction (from Federal tax obligations). Recall that the Border Tax Adjustment was to raise $1 trillion over the next decade. Health care reform was to raise another $1 trillion. The end of the SALT deduction was to raise $1.5 trillion. If these revenues are no longer likely, what will be replacing them? Can the resulting deficit be assumed away if we forecast sufficient faster growth, spurred by the tax cuts themselves? Trump’s nomination of the next Federal Reserve Chair is expected any day. Surveys of market participants see Warsh as most likely to get the nod while betting websites see Powell as more likely. Reports suggest that Treasury Secretary Mnuchin prefers Powell. This takes an unnecessary risk of clout if not credibility if Trump picks someone else. |

Economic Events: United States, Week October 16 |

EurozoneEuropean politic anxiety has increased, not lessened as expected, since the German election. Spain’s largest constitutional crisis in a generation is winding down. Puigdemont’s secessionist play failed. There was no international support. The elite, political, economic and royal, showed a common front. Nor was Puigdemont successful in helping topple Rajoy’s minority government. Instead, Puigdemont danced around: declaring and suspending independence. Madrid is the not the only one calling for a clear, unambiguous statement. The far-left party in his regional government alliance has threatened to withdraw support from Puigdemont, which would likely trigger a new regional election unless he declares independence. Austria holds an election on October 15. The political spectrum in Austria has shifted to the right. Even the Social Democrats supported abolishing Muslim pre-schools because it created separate societies. The populist-nationalist Freedom Party has been polling in second place with about one in four voters. The Popular Party poised to record a plurality of votes has already adopted much of the Freedom’s Party’s anti-immigrant and anti-Muslim stance. The last time the Freedom Party was part of the Austrian government, many other European countries ostracized it. It will be interesting to see what happens, though we suspect a different response this time. Italy’s approved a new electoral reform bill, which appears to have few bells and whistles and does not include a bonus number of seats for a party with the most votes. It rewards pre-election coalitions. This is to the detriment of the populist-nationalist Five-Star Movement, which rules out such coalitions. It seems to be a small step toward addressing the fragmentation of Italy’s politics. It may still be short of creating majority parties, but the coalitions may consist of large blocs. Ideas of an election this year, or even in Q1 next year, may be exaggerated. The electoral law needs to be debated and approved by the Senate. More pressing is the 2018 budget. That will take the next several weeks. Then there is Berlusconi, who has challenged being barred from running for office. It is not immediately clear if Berlusconi indeed wants to run for office again. Still, it would make sense that Berlusconi and his allies seek to delay an election until the European judicial decision is handed down, and that may not be until next year. |

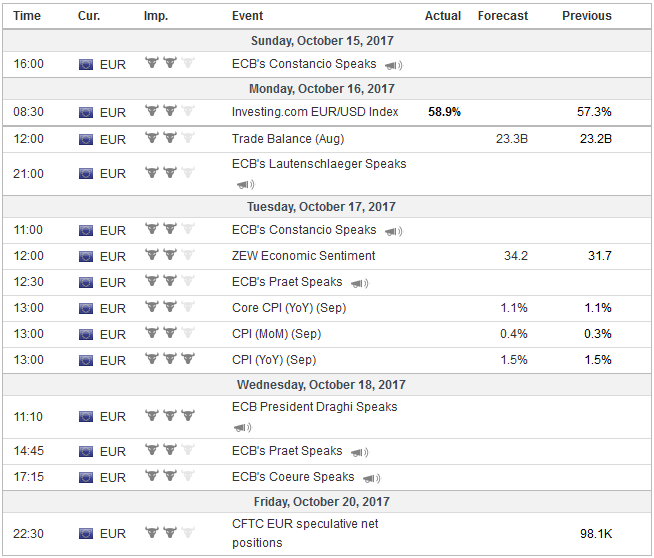

Economic Events: Eurozone, Week October 16 |

New ZealandTurning to Asia-Pacific, New Zealand held elections last month. New Zealand First support is needed to form the next government. Although the ideological affinity is with the governing Nationals, pragmatic consideration, like the deal that can be arranged, may be more important. An announcement is expected at the start of the new week. A center-right government would appear to be what the market is anticipating. The New Zealand dollar carved a bottom below $0.7000 in the first part of last week, from which it launched an assault on $0.7200 before the end of the week. This is an important technical area that contains the 20-day moving average and a retracement objective of the election-related leg down since September 20. The technical indicators are consistent with additional gains, though the $0.7240-$0.7300 may restrain the upside initially. |

Economic Events: New Zealand, Week October 16 |

ChinaThe 19th Chinese Communist Party Congress begins the middle of the week. For political theater, it may be more nuanced for investors’ palate for the dramatic may find very interesting. It seems widely recognized as a showcase for President Xi’s power, which as a recognized “core leader” may be the most since Deng Xiaoping. For investment opportunities, the Congress may also be light. However, the impact could be indirect. If one believes the not very whispered whispers that Chinese officials have ordered and engineered great stability ahead of the Congress, then some increase in volatility should be expected. Chinese stocks have lagged most other markets, but recent gains Shanghai have lifted the Composite to its best levels since March 2016. The Shanghai Composite has risen in four of the past five quarters. The 4%+ gain in Q3 was the largest since Q4 15, during the bubble. The week after the Party Congress ends, China’s government is expected to sell dollar bonds for the first time in more than a decade. The small amount ($2 bln) that is expected to be raised is a little importance to China, and will likely be priced tightly, helped by novelty and scarcity considerations. It may provide a benchmark for other dollar borrowers, like businesses. What is striking is that this offering, which could be the first of many, it seems to be another testament to the resilience of the dollar standard. China’s offering is emblematic of developing countries demand. According to figures in the Wall Street Journal, private and public sector dollar borrowings from emerging market countries, this year alone is in excess of $500 bln, a new record. The BIS estimates that total dollar debt owed by non-US government and businesses at $10.7 trillion, of which $3.7 trillion is accounted for by emerging markets. |

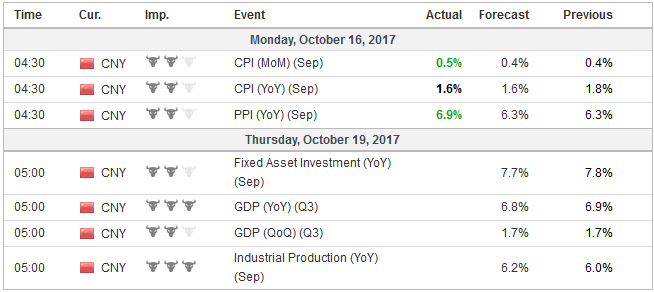

Economic Events: China, Week October 16 |

JapanJapan goes to the polls on October 22. The main question now is whether the LDP and its Komeito Party ally will retain their super-majority. The Party of Hope is not running enough candidates to win a majority of the seat. Polls suggest it has lost some momentum. There appears to be some infighting, according to reports. There will be 465 seats in the next Diet. The governing coalition needs to win 307 seats to retain its 2/3 majority. Under what conditions could Abe feel compelled to step down? We suspect that nothing shy of not being able to marshal a majority coalition would push Abe out of office. It is possible that a defeat in which the LDP itself fails to win an outright majority may spur a leadership challenge this time next year, Abe would likely to retain office. The two big policy issues that the Party of Hope has staked out is the phasing out of nuclear power entirely and abolishing the retail sales tax hike planned for 2019. It is not clear, at this juncture, that Abe can co-opt either issue. A cabinet reshuffle after the election seems only natural. Here there may be an opportunity to steal some thunder of the Party of Hope and further expand on Abe’s third arrow through the power of appointment to the cabinet. |

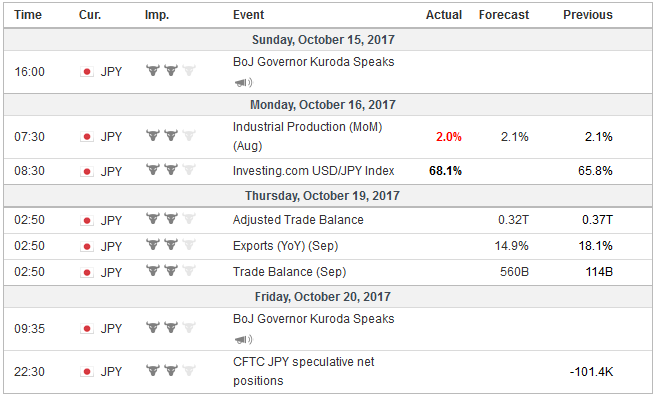

Economic Events: Japan, Week October 16 |

United KingdomThe UK, which reports important economic data, is also subject to political considerations. The EU’s Barnier’s claim that Brexit talks are deadlocked means that the heads of state (EU Council), which meet at the end of next week, are unlikely to overrule their chief negotiator. That means that the familiar issues, like the exit bill, Northern Ireland’s border, and citizens’ rights will continue to be discussed. If “sufficient” progress is made, December is the next window of opportunity to shift the talks to the new relationship and trade. Ahead of the inflation, retail sales and labor market reports, the market is discounting more than a 75% chance of a rate hike next month. BOE Governor Carney has not wavered in his assessment that a rate hike may be necessary for the coming months. Speculators in the futures market, a proxy for trend followers and momentum players, are net long 15.5k sterling contracts. As recently as early September, they were net short 53k contracts. The Bloomberg survey finds a median of respondents expect inflation to tick up. However, average weekly pay is not likely to rise, and retail sales are expected to have softened. Separately, the BOE reported last week that UK banks had tightened credit for unsecured borrowing, and annual growth in consumer credit slowed below 10% for the first time since April 2016. Market positioning suggests the reaction may be more dramatic to disappointment, especially anything that would justify waiting an extra month before hiking rates. Many economists still expect UK inflation to peak here in Q4, while the economy continues to gradually slow. The expansion is likely slowing a the third consecutive year. |

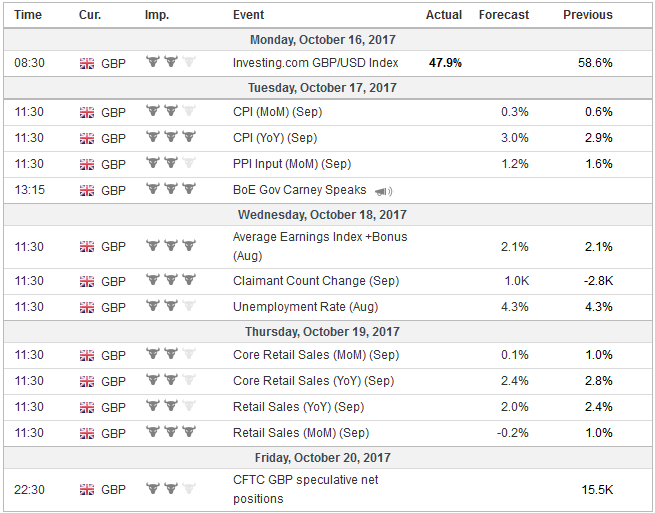

Economic Events: United Kingdom, Week October 16 |

Switzerland |

Economic Events: Switzerland, Week October 16 |

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,Featured,newsletter,NZD,SPY