The dollar fell against all the major currencies and most of the emerging market currencies last week. The Dollar Index fell by 1.3%, the biggest loss since the last week of March, and posted its lowest close in nearly three weeks ahead of the weekend. There seemed to be a change in the market after key equity benchmarks, like the MSCI ACWI Index of both emerging and developed markets put in a recovery high in the middle of last week. The S&P 500 also peaked at...

Read More »FX Daily, March 25: Monday Blues: Equities Pare Quarterly Gains

Swiss Franc The Euro has fallen by 0.12% at 1.1231 EUR/CHF and USD/CHF, March 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have soured after the US shares dropped the most since very early in the year before the weekend. Asia’s sell-off was led by the 3% decline in Nikkei, while Malaysia fared among the best, surrendering 1%. Europe’s Dow...

Read More »FX Weekly Preview: Brexit Comes to a Head, and while Europe and US Data Rebound, the Equity Rally Falters

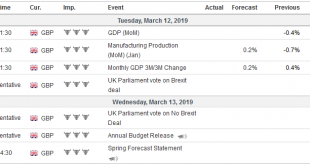

Brexit comes to a head. By nearly all reckoning, the Withdrawal Bill will be resoundingly defeated in the House of Commons on March 12. The margin of defeat may not match the first rejection, but it will be the death knell to the path that had been negotiated for a year and a half. On March 13, the House of Commons will vote on leaving the EU without a withdrawal agreement. Most, except the most extreme partisans, think...

Read More »FX Daily, March 08: Equities Slump on Growth Concerns ahead of US Jobs

Swiss Franc The Euro has fallen by 0.03% at 1.1313 EUR/CHF and USD/CHF, March 08(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A weak economic assessment in the Beige Book and an ECB that slashed growth forecasts have been followed by news of a nearly 21% slump in China’s exports have marked the end of the dramatic equity rally that was seen in the first...

Read More »FX Weekly Preview: The Week Ahead

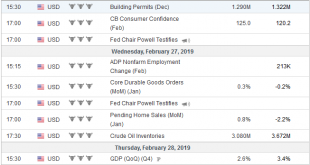

After a dismal end of 2018, investors are faring better through the first two- thirds of the Q1 19. Equity markets have recouped a good part of the late-2018 decline. Bond yields, however, have not returned to where they previously were. The tightening of financial conditions, which was both cause and effect of heightened anxiety among investors, and spooked some central bank have eased considerably. The volatility of...

Read More »FX Daily, January 10: Equity Bounce Stalls while the Greenback Steadies at Lower Levels

Swiss Franc The Euro has risen by 0.39% at 1.1288 EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities, bonds and the dollar are consolidating the moves seen earlier this week. This means equities are trading heavy and bonds firmer. The euro is paring gains that carried it to its best level (~$1.1570) since mid-October. After...

Read More »Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January...

Read More »FX Daily, December 20: Stocks Slump and the Dollar Slides as Market Concludes Fed is Mistaken

Swiss Franc The Euro has risen by 0.20% at 1.1334 EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Once again the US equity market failed to hold on to even minimal upticks. The sharply lower close spurred follow-through selling in global equities. Few have been spared the wrath of investors who apparently were disappointed with the...

Read More »FX Daily, December 06: New Spanner in US-China Relations Weighs on Risk Appetites

Swiss Franc The Euro has fallen by 0.15% at 1.13 EUR/CHF and USD/CHF, December 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets were fragile amid trade uncertainty and economic slowdown fears. News that Canada arrested the CFO of Huawei on behalf of the US, ostensibly for violating the embargo against Iran triggered an almost immediate...

Read More »FX Daily, December 04: Stock Rally Arrested, but Bond and Oil Advance Continues, leaving Dollar in a Lurch

Swiss Franc The Euro has risen by 0.12% at 1.1339 EUR/CHF and USD/CHF, December 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity markets are unable to build on yesterday’s advance, but bonds and oil are extending gains. The dollar remains on the defensive and is off again all the major currencies. The lack of a joint statement over the weekend by the US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org