Stock Markets EM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR. Stock Markets Emerging Markets, October 14 Source: economist.com - Click to enlarge China China reports CPI and PPI Monday. The former is expected to rise 1.6% y/y and the latter by 6.4% y/y. The 19th CPC National Congress begins Wednesday. China then reports September retail sales, IP, and Q3 GDP Thursday. The y/y readings are expected at 10.2%, 6.4% y/y, and 6.8% y/y, respectively. Over the weekend, China reported stronger than expected

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR. |

Stock Markets Emerging Markets, October 14 Source: economist.com - Click to enlarge |

ChinaChina reports CPI and PPI Monday. The former is expected to rise 1.6% y/y and the latter by 6.4% y/y. The 19th CPC National Congress begins Wednesday. China then reports September retail sales, IP, and Q3 GDP Thursday. The y/y readings are expected at 10.2%, 6.4% y/y, and 6.8% y/y, respectively. Over the weekend, China reported stronger than expected September money and new loan data that supports the view that the economic outlook in Q4 will remain solid. IsraelIsrael reports September CPI Monday, which is expected at -0.2% y/y vs. -0.1% in August. If so, this would be well below the 1-3% target range. Bank of Israel then meets Thursday and is expected to keep rates steady at 0.10%. The bar to further easing is high, but current loose policy is likely to maintained through 2018. IndonesiaIndonesia reports September trade Monday. Exports are expected to rise 18% y/y and imports by 20.6% y/y. Bank Indonesia then meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.7% y/y in September, in the bottom half of the 3-5% target range. BI has said further easing will be data dependent. PolandPoland reports August trade and current account data Monday. Poland then reports September industrial and construction output, PPI, and real retail sales Wednesday. The economy is expected to remain robust, which we think makes it difficult to justify steady rates through 2018. The central bank releases its minutes Thursday. SingaporeSingapore reports September trade Tuesday, with NODX expected to rise 12.7% y/y vs. 17.0% in August. Last week, the MAS tweaked its forward guidance to give it flexibility on policy. At the same time, it highlighted slower growth and low price pressures in 2018. April tightening is possible, but will depend on how Q4 and Q1 data come in. South AfricaSouth Africa reports September CPI Wednesday, which is expected to rise 4.9% y/y vs. 4.8% in August. If so, this would still be within the 3-6% target range. We think the SARB will resume cutting rates with a 25 bp move at its November 23 meeting. August retail sales will also be reported that day, and are expected to rise 2.4% y/y vs. 1.8% in July. KoreaBank of Korea meets Thursday and is expected to keep rates steady at 1.25%. CPI rose 2.1% y/y in September, near the 2% target. For now, we think the risks are balanced and so we see steady rates well into 2018. ChileChile central bank meets Thursday and is expected to keep rates steady at 2.5%. CPI rose 1.5% y/y in September, well below the 2-4% target range. While the central bank has signaled that the tightening cycle is over for now, low inflation gives it flexibility to cut rates again if the economy slows again. MalaysiaMalaysia reports September CPI Friday, which is expected to rise 4.2% y/y vs. 3.7% in August. Bank Negara does not have an explicit inflation target. As a result, it can take a wait and see approach before hiking rates. TaiwanTaiwan reports September export orders Friday, which are expected to rise 9.7% y/y vs. 7.5% in August. Exports have been robust this year, and the recent orders data suggest this trend will continue. The constructive mainland China outlook should help Taiwan and the other regional economies to continue performing well. BrazilBrazil reports mid-October IPCA inflation Friday, which is expected to rise 2.72% y/y vs. 2.56% in mid-September. Inflation has bottomed, which is why COPOM has signaled a slower pace of easing ahead. We look for a 75 bp cut to 7.5% October 25 and a final 50 bp cut to 7% December 6. |

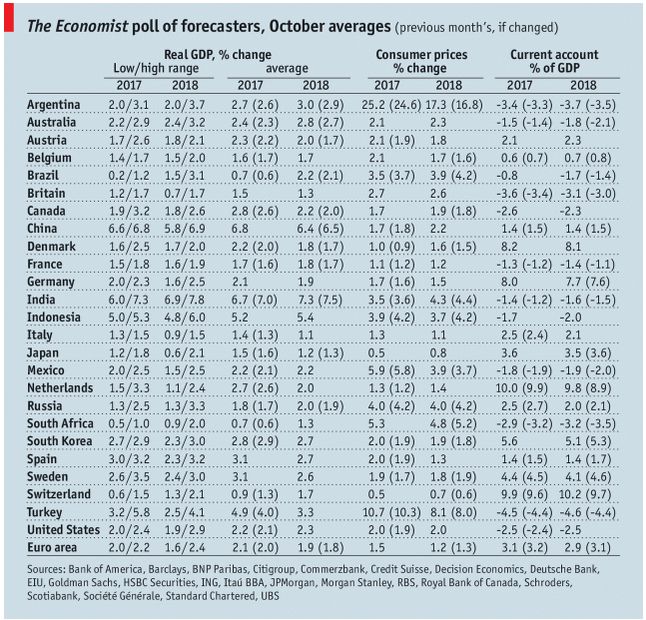

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin