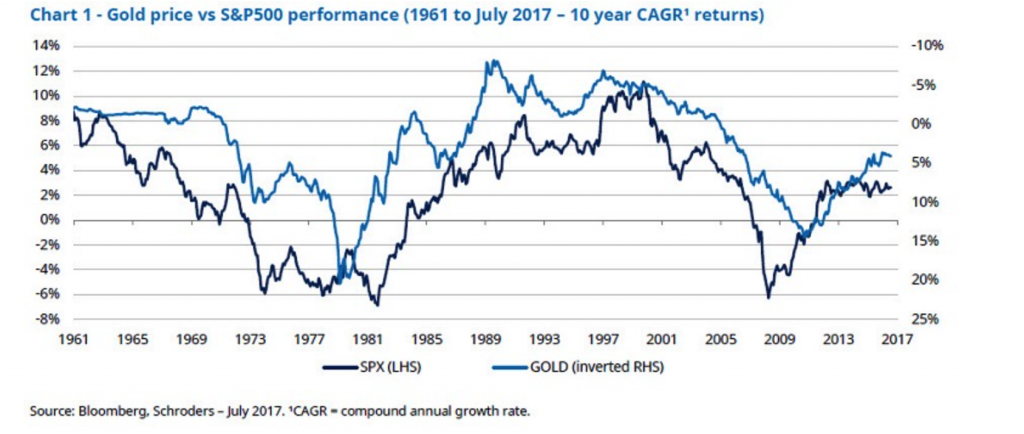

– 4 reasons why “gold has entered a new bull market” – Schroders– Market complacency is key to gold bull market say Schroders– Investors are currently pricing in the most benign risk environment in history as seen in the VIX– History shows gold has the potential to perform very well in periods of stock market weakness (see chart)– You should buy insurance when insurers don’t believe that the “risk event” will happen– Very high Chinese gold demand, negative global interest rates and a weak dollar should push gold higher Gold price and S&P500 Performance, 1961 - 2017(see more posts on gold price, S&P 500, ) - Click to enlarge Market complacency: the market stalker Market complacency is becoming a bit of a theme

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, gold price, GoldCore, newsletter, S&P 500, S&P 500 Index, S&P 500, S&P 500 Index

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

| – 4 reasons why “gold has entered a new bull market” – Schroders – Market complacency is key to gold bull market say Schroders – Investors are currently pricing in the most benign risk environment in history as seen in the VIX – History shows gold has the potential to perform very well in periods of stock market weakness (see chart) – You should buy insurance when insurers don’t believe that the “risk event” will happen – Very high Chinese gold demand, negative global interest rates and a weak dollar should push gold higher |

Gold price and S&P500 Performance, 1961 - 2017(see more posts on gold price, S&P 500, ) |

Market complacency: the market stalkerMarket complacency is becoming a bit of a theme amongst financial commentators and analysts of late. Many seem perplexed as to why the market seems to be so enthusiastic and relaxed given the state of the world (Trump leadership, Venezuela, North Korea, global debt levels…to name a few).

One of the most common measures for market complacency (or dissatisfaction) is the VIX Index. The index is a popular measure of the implied volatility of the S&P500 index options over the next 30 days. As we explained earlier in the week: The VIX index is often referred to as the ‘Fear Index’. Many believe this is a misnomer and does not portray what is really going on. The index has been trading at historically low levels. Apparently investors continue to bet that the index will remain low if money keeps pouring into markets and the global economy carries on improving. |

S&P500 Volatility Index, 1990 -2018(see more posts on S&P 500, ) |

Not just about equities and complacencyAs with the financial crisis, the thing that causes the most damage is that which we turn a blind eye to. This is exactly what is happening right now by those pumping money into both the economy and financial markets. However, the case for gold is not strong just because we think no one else is able to smell the (very strong) coffee. Schroders also make an argument that Chinese demand, negative global interest rates and a potentially weak dollar will be major drivers of gold. |

|

| Conclusion

We have to agree with the authors of this insightful piece: gold is currently extremely undervalued and under appreciated given the amount of risk that is in the financial system.

|

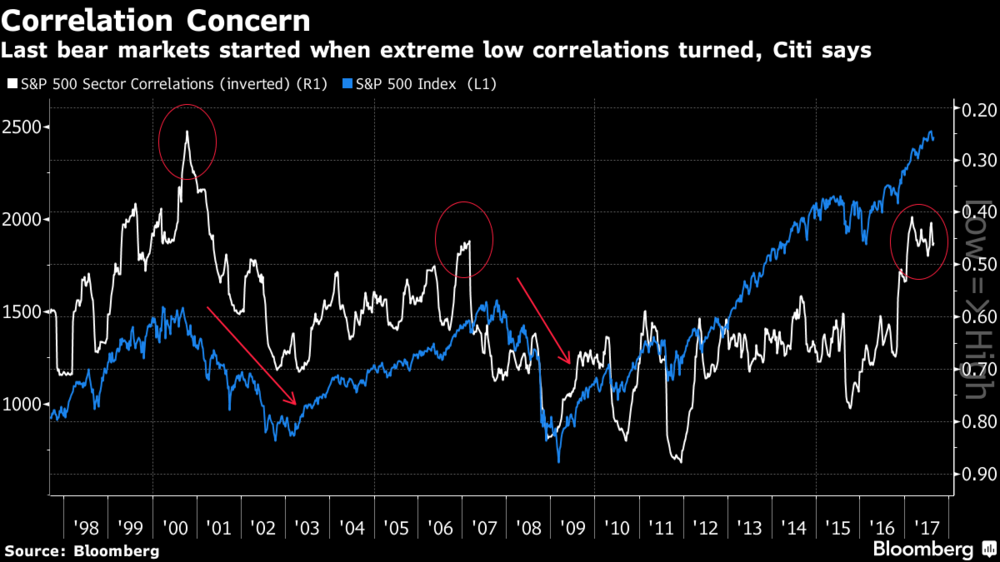

S&P500 Sector Correlations and S&P500 Index, 1998 - 2017(see more posts on S&P 500 Index, ) |

This week gold broke through the key resistance of $1,300. For some time market commentators have been signalling this level as the point of entry for a new bull market.

Often price can be distracting when it comes to trying to figure out what is going on. Two Schroders fund managers called the new bull market in gold about a week before the price broke through the key level.

Gold has entered into a new bull market. As we have discussed previously, there are four main reasons for our stance:

- Global interest rates need to stay negative

- Broad equity valuations are extremely high and complacency stalks financial markets

- The dollar might be entering a bear market

- Chinese demand for gold has the potential to surge (indeed, investment demand in China for bar and coin already increased over 30% in the first quarter of 2017, according to the World Gold Council)

Whilst they offered up four key reasons for the strength in gold, they highlighted the issue of broad equity valuations and market complacency as the most ‘pertinent’ of the four drivers.

Given the current state of play in the world, James Luke and Mark Lacey ‘strongly believe gold could turn out to be an underowned and well-priced insurance policy.’

Extremely high broad equity valuations look precarious

Starting with the S&P500, Luke and Lacey believe that it is currently very expensive based on a variety of measures.

The S&P500 made an all-time high of 2478 in July and is now up just under 11.5% year-to-date (source Bloomberg, 17 August 2017).

The valuation of this index is expensive on a variety of measures. Whether we look at simple price/book, trailing price/earnings or enterprise value/cashflow (each of which are different ways to value a company), the index is trading on valuation multiples which are 60% to 100% higher than the historical median over the last 90 years.

Whichever your preferred metric, historical regression analysis suggests expected returns for equities, from today’s starting point, are very low.

Why is the S&P500 so overvalued? This is something we have covered previously. There is an almost infallible belief that future earnings growth will be supported by Trump’s drive to cut corporate tax and the the fact that companies’ cost of capital is at an all-time low.

US companies may well receive a welcome reduction in the corporate tax rate, but the low cost of capital argument is flawed. Increasing interest rates are not supportive for equity valuations that are already high (versus history) as companies’ cost of capital increases. As unemployment continues to fall, inflation will start to pick up at the margin, regardless of the lag. Like it or not, we are firmly in a cycle of increasing nominal (not real) interest rates.

Gold and weak equity environments have history

As much as gold’s safe haven status is disputed in the mainstream, history cannot be ignored. This is something we admittedly bang-on about on a regular basis. It is something which is so simple and yet is refuted with the most complicated arguments.

Luckily Luke and Lacey agree on gold’s historical performance as evidence for it’s safe haven status.

If we look back at gold price performance between 1961 and July 2017 (see chart above), it is very clear that gold price annual returns were positive, particularly during periods of high inflation, while stock market returns were negative.

We don’t see any argument as to why gold’s previous performance against a weak stock market will not repeat itself once markets wake-up to the real story.

What is the real story? As Luke and Lacey point out, stock market performance is not reason alone to argue that a gold bull market is in play. It is overall market complacency.

At the moment the VIX is trading at a 27-year low. Investors are currently pricing in not just a stable pricing environment for the S&P500 for the next few months, but basically the most benign risk environment in the history of the index.

To us, this is odd from many angles. Not least because current extreme equity valuations are set against the startling fact that global central banks are moving towards an attempt to reverse the most extreme set of policies in the history of monetary policy. More visceral external factors are also lurking in the background.

Tags: Daily Market Update,Featured,gold price,newsletter,S&P 500,S&P 500 Index