Dave Lukas of Misfit Entrepreneur invites Stephen Flood, CEO of GoldCore, to the show. Dave and Stephen talk about what people should know before investing in gold and silver, the present state of inflation, central banking, and the monetary system. Further, he explains why gold is still your safe-haven asset and how it provides you with personal sovereignty. They also talk about cryptocurrencies and their future. Stephen also discusses some of the lessons he’s...

Read More »Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26. Gold and silver have continued to sell off this morning with gold trading as low as $1,794 and silver trading down to $22.14. The FOMC minutes showed a much more hawkish Fed than markets had been expecting. The minute suggests that the Fed...

Read More »Gold and Silver Will Surge to Record Highs Over $1,900 and $50 Per Ounce – IG TV Interview

Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years. Gold is overbought and may go lower or higher in the short term, but the many financial, geopolitical and monetary risks in the world are issues which are here to stay. This bodes well for the price of gold and should...

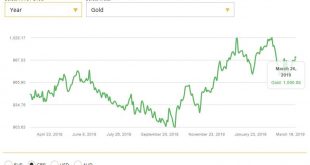

Read More »Gold To Reach 6 Year High Over $1,400 on Uncertain Outlook for Global Markets

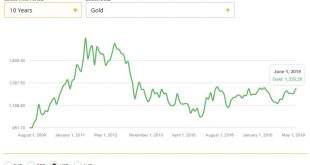

by Bloomberg Gold is finally gaining the traction needed to boost prices to a level not seen since 2013 as concern mounts over increased trade war tensions and the global growth outlook. Bullion may touch $1,400 an ounce this year as investors hedge risk, according to Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone Inc. Spot gold was at about $1,326 an ounce on Monday after jumping to...

Read More »Gold Hits 10 Week High At $1,328/oz as Trade Wars Spur Safe Haven Demand

Gold has consolidated on yesterday’s gains and is marginally higher as risk aversion creeps back into markets. Gold rose 1.5% yesterday to its highest level in more than three months. Concerns that trade wars look set to escalate globally and fears that President Trump’s threat of tariffs on Mexico will hurt the global economy are spurring safe haven demand. Gold had a fourth straight session gain yesterday, settling at...

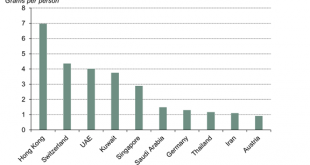

Read More »Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate 20% plan to invest in gold in the next 12 months Almost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online by Alistair Hewitt of the World Gold Council There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the...

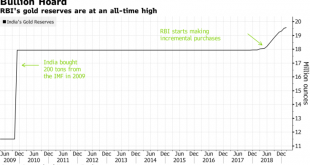

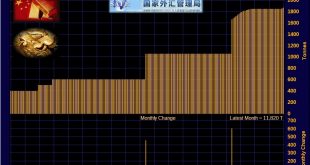

Read More »World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBC Many other central banks including large creditor nations Russia and China are also adding to gold holdings via Bloomberg India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their...

Read More »SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

Strengths The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey. Turkey’s gold reserves reversed this week by rising $227 million from the previous week. The central bank’s holdings...

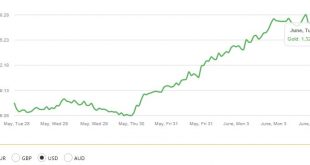

Read More »Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks – Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland – Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage – UK sees sharp slowdown in mortgage approvals in February as housing market slows – Gold surges to near all time record highs in Australian dollars at $1,860/oz –...

Read More »China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org