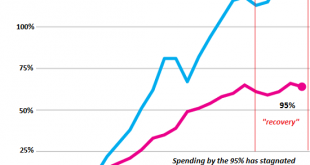

The authors’ thesis doesn’t explain the 47-year downtrend of labor’s share of the economy. A provocative essay, Don’t Blame the Robots, makes the bold claim that “Housing Prices and Market Power Explain Wage Stagnation.” (Foreign Affairs) In other words, the stagnation of the bottom 95% of wages isn’t caused by automation or offshoring, but by the crushingly high cost of housing: “Yet recent academic work in...

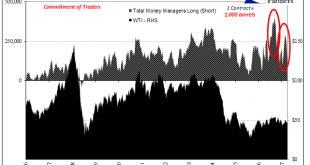

Read More »COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year. It was earlier in February when money managers piled in to WTI longs, apparently expecting better things...

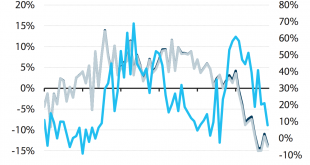

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

Read More »Swiss Life under scrutiny of US authorities for tax evasion

Swiss Life denies it has flouted US regulations - Click to enlarge Insurance firm Swiss Life has announced that it has been approached by the US Department of Justice (DOJ) regarding its cross-border business with US clients. After going after Swiss banks with a vengeance for abetting tax evasion, it appears that it is now the turn of the Swiss insurance industry to attract unfavourable attention from the DOJ. Products...

Read More »Swiss mobile roaming charges – a glimmer of hope

© Ocusfocus | Dreamstime Switzerland’s federal council, the country’s seven-person executive or cabinet, has come up with a plan to cut those exorbitant mobile roaming phone bills that many of us return home to after trips abroad, an experience which hurts even more now roaming charges have been eliminated for EU residents. The roaming proposal is part of a wide-ranging revision to Switzerland’s telecommunications laws,...

Read More »British People Suddenly Stopped Buying Cars

– British people suddenly stopped buying cars – Massive debt including car loans, very low household savings – Brexit and decline in sterling and consumer confidence impacts – New cars being bought on PCP by people who could not normally afford them – UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley – Bank of England is investigating to make sure UK banks...

Read More »Canada’s RHINO(s)

The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact. But what we really find in Canada is what we find everywhere else. The end of the “rising dollar”...

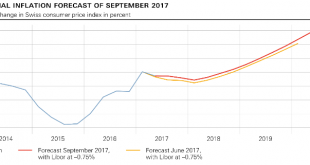

Read More »SNB Monetary Policy Assessment September 2017 and Comments

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

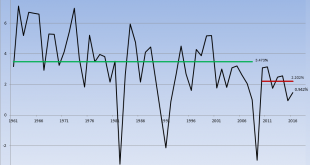

Read More »Swiss Producer and Import Price Index in August 2017: +0.6 YoY, +0.3 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments There were big moves in the metals markets this week. The price of gold was up an additional $21 and that of silver $0.30. Will the dollar fall further?As always, we are interested in the fundamentals of supply and demand as measured by the basis. But first, here are the charts of the prices of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org