Summary: The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again. The US dollar’s sell-off accelerated. It has been selling off since the start of the year. The first phase of the decline at...

Read More »Emerging Markets: Preview for the Week Ahead

Stock Markets EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM. Stock Markets Emerging Markets, September 11 Source: economist.com - Click to enlarge China China should report August new loan and money supply data this...

Read More »Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house...

Read More »Hard times continue for Swiss private banks

Numbers of banks in Switzerland have shrunk since the financial crisis. Over half of private banks in Switzerland analysed by KPMG last year experienced net outflows of client cash. In a difficult period for finance, many could be forced to shut down or be bought out. “Implement truly radical change, or continue to see performance deteriorate.” This was the message of a study released Thursday by audit group KPMG with...

Read More »Government plans to tackle high roaming charges

The changes would affect a range of telecoms services. Switzerland is one of the most connected countries on the planet, but mobile and internet users in still grumble about lack of choice, unwelcome cold-calling from companies, and high roaming charges when travelling abroad. The revised Telecommunications Actexternal link, sent by the cabinet to the parliament on Thursday, makes a stab at tackling some of these...

Read More »Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

– Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy– Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower– Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%– Geo-political concerns including North Korea, falling USD push gold 2.1% in week – Gold prices reach $1,355 this morning following Mexico earthquake– Safe haven demand sees gold over one year high,...

Read More »Global PMI Roundup; August 2017

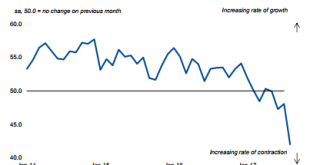

The first few days of any calendar month are now flooded with PMI data. Mostly due to Markit’s ongoing and increasing partnerships, we now have access to economic or business sentiment from and for almost anywhere in the world. It isn’t clear, however, if that is a good or useful development. For example, we can see quite plainly that there is a whole bunch of trouble brewing in Kenya. The Stanbic Bank/Markit Kenya PMI...

Read More »Emerging Markets: What has Changed

Summary: South Korea completed installation of the THAAD missile shield. Indonesia is considering issuing its first global IDR-denominated sovereign bonds. Taiwan is undergoing a cabinet shuffle. Brazil has seen some positive political developments. Brazil’s central bank signaled that the easing cycle is nearing an end and that the pace of easing will slow. Chile’s central bank boosted its growth forecasts. Stock...

Read More »Le retour de l’or sur la scène monétaire mondiale?

Mars 2009, le gouverneur de la Banque populaire de Chine M Zhou Xiaochuan revint dans le cadre d’une conférence intitulée Reform the international Monetary System sur la vision de Keynes au sujet du bancor.Pour lui, le système centré sur le dollar américain et les taux de changes flottants, plus ou moins librement, devrait être repensé. Bancor: À l’occasion du sommet de Bretton Woods en 1944, deux plans de création de...

Read More »The number of Swiss brewers continues to rise despite declining beer consumption

A recent report shows a 2% drop in average Swiss beer consumption in 2016. Over the last 20 years it has dropped 4% to 54.9 litres per person. On its own this would be no cause for alarm, however in 2016, the number of breweries in Switzerland rose by 21% to 753. Since 2011, the number is up 118% from 345. The website bov.ch lists 794 breweries in Switzerland so it is possible that the number has grown further since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org