In a recent interview with Mises Weekends, Claudio Grass examined some of the advantages of the Swiss political system, and how highly decentralized politics can bring with it great economic prosperity, more political stability, and a greater respect for property rights. Since the Swiss political system of federalism is itself partially inspired by 19th-century American federalism, the average American can...

Read More »Why Switzerland Could Save the World and Protect Your Gold

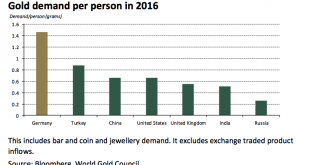

Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth. International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property. Country respects the importance of gold ownerships and 70% of...

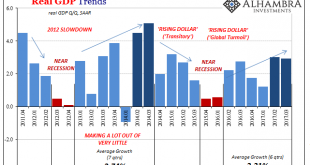

Read More »Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate. They also say...

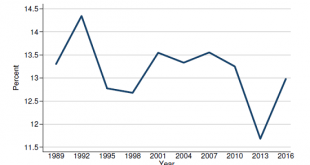

Read More »Observations on Wealth-Income Inequality (from Federal Reserve Reports)

There’s a profound difference between assets that produce no income and those that produce net income. To those of us nutty enough to pore over dozens of pages of data on wealth and income in the U.S., the Federal Reserve’s quarterly Z.1 reports and annual Survey of Consumer Finances (SCF) are treasure troves, as are I.R.S. tax and income reports. Allow me to share a few observations on family wealth and income drawn...

Read More »Swiss Retail Sales, September: Stable Nominal and 0.8 percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »Consumers continue to expect a positive economic development

Bern, 02.11.2017 – Consumer sentiment in Switzerland remains above average. At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average. This indicates that...

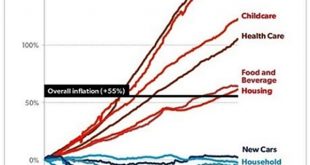

Read More »What Could Pop The Everything Bubble?

As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop. I’ve long held that if a problem can be solved by creating $1 trillion out of thin air and buying a raft of assets with that $1 trillion, then central banks will solve...

Read More »Gold and Silver Get Powelled – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Rumors Driving Short Term Price Swings The prices of the metals dropped a bit more this week, -$7 and -$0.16. We all know the dollar is going down, that it is the stated policy of the Federal Reserve to make it go down. We all know that gold has been valued for thousands of years. So why do we measure the timeless metal...

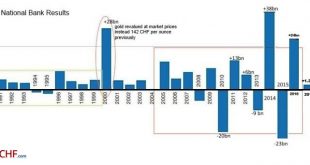

Read More »The good years have started, increasing SNB Profits

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But in 2017, the picture is changed. Assuming a “biblical” cycle of seven good years and seven bad years, the SNB could now increase profits every year – thanks to a weaker franc and the seven good years. … until the next recession comes and the...

Read More »FX Daily, October 31: Month-End Leaves Market at Crossroads

Swiss Franc The Euro has risen by 0.41% to 1.628 CHF. EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe’s Dow Jones Stoxx 600 is also flattish today, but up 1.6%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org