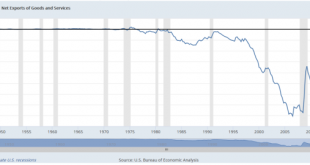

Dans la série sur la balance des paiements et les zooms sur les balances commerciales, voici l’évolution de la balance commerciale américaine. Nous voyons clairement qu’elle était neutralisée à 0 durant l’ère où les devises du monde devaient être arrimées, selon les Accords de Bretton Woods, au dollar qui lui-même était partiellement couvert par l’or. La valeur du dollar devait se référer à un prix fixe de l’or de 35...

Read More »Is the Yen or Swiss Franc a Better Funding Currency?

Summary: Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution. Retail investors and some institutional investors focus on the asset they want to acquire in anticipation of price appreciation. The game for some institutional investors...

Read More »Bitcoin Has No Yield, but Gold Does – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Bitcoin and Credit Transactions Last week, we said: It is commonly accepted to say the dollar is “printed”, but we can see from this line of thinking it is really borrowed. There is a real borrower on the other side of the transaction, and that borrower has powerful motivations to keep paying to service the debt. Bitcoin...

Read More »FX Daily, August 16: Swiss Franc and Yen Remain Heavy as New Distractions Replace DPRK

Swiss Franc The Euro has fallen by 0.11% to 1.1398 CHF. EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ). FX Rates The Japanese yen and Swiss franc remain heavy as the markets continueto shift away from the geopolitical risks. A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB’s Draghi will not be discussing the central bank’s...

Read More »Jumbolinos Wheeled out to Pasture

A Jumbolino taking off from Lugano (Keystone) - Click to enlarge Swiss International Air Lines has for the last time flown passengers in an Avro RJ100, fondly called a Jumbolino by many pilots, flight attendants and passengers. The full plane, which flew from London to Zurich on Monday night, carried 81 passengers. Swiss, which rose from the ashes of Swissair in 2002, took on a total of 21 Avro...

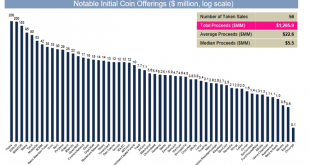

Read More »Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver Latest developments show risks in crypto currencies Confusion as bitcoin may split tomorrow SEC stepped into express concern over ICOs ICOs have so far raised $1.2 billion in 2017 ICOs preying on lack of understanding from investors Physical gold not vulnerable to technological risk Beauty and safety in simplicity of gold and silver Forks and ICOs solves bitcoin v...

Read More »Indian arms dealer’s Swiss accounts under scrutiny

The Pilatus PC-7 is used by the Swiss Air Force as a training aircraft and for aerobatic shows (Keystone) Swiss authorities have received requests for information concerning possible Swiss bank accounts of Indian defence deals broker Sanjay Bhandari. He is under investigation for allegedly helping Swiss firm Pilatus secure an order for 75 training aircraft for the Indian Air Force in 2012. The decision on whether or not...

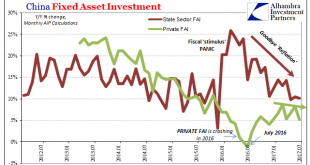

Read More »Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

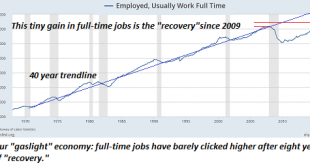

Read More »Are We Already in Recession?

If we stop counting zombies, we’re already in recession. How shocked would you be if it was announced that the U.S. had just entered a recession, that is, a period in which gross domestic product (GDP) declines (when adjusted for inflation) for two or more quarters? Would you really be surprised to discover that the eight-year long “recovery,” the weakest on record, had finally rolled over into recession? Anyone with...

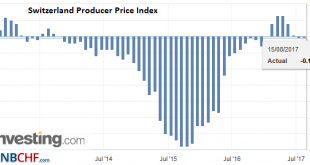

Read More »Swiss Producer and Import Price Index in July 2017: -0.1 YoY, -0,1 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org