Swiss Franc EUR/CHF - Euro Swiss Franc, March 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March. The Fed did hike rates, but the dollar fell as the earlier than anticipated hike did not appear to impact the anticipated pace of normalization. In fact, if anything, the market has discounted less of a chance of June hike than it did before the Fed’s hike (50% vs. 54% according to Bloomberg’s calculation). The dollar also lost some luster as speculation emerged that the divergence theme that drove many bulls was now morphing to its opposite: convergence. China raised some technical rates within hours of the Fed’s hike. Some officials (German and Austrians) suggested that maybe the ECB would raise interest rates (deposit rate, which in turn lifts EONIA) before finishing its asset purchases. A member of the BOE’s Monetary Policy Committee voted for an immediate hike, while the patience of other members seemingly thinned. There as even some talk that the BOJ would raise its 10-year yield target.

Topics:

Marc Chandler considers the following as important: AUD, CAD, China Manufacturing PMI, China Non-Manufacturing PMI, EUR, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, FX Trends, GBP, Germany Retail Sales, Germany Unemployment Change, Germany Unemployment Rate, Italy Consumer Price Index, Japan Household Spending, Japan National Consumer Price Index, JPY, MXN, newsletter, U.K. Gross Domestic Product, U.S. Chicago PMI, U.S. Michigan Consumer Sentiment, USD, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 31(see more posts on EUR/CHF, ) |

FX RatesThe US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March. The Fed did hike rates, but the dollar fell as the earlier than anticipated hike did not appear to impact the anticipated pace of normalization. In fact, if anything, the market has discounted less of a chance of June hike than it did before the Fed’s hike (50% vs. 54% according to Bloomberg’s calculation). The dollar also lost some luster as speculation emerged that the divergence theme that drove many bulls was now morphing to its opposite: convergence. China raised some technical rates within hours of the Fed’s hike. Some officials (German and Austrians) suggested that maybe the ECB would raise interest rates (deposit rate, which in turn lifts EONIA) before finishing its asset purchases. A member of the BOE’s Monetary Policy Committee voted for an immediate hike, while the patience of other members seemingly thinned. There as even some talk that the BOJ would raise its 10-year yield target. Late the quarter, doubts rose that US President Trump will be able to pass his economic agenda. |

FX Daily Rates, March 31 |

| As the quarter ends, much of the convergence story has been undermined. There has been a push back against the hawkishness of some of the creditors in EMU. Earlier today ECB’s Knot was explicit. There was a logic to the sequencing of the exit from extraordinary monetary measures that the Federal Reserve executed. Finish asset purchases before raising rates. The hawk at the MPC is due to step down in a few months, and most of the MPC seems considerably more cautious, perhaps in the face of weakening wage pressures.

The Mexican peso is appreciated by almost 4.5% this month to lift the year-to-date gain to 11%. It is the strongest currency in the world in Q1. The Russian rouble is the second strongest, with a 9.3% gain. Among the majors, the Australian dollar has done best with a 6.2% gain. Ideas that the Trump Administration was softening its demands of NAFTA changes helped the peso extend gains. However, we think that many may have misunderstood the US position. Some clarification from Commerce Secretary Ross confirms our suspicion. The changes the US will demand to NAFTA still seem significant. The peso seems vulnerable. Technical indicators are stretched and suggest being particularly sensitive to a reversal pattern in the price action. The US dollar is sporting a slightly softer profile. Firmness in Asia gave way to selling in early European turnover. The euro had been sold from $1.0910 at the start of the week to almost $1.0670 yesterday. It is consolidating now. The $1.0710-$1.0720, which we had identified as support may now serve as resistance. A break could spur near-term gains back toward $1.0760. Some observers and economists criticize the Fed for being too dovish. The Fed tells the market that it thinks it will raise interest rate five times by the end of next year. The market does not believe it. The market expects a more dovish Fed than the Fed does. The 10-year breakeven and the University of Michigan survey suggests one potential explanation why the market is giving little credence to the FOMC’s projections. |

FX Performance, March 31 |

JapanEarlier today, Japan report its second consecutive increase in its core CPI in more than a year. However, it stands at a mere 0.2%, with headline CPI at 0.3%. Tokyo core CPI, which reported with a smaller lag, was 0.4% lower than a year ago, twice the decline the market expected. |

Japan National Consumer Price Index (CPI) YoY, February 2017(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Having met with Japanese officials on my business trip to Asia, investors ought not underestimate the determination of the BOJ to continue to pursue its 2.0% inflation target.

The dollar approached JPY110 at the start of the week and traded to JPY112.20 in Asia today before slipping back to JPY111.70. The high corresponds to a 38.2% retracement of the dollar’s decline since the March 10 high near JPY115.50. The JPY112.80 area corresponds to a 50% retracement objective and the 20-day moving average. |

Japan Household Spending YoY, February 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

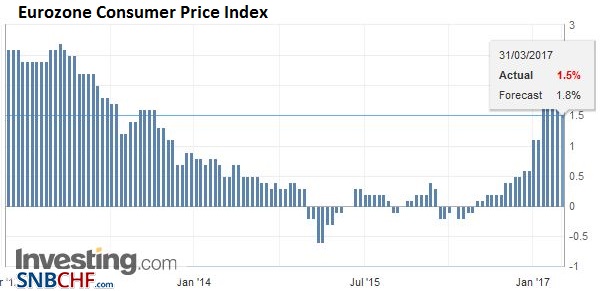

EurozoneThe preliminary estimate of March CPI in the eurozone rules out any shift in next months’ ECB meeting. It is not only that the headline rate fell back to 1.5% from 2.0%, well below expectations. |

Eurozone Consumer Price Index (CPI) YoY, February 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

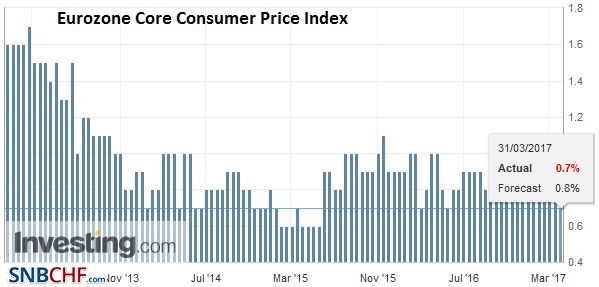

| Core rate fell from 0.9% to 0.7%. The core rate bottomed at 0.6%. The preliminary March reading means that the hawkish push by some at the ECB will be easily repulsed. |

Eurozone Core Consumer Price Index (CPI) YoY, February 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

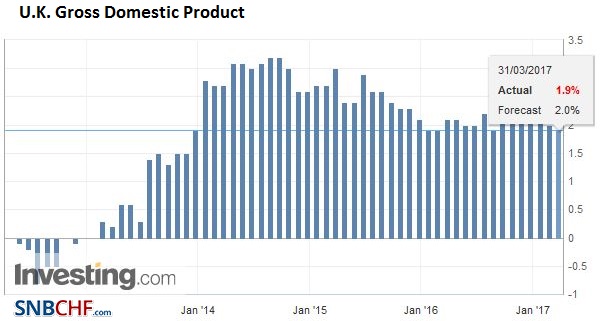

United KingdomSterling fell a little more than two cents from the high recorded at the start of the week (~$1.2615). It seems vulnerable from a technical vantage point even though it posted its first quarterly advance since the referendum. The dollar-bloc currencies are little changed on the day. While the Aussie was the strongest of the majors in Q1, the Canadian dollar was the weakest, gaining about 0.7% against the US dollar. |

U.K. Gross Domestic Product (GDP) YoY, February 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

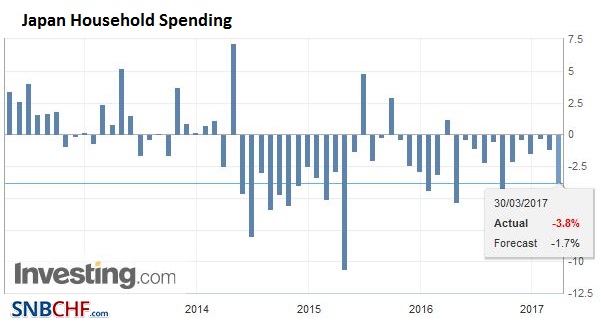

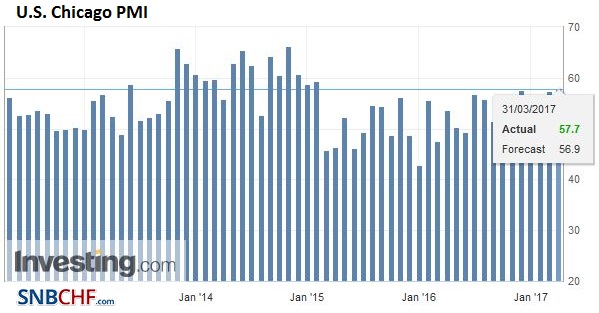

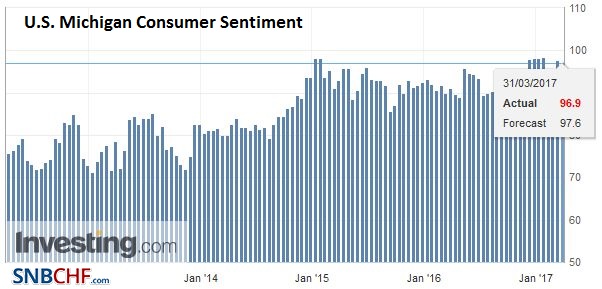

United StatesThe US session features Feb personal income and consumption, the Chicago PMI, and the University of Michigan’s consumer confidence and inflation expectations survey. Personal consumption will impact GDP forecasts, and there are upside risks to the 0.2% rise expected. Retail sales in Feb were disappointing, but there were sharp upward revisions to January. This will likely be picked up in today’s broader measures of consumption. The macro-conditions for raising the target of 10-year bond yields are similar not there in Japan. To be sure, Q1 growth looks firm, helped by industrial production ( Feb IP was reported today with a 2.0% rise, compared with 1.2% expectations) and exports. Yet despite strong labor market (it was reported today that Feb unemployment unexpectedly fell to 2.8% from 3.0%), household spending continues to disappoint. It fell 3.8% year-over-year in Feb, after a 1.2% decline in Jan. The median expectation (Bloomberg survey) was for a 1.7% decline. It has not risen on a year-over-year basis since Feb 2016, which itself was the first increase since August 2015. In recent days, US sentiment has stabilized. Some were making the case that with the lack of progress on health care, the shift to tax cuts was good for investors. The US Congress continues to work on a compromise, without incidentally trying to get Democrat support. And healthcare savings (fro less coverage for fewer people) was supposed to help finance the tax reform, without requiring Democrat assistance. Several regional Fed Presidents continue to signal the potential for a quick rather than a slower pace of Fed hikes. Oil prices also recovered smartly. The nearly 5% gain through early Friday is the most in a week since the week ending December 2, following OPEC’s decision to cut output. The higher oil prices and firm US data helped US 10-year Treasuries recover about eight basis points from the low point at the start of the week. The US 2-year yields rose nearly as much. |

U.S. Chicago PMI, February 2017(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

| The long-term inflation expectations in the University of Michigan survey are important. Inflation expectations pick up in surveys are often cited in FOMC statements The preliminary March reading was 2.2% (5-10 year expectation). This is a new low (since 1979). The 10-year breakeven is a market-based measure of inflation expectations. It is net-net steady at the end of the year, just below 2.0%.

The IMF’s COFER data will be reported later today. It is the most authoritative source of central bank reserve data. The report will cover the end of 2016. Of particular interest, the Chinese yuan will be broken out, like the dollar, euro, sterling, yen, Canadian and Australian dollars. The IMF had estimated that prior to joining the yuan may have accounted for $100 bln of global reserves. |

U.S. Michigan Consumer Sentiment, February 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Additional graphs by snbchf team

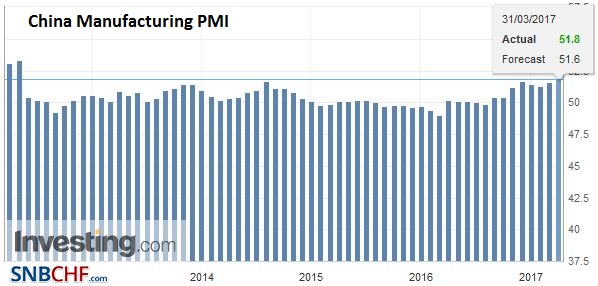

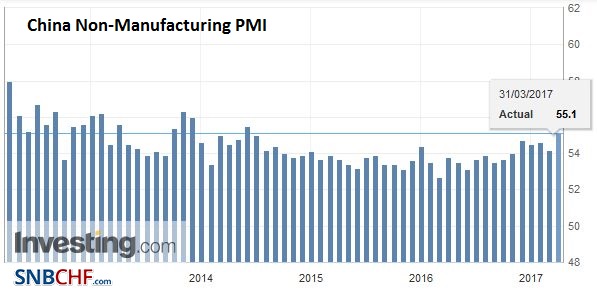

China |

China Manufacturing PMI, February 2017(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

China Non-Manufacturing PMI, February 2017(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

Germany |

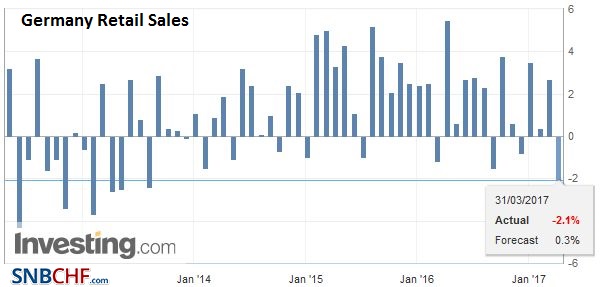

Germany Retail Sales YoY, February 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

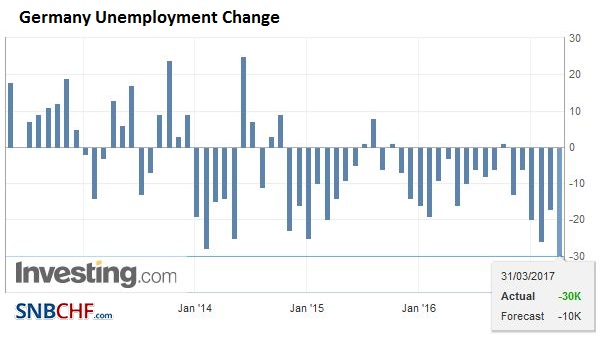

Germany Unemployment Change, February 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

|

Germany Unemployment Rate, February 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

Italy |

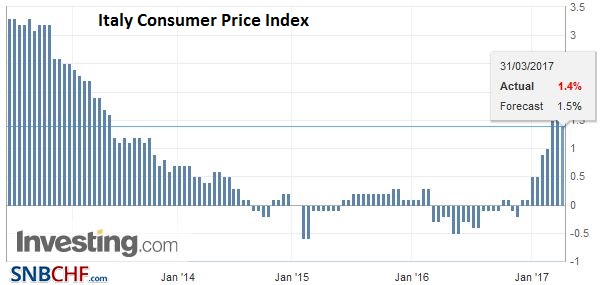

Italy Consumer Price Index (CPI) YoY, February 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Germany Retail Sales,Germany Unemployment Change,Germany Unemployment Rate,Italy Consumer Price Index,Japan Household Spending,Japan National Consumer Price Index,MXN,newsletter,U.K. Gross Domestic Product,U.S. Chicago PMI,U.S. Michigan Consumer Sentiment,yuan