Taking stock of recent dovish shifts in European central banks’ communication and reaffirming our broadly constructive macro outlook.The European Central Bank (ECB) does not seem overly concerned about the soft patch in the economy in Q1 and appears willing to collect more data before they start discussing the timing and modalities of the next policy steps. We expect the ECB to hint at an imminent end to asset purchases at its June meeting, but to wait until July to announce the modalities of tapering. We continue to forecast a first rate hike in Q3 2019.We expect the Swiss National Bank to hike rates toward the end of this year, assuming the ECB has embarked on a clear normalisation path. Our baseline scenario is for a first 25bp rate hike in December 2018, although the risks are tilted

Topics:

Team Asset Allocation and Macro Research considers the following as important: Central bank communication, Dovish monetary policy, European central banks, Macroview, Policy normalisation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Taking stock of recent dovish shifts in European central banks’ communication and reaffirming our broadly constructive macro outlook.

The European Central Bank (ECB) does not seem overly concerned about the soft patch in the economy in Q1 and appears willing to collect more data before they start discussing the timing and modalities of the next policy steps. We expect the ECB to hint at an imminent end to asset purchases at its June meeting, but to wait until July to announce the modalities of tapering. We continue to forecast a first rate hike in Q3 2019.

We expect the Swiss National Bank to hike rates toward the end of this year, assuming the ECB has embarked on a clear normalisation path. Our baseline scenario is for a first 25bp rate hike in December 2018, although the risks are tilted towards a later move.

Our broadly constructive forecasts for global and European growth this year and next look consistent with Sweden’s Riksbank pulling the trigger on rate increases in Q4 2018, although the first rate hike could be larger in size than currently expected (+10bp).

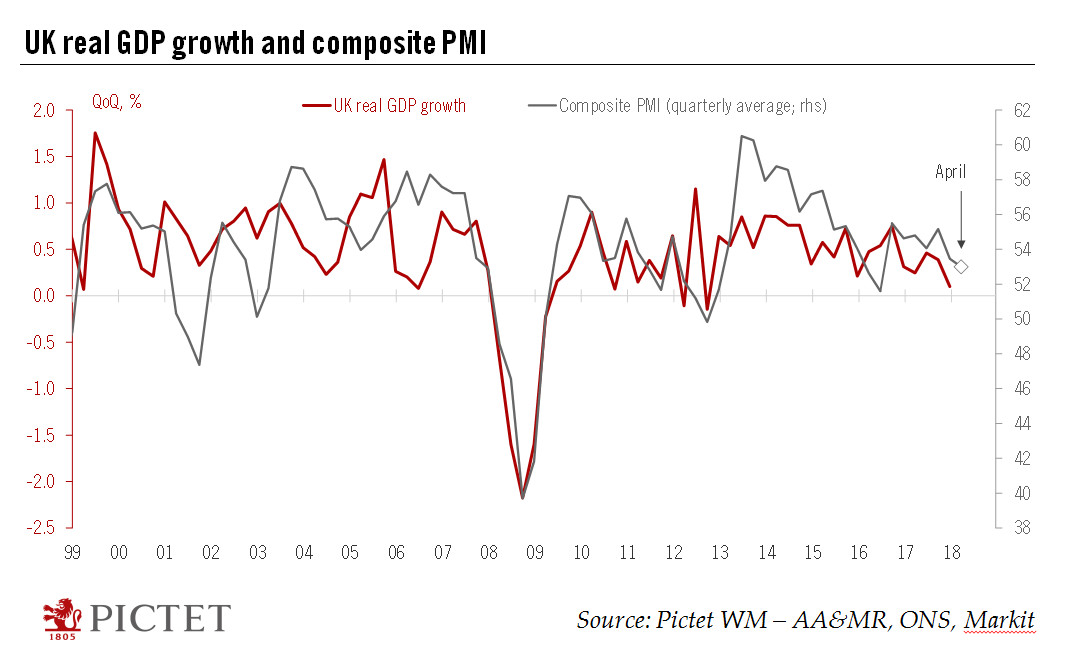

In the UK where prolonged growth underperformance, falling inflation (see chart) and rising political uncertainty mean that the Bank of England (BoE) is likely to postpone the next rate hike to August 2018. The likelihood that the BoE will have to stop after this move has increased, and will depend on the progress of Brexit negotiations. We are adjusting our end-of-year target for the 10-year Gilt yield slightly downward from 1.7% to 1.5%.

On the currency front, the dovish shift in European central banks’ communication is in contrast with the ongoing hawkish shift at the Fed. This could provide an additional tailwind to the US dollar rebound and increases the chance that the greenback exceeds our short-term projections against European currencies. More precisely, there is the potential for the euro to fall as low as USD1.17 in the very short term—but without much impact on our three-month projection of USD1.20.