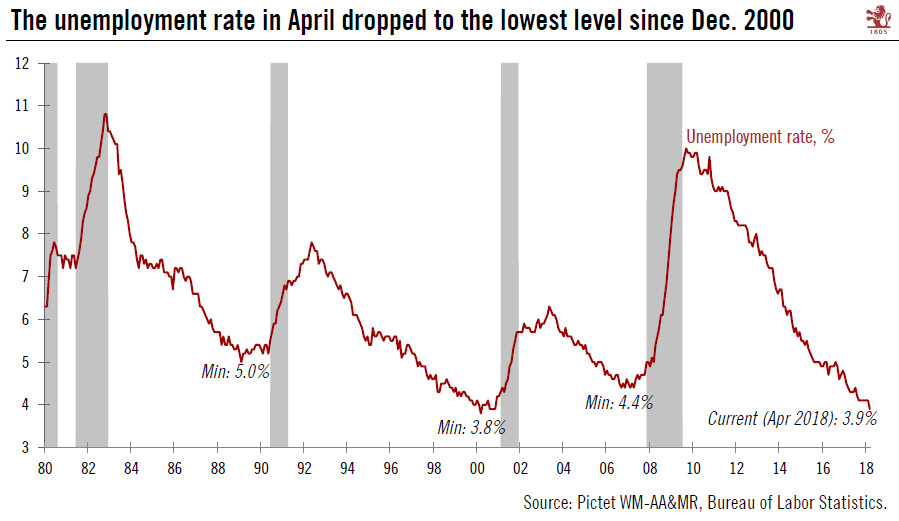

There was little in the April non-farm payroll report to divert the Fed from its gradualist approach to rate hikes.The US labour market continues on a familiar pattern: employment momentum remains robust, but wage growth is still disturbingly lacklustre.In April, 164,000 payrolls were added and the three-month average was a solid 208,000/month. The unemployment rate dropped to 3.9%, the lowest since December 2000 (although this was partly due to a drop in the labour-force participation rate). Wages, the real focus these days, rose only 0.1% m-o-m in April and the y-o-y print remained unchanged at 2.6%. Average hourly earnings were also up 2.6% y-o-y for production workers.While the April data are another dent in the laws of economics (and particularly the famous Phillips curve linking a

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

There was little in the April non-farm payroll report to divert the Fed from its gradualist approach to rate hikes.

The US labour market continues on a familiar pattern: employment momentum remains robust, but wage growth is still disturbingly lacklustre.

In April, 164,000 payrolls were added and the three-month average was a solid 208,000/month. The unemployment rate dropped to 3.9%, the lowest since December 2000 (although this was partly due to a drop in the labour-force participation rate). Wages, the real focus these days, rose only 0.1% m-o-m in April and the y-o-y print remained unchanged at 2.6%. Average hourly earnings were also up 2.6% y-o-y for production workers.

While the April data are another dent in the laws of economics (and particularly the famous Phillips curve linking a strong labour market to stronger wage growth), it is undoubtedly a soothing message for those worried about US overheating and inflation getting out of hand due to sudden wage acceleration. Even in the booming energy sector, pay raises remain spectacularly unexciting. Mining jobs were up a strong 9.6% y-o-y in April, but wage growth was only 2.1% y-o-y in the sector. Manufacturing wages were up only 1.4% y-o-y.

From the Federal Reserve’s perspective, the April employment report adds little incremental value. The Fed is likely to ignore stalled wage growth, instead preferring to highlight the still-solid employment momentum as a key reason to keep hiking rates gradually. The bar for altering the ‘routine’ of one rate hike per quarter is high. We maintain our call for three additional rate hikes this year (with the next one in June), and two next year.