At its latest meeting, the Fed showed it remained cool-headed about inflation risks. It should not deviate from its gradualist approach of one rate hike per quarter.The Federal Reserve meeting of 1-2 May 2018 brought no surprises. As the Fed kept rates unchanged (i.e., the Fed’s interest rate on excess reserves still at 1.75%), as widely expected, the focus was on the post-meeting statement for possible signals on future rate hikes. There was no press conference.The question was how the Fed would react to recent stronger inflation prints; indeed, core PCE inflation (the Fed’s crucial inflation benchmark) was up quite solidly in Q1 (2.5% q-o-q seasonally-adjusted annualized terms) and the y-o-y reading moved up to 1.9% in March, getting close to the 2% Fed’s target. The Fed noted this

Topics:

Thomas Costerg considers the following as important: Fed May Meeting, Fed rate hikes, Macroview, US monetary policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

At its latest meeting, the Fed showed it remained cool-headed about inflation risks. It should not deviate from its gradualist approach of one rate hike per quarter.

The Federal Reserve meeting of 1-2 May 2018 brought no surprises. As the Fed kept rates unchanged (i.e., the Fed’s interest rate on excess reserves still at 1.75%), as widely expected, the focus was on the post-meeting statement for possible signals on future rate hikes. There was no press conference.

The question was how the Fed would react to recent stronger inflation prints; indeed, core PCE inflation (the Fed’s crucial inflation benchmark) was up quite solidly in Q1 (2.5% q-o-q seasonally-adjusted annualized terms) and the y-o-y reading moved up to 1.9% in March, getting close to the 2% Fed’s target. The Fed noted this improvement while it dropped the sentence that it is “monitoring inflation developments closely”.

Still, the underlying message is that the Fed remains cool-headed about inflation risks despite the recent pick up in price pressures and the tight labour market. The Fed seems ready to let inflation rise slightly above 2% temporarily. Put differently, this means the bar to alter the Fed’s ‘routine’ of gradual tightening (one rate hike per quarter) is very high.

Backing this view, the Fed added a second mention of the word “symmetric” to qualify its inflation goal— a hint that 2% is not necessarily a ceiling for inflation and that the Fed will not hit the brakes hard if 2% is exceeded temporarily. It is worth keeping in mind that core inflation has averaged only 1.6% in recent years.

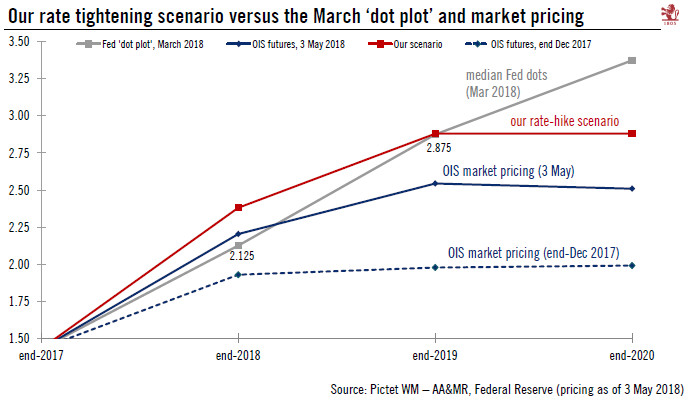

We believe the likelihood that the Fed alters its current routine of one quarter-point rate hike per quarter as pretty remote. US monetary tightening is likely to remain “gradual”. We still expect three additional rate hikes this year (in June, September and December), and two more next year (in March and June).