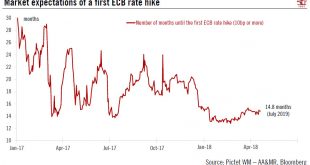

The ECB Governing Council acknowledges “moderation” in the pace of the euro area's recovery. It may wait until July before announcing its next policy decision.Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement today mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.ECB president Mario Draghi said that the Governing...

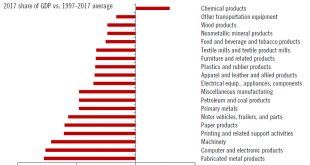

Read More »Still no sign of a US ‘manufacturing renaissance’

The manufacturing sector’s share of the US economy continues to decline.The Bureau of Economic Analysis recently released data for US GDP by industry for Q4 2017, providing a good opportunity to examine how US manufacturing is doing. The answer is: still not so well.Manufacturing accounted for 11.6% of US GDP in Q4 2017, the same as a year earlier but well below levels in previous years (e.g., 16.1% in 1997, 12.8% in 2007). In other words, there is still no sign of a manufacturing...

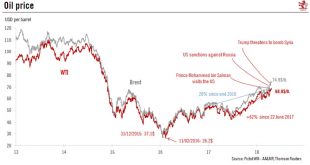

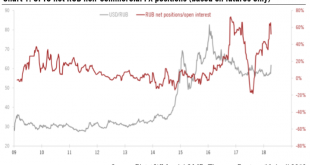

Read More »Where next for oil prices?

Oil prices are significantly above their long-term equilibrium, but should converge towards their equilibrium in the coming months.Oil prices have surged to their highest levels since 2014 (USD69.56 for West Texas Intermediate (WTI) on 19 April and USD75.27 for Brent on 24 April ). They are now USD6 to USD9 above our calculation of their long-term fundamental price equilibrium.Three factors explain the current price premium:Geopolitics: Between Saudi Arabia’s Prince Mohammed bin Salman visit...

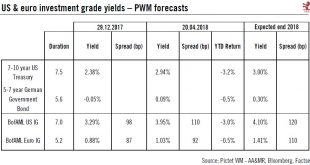

Read More »Spreads for investment grade credits torn in different directions

After a difficult start to the year, we remain neutral on prospects for developed market investment grade credits for the coming 12 months.Although US investment grade (IG) and euro IG have posted a negative total return so far this year, credit continues to offer interesting yield pick-up for investors (especially in euro).Overall, we are neutral on prospects for US and euro IG over the coming 12 months. We see US and euro credit yields rising due to higher sovereign yields (especially for...

Read More »Russian rouble: significantly undervalued but quite risky

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. US sanctions target seven Russian oligarchs, 12 companies controlled by them, and 17 high-ranking government officials. The measures freeze any US assets held by those targeted and cut them...

Read More »Euro area core inflation to rise again after Easter

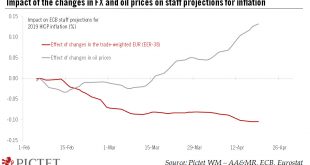

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only...

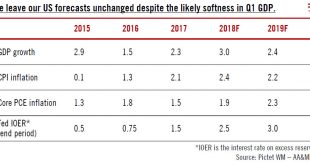

Read More »US growth update: Let’s ignore Q1 GDP

Forthcoming slower US Q1 GDP can be considered temporary and technical.The Bureau of Economic Analysis will release the preliminary estimate of Q1 GDP growth on 27 April. Currently Q1 growth is tracking around 2% q-o-q (annualised), a deceleration from 2.9% in Q4-2017. We think this slowdown is transitory and does not reflect the underlying growth trend; we expect some solid catch-up in Q2.We are marking up our Q2 growth forecast to 3.6% from 3.0%, as we expect both investment and...

Read More »Euro area core inflation to rise again after Easter

Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org