US residential construction is growing solidly, but the apartment sub-segment is showing signs of softening.US construction is doing broadly fine, echoing the solidity of the US business cycle. On a y-o-y basis, construction was up 3.9% in March and 5.5% y-o-y in Q1 2018. Construction outperformed nominal GDP, which was up 4.8% y-o-y in Q1.The main engine is the residential market, up 7.8% y-o-y in Q1. Nonresidential construction is growing less rapidly (+3.8% y-o-y in Q1), dampened particularly by soft construction in manufacturing (-4.5%) and in power plants (-6.2%).The picture is not actually all that rosy in the residential sector. Construction of apartments has been particularly soft lately, as confirmed by data for March (released on 1 May). The sub-segment posted a third monthly

Topics:

Thomas Costerg considers the following as important: Macroview, US construction, US housing

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US residential construction is growing solidly, but the apartment sub-segment is showing signs of softening.

US construction is doing broadly fine, echoing the solidity of the US business cycle. On a y-o-y basis, construction was up 3.9% in March and 5.5% y-o-y in Q1 2018. Construction outperformed nominal GDP, which was up 4.8% y-o-y in Q1.

The main engine is the residential market, up 7.8% y-o-y in Q1. Nonresidential construction is growing less rapidly (+3.8% y-o-y in Q1), dampened particularly by soft construction in manufacturing (-4.5%) and in power plants (-6.2%).

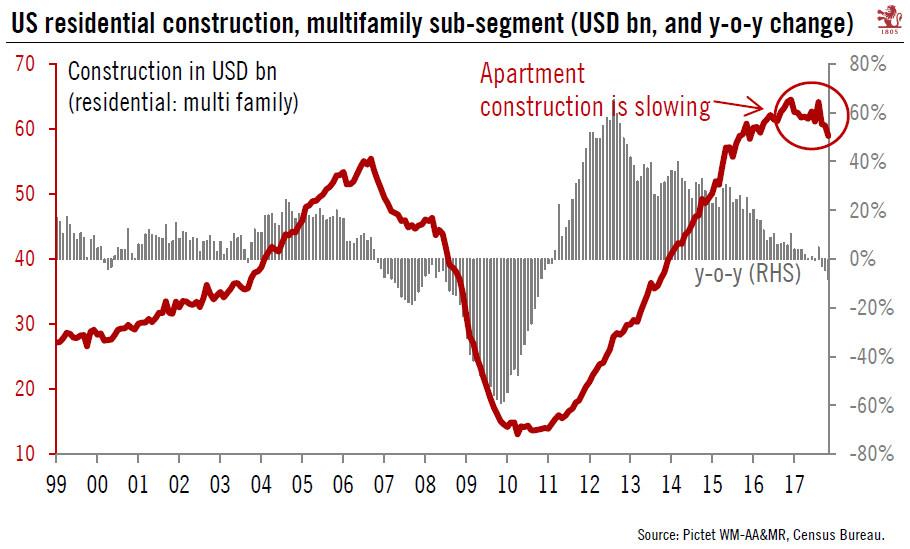

The picture is not actually all that rosy in the residential sector. Construction of apartments has been particularly soft lately, as confirmed by data for March (released on 1 May). The sub-segment posted a third monthly drop in March and was down a sharp 8.2% y-o-y.

Reassuringly, the apartment construction market is only a small portion of total private construction (just 6%, compared with 29% for single-family unit construction, the rest being home improvement). Still, how apartment construction fares is worth monitoring as it has helped drive the housing recovery since the subprime crisis, and it is not clear that the single-family market can entirely pick up the slack given the sharp increase in property prices, rising mortgage rates and still-mixed household formation. All in all, US housing is likely to play only a secondary role in the 2018 growth picture.