ECB’s M3 and credit report for May showed a large rebound in long-term bank loans to corporates.The ECB’s M3 and credit report for May published this week was pretty strong overall and confirmed that lending dynamics in the euro area are in good shape. Bank credit flows to non-financial corporations (NFC, adjusted for seasonal effects and securitisations) amounted to €22bn in May, much more than the April figure of €11bn. Corporate-sector lending increased 3.6% year-over-year in May, its fastest rate since May 2009 and up from 3.3% in April.One factor that could partly explain the rebound is the lower issuance activity after the surge seen in Q1. On a country-by-country basis, the rebound was particularly strong in Germany (+€8bn) and in France (+€7bn). Flows to NFC were also positive

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

ECB’s M3 and credit report for May showed a large rebound in long-term bank loans to corporates.

The ECB’s M3 and credit report for May published this week was pretty strong overall and confirmed that lending dynamics in the euro area are in good shape. Bank credit flows to non-financial corporations (NFC, adjusted for seasonal effects and securitisations) amounted to €22bn in May, much more than the April figure of €11bn. Corporate-sector lending increased 3.6% year-over-year in May, its fastest rate since May 2009 and up from 3.3% in April.

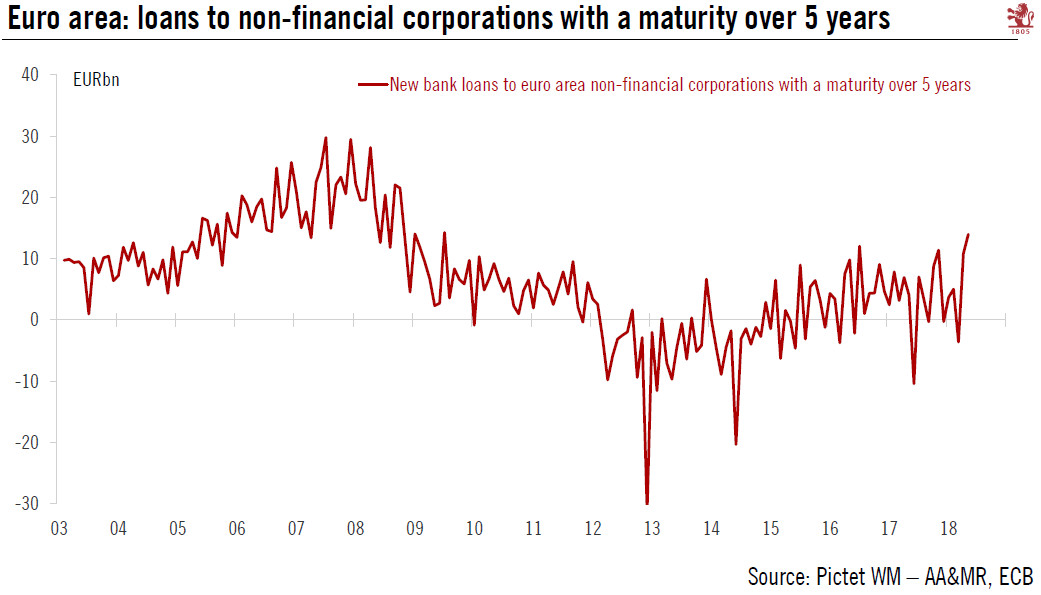

One factor that could partly explain the rebound is the lower issuance activity after the surge seen in Q1. On a country-by-country basis, the rebound was particularly strong in Germany (+€8bn) and in France (+€7bn). Flows to NFC were also positive albeit weaker in Italy and Spain (+€1bn in both countries). One development of note was the rise in long-term loans with a maturity over five years. Indeed, May saw the strongest flows of long-term bank loans in almost nine years (see Chart). The large rebound in long-term loans in particular bodes well for business investment spending. Looking ahead, the ECB’s Bank Lending Survey remained broadly consistent with improving credit conditions. Forward-looking indicators continued to point to rising lending volumes.

Overall, the balance of risks to the euro area growth outlook remains tilted to the downside. Nevertheless, the rise in bank credit flows is a positive sign, confirming that domestic fundamentals remain solid. This should be enough to compensate for further limited deterioration in external demand.