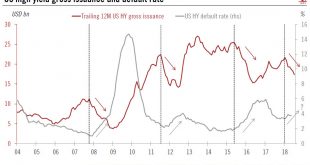

Unlike its euro counterpart, spreads on US high yield have held in well this year so far. However, with the default rate stalling and trade tensions rising, we think this could change.US high yield (HY) is one of the few segments in the fixed income space that has posted a positive total return since the beginning of the year. Thanks to lower duration, US HY has so far suffered less from the surge in US Treasury yields than its investment-grade counterpart. Moreover, some index-heavy sectors...

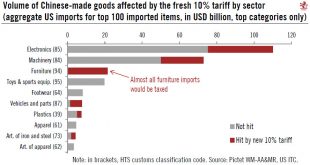

Read More »Fresh tariffs on Chinese imports would fall disproportionately on furniture

Latest Trump tariffs move beyond Chinese tech imports.This week, the Trump administration announced it would slap a 10% tariff on USD200 billion of imports from China, on top of the USD50 billion already announced. After a consultation period, the tariffs could come into force as soon as September (see our Flash Note ‘US-China trade update’, 11 July 2018). The US imported USD506 billion of merchandise from China in 2017.Officially, the new set of tariffs are a response to China’s...

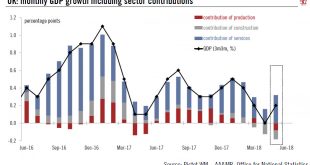

Read More »Europe chart of the week – UK GDP growth

Short-term rebound in the UK, driven by services.The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below).Looking at the details, the services sector (79% of the economy) grew by 0.3% in the three months to...

Read More »Europe chart of the week – UK GDP growth

Short-term rebound in the UK, driven by services. The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below). Looking at the details, the...

Read More »Underlying US inflation remains moderate

While trade tariffs could impact prices at some point, inflation looks unlikely to spiral out of control.Leaving aside energy prices (up 24% y-o-y), core CPI inflation in the US remained moderate in June rising 0.16% m-o-m, which pushed the y-o-y reading slightly up, to 2.3% from 2.2% in May. A print of 2.3% y-o-y, while above the one-year average of 1.9%, is a relatively tame reading in light of the very low US unemployment rate of 4.0%. By contrast, core CPI inflation peaked at 2.9% y-o-y...

Read More »Risk of trade war grows

The new US tariffs threatening Chinese imports and probable retaliation could bite into US and Chinese growth. As US midterm elections approach, the situation could worsen before it gets better.The Trump administration has stepped up its trade actions further by increasing the net of Chinese imports that will be subject to US tariffs: on top of the USD50 billion of Chinese imports subject to a 25% tariff already announced, the US Trade Representative has prepared a list of a further USD200...

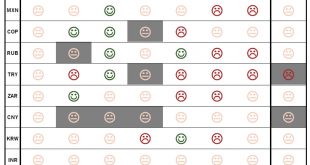

Read More »No EM currency looks attractive for now

Trade disputes should continue to weigh on emerging market currencies in the short term.Despite a relatively stable US dollar index and 10-year US Treasury yield since the end of May, emerging market (EM) currencies have remained under pressure, especially as a result of the recent escalation in trade tensions and a significant decline in the renminbi. The two latter factors have particularly weighed on Asian EM currencies.Since mid-June, the Chinese renminbi has weakened significantly...

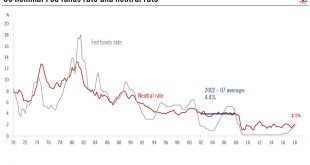

Read More »Close to neutral

We are now very close to the neutral rate of interest in the US, meaning Fed policy is ceasing to be expansionary.After seven quarter-point rate hikes in the US since the end of 2015, we reckon we are close to a neutral rate of interest – the rate of interest consistent with trend growth, stable prices and full employment. We calculate that the current neutral rate is 2.1%, compared with a Fed funds rate of 2.0%.A neutral rate of 2.1% is considerably lower than the 4.4% rate that prevailed...

Read More »Weekly View – markets live another day

The CIO office’s view of the week ahead.Last week saw some welcome stabilisation in markets, even though the first wave of US tariffs against Chinese products kicked in on Friday, followed immediately by Chinese counter-measures for an equivalent amount. Instead, investors remained focused on the dollar. The recent strength of the greenback has contributed much to emerging markets’ (EM) weakness. But the dollar index weakened at the end of last week following the release of average US...

Read More »Euro area: a slight rebound

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org