Latest Trump threats menace car imports.The US trade rhetoric has reached a fever pitch in recent weeks: after threatening China with additional tariffs if they retaliate against the first batch of US actions (set to enter into force on 6 July), President Trump has turned his attention to foreign car producers, which he has threatened with a 20% import tariff.A few weeks ago, Trump ordered a review of all car imports on the rather legally loose ground of “national security” – the same reason he used to justify the steel and aluminium tariffs that came into force in early June. His latest tweets suggest he is targeting European producers in particular.Various uncertainties continue to shroud Trump’s trade policy. It remains especially unclear what the ultimate goal of his administration’s

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest Trump threats menace car imports.

The US trade rhetoric has reached a fever pitch in recent weeks: after threatening China with additional tariffs if they retaliate against the first batch of US actions (set to enter into force on 6 July), President Trump has turned his attention to foreign car producers, which he has threatened with a 20% import tariff.

A few weeks ago, Trump ordered a review of all car imports on the rather legally loose ground of “national security” – the same reason he used to justify the steel and aluminium tariffs that came into force in early June. His latest tweets suggest he is targeting European producers in particular.

Various uncertainties continue to shroud Trump’s trade policy. It remains especially unclear what the ultimate goal of his administration’s trade policy is. Apart from offering protection to a politically sensitive industry ahead of the midterm elections, this uncertainty holds true for Trump’s proposed tariffs on car imports. Hopefully, the latest threats are just political rhetoric.

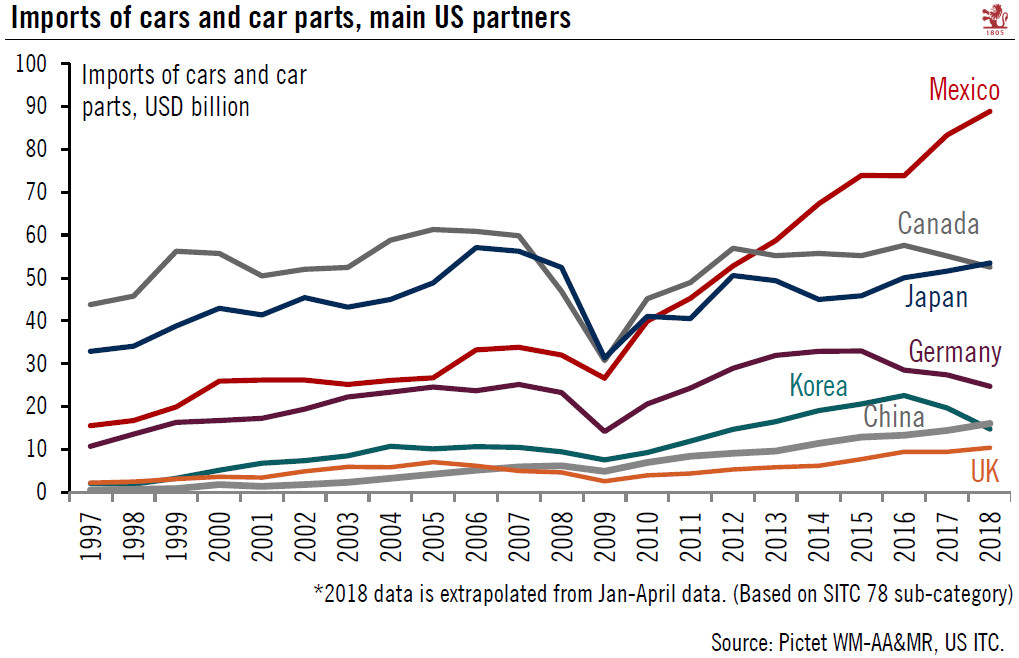

Totalling USD 27.4 billion in 2017 (see chart), Germany is the fourth-largest source of cars and car parts coming into the US. These imports have been declining since 2015, when they peaked at USD 33.0 billion. Mexico is still top of the list with USD 83.3 billion in 2017, followed by Canada with USD 55.2 billion. Interestingly, China is about to overtake South Korea to become the fifth-largest car/car parts importer, with imports up 11.7% in the first four months of 2018, compared with a sharp drop of 24.9% for South Korea.