A new set of tariffs on Chinese imports threatened by the Trump administration look like a stealth tax on consumers.After the steel and aluminium tariffs introduced in early June, another stage was reached last week when the Trump Administration announced that further tariffs specifically aimed at imports from China will kick in on 6 July (first on USD34 billion of imports, to be followed shortly thereafter by tariffs on a further USD16 billion). The tariff rate will be 25%. Officially, these tariffs are a reaction against China’s ‘Made in 2025’ industrial policy and China’s alleged theft of US companies’ intellectual property.President Trump further ratcheted up the pressure on Monday, reacting to China’s announced retaliation (a 25% tariff placed on USD50 billion of US imports). Trump

Topics:

Thomas Costerg considers the following as important: China-US trade, Chinese import tariffs, Macroview, Trade tariffs, US cosumer spending

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A new set of tariffs on Chinese imports threatened by the Trump administration look like a stealth tax on consumers.

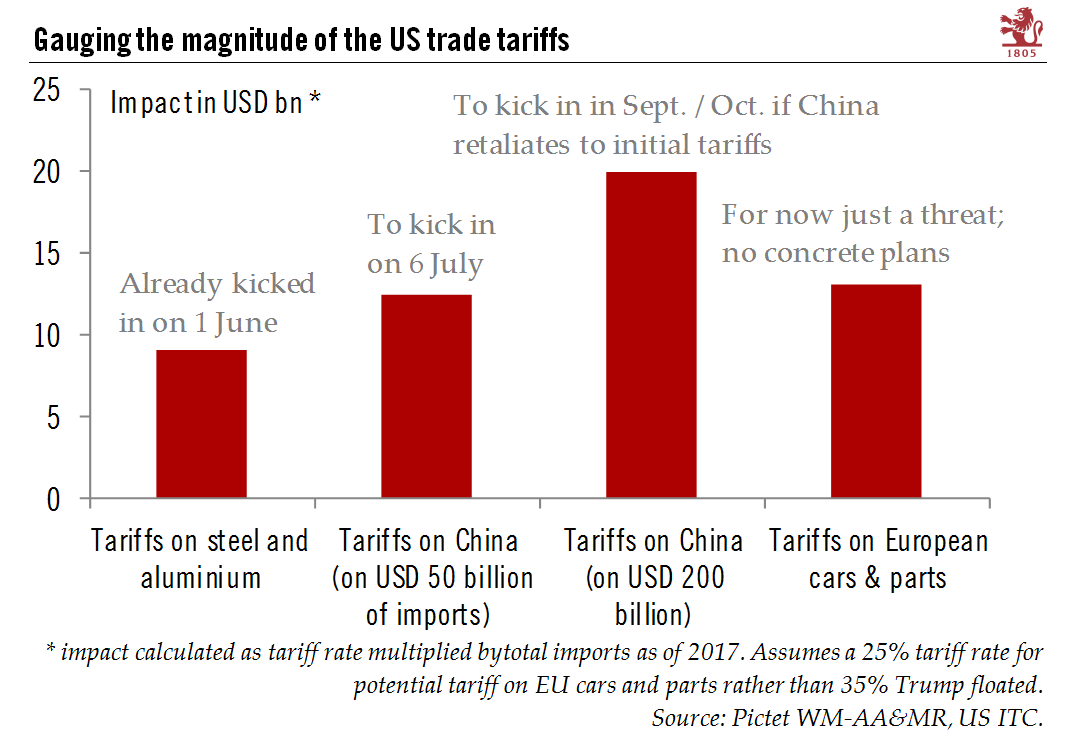

After the steel and aluminium tariffs introduced in early June, another stage was reached last week when the Trump Administration announced that further tariffs specifically aimed at imports from China will kick in on 6 July (first on USD34 billion of imports, to be followed shortly thereafter by tariffs on a further USD16 billion). The tariff rate will be 25%. Officially, these tariffs are a reaction against China’s ‘Made in 2025’ industrial policy and China’s alleged theft of US companies’ intellectual property.

President Trump further ratcheted up the pressure on Monday, reacting to China’s announced retaliation (a 25% tariff placed on USD50 billion of US imports). Trump instructed the US Trade Representative to take steps to put another 10% tariff rate on USD200 billion of Chinese imports if China goes ahead with its retaliation plan.

To try to gauge the impact and the magnitude of these tariffs, we calculated the tariff rate multiplied by the volume of imports affected (see Chart). The potential 10% rate on USD200 billion of Chinese imports would, at face value, bring in USD20 billion to the federal coffers. The relatively low rate of 10% makes it look like a tax on the US consumer more than anything else. Indeed, imports from China are mostly consumer goods like electronics, textile, toys and furniture. In fact, quite like the kind of federal value added tax that the US has long abhorred.