While we are maintaining our 3% growth forecast for 2019, we have slightly reduced our baseline forecast for 2019.The Trump administration has been stepping up its trade rhetoric further, with concrete increases in trade tariffs already kicking in, and others in the near-term pipeline: tariffs on steel and aluminium came into effect in early June, and there will be 25% tariffs on USD 34 billion of Chinese imports (out of a total of USD505 billion in 2017) from 6 July. President Trump has threatened further tariffs of 10% on USD 200 billion of Chinese imports, and recently warned about possible 20% tariffs on European Union car imports.This more aggressive trade stance could hurt US growth, particularly in 2019, both directly and indirectly (via business and consumer confidence), although

Topics:

Thomas Costerg considers the following as important: Macroview, Trump trade tariffs, US GDP growth, US growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

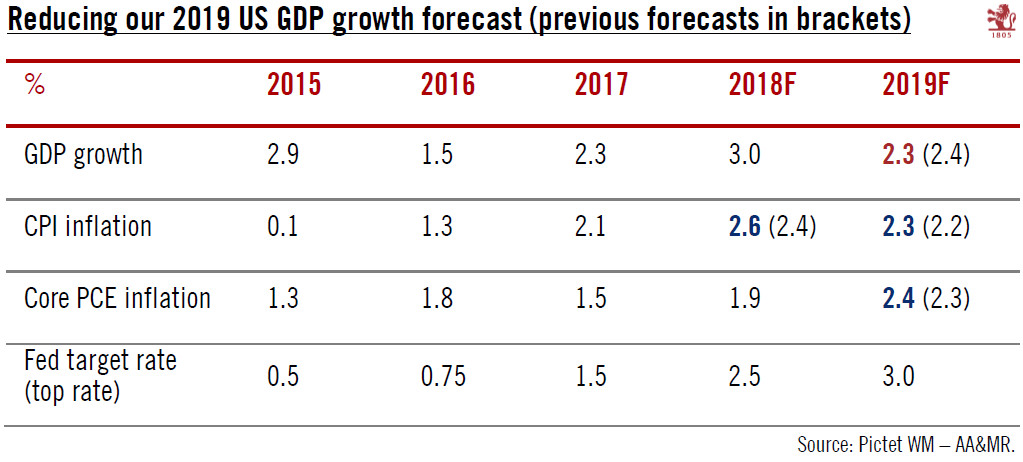

While we are maintaining our 3% growth forecast for 2019, we have slightly reduced our baseline forecast for 2019.

The Trump administration has been stepping up its trade rhetoric further, with concrete increases in trade tariffs already kicking in, and others in the near-term pipeline: tariffs on steel and aluminium came into effect in early June, and there will be 25% tariffs on USD 34 billion of Chinese imports (out of a total of USD505 billion in 2017) from 6 July. President Trump has threatened further tariffs of 10% on USD 200 billion of Chinese imports, and recently warned about possible 20% tariffs on European Union car imports.

This more aggressive trade stance could hurt US growth, particularly in 2019, both directly and indirectly (via business and consumer confidence), although for now we think the ‘bite’ will remain limited: we are still not formally in a ‘trade war’. We are maintaining our baseline 2018 US GDP growth forecast of 3.0%, but reducing our 2019 growth forecast by 0.1 percentage point (ppt) to 2.3%. We are also leaving our 2018 core PCE inflation forecast unchanged at 1.9%, but increasing our 2019 forecast by 0.1 ppt to 2.4%.

If further tariffs were applied on a larger scale than they have so far, and on a permanent basis (for instance on the additional USD 200 billion of Chinese imports Trump is threatening to hit), we would be forced to tilt toward our alternative scenario, with 2019 growth likely to be 0.3 ppt lower than our new baseline forecast and core inflation 0.1 ppt higher.

We are also leaving our Fed scenario unchanged. We still see a total of four quarter-point rate hikes this year and two in 2019. In the alternative scenario, there would be no rate hikes in 2019.