Clear signs from the ECB that it won’t raise rates until H2 2019 mean we are revising our expectations for monetary tightening in Switzerland.The Swiss National Bank’s (SNB) monetary meeting was held last week. The press release was little changed from the previous one. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly valued” and the “situation on foreign exchange markets as fragile”.During the press conference, SNB president Thomas Jordan remained cautious overall. Importantly, the 2020 inflation forecast was revised down to 1.6% from 1.9%.A dovish ECB and political uncertainties in Europe as well as the SNB’s downward

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Clear signs from the ECB that it won’t raise rates until H2 2019 mean we are revising our expectations for monetary tightening in Switzerland.

The Swiss National Bank’s (SNB) monetary meeting was held last week. The press release was little changed from the previous one. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly valued” and the “situation on foreign exchange markets as fragile”.

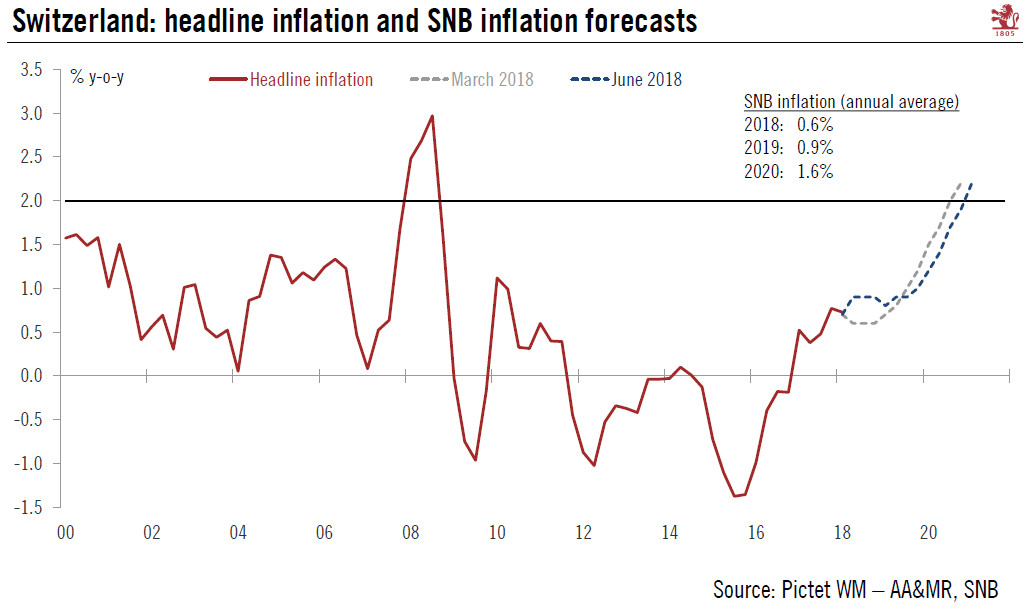

During the press conference, SNB president Thomas Jordan remained cautious overall. Importantly, the 2020 inflation forecast was revised down to 1.6% from 1.9%.

A dovish ECB and political uncertainties in Europe as well as the SNB’s downward revision of its own medium-term inflation forecasts lead us change our call for the timing of SNB policy tightening.

We now expect the first SNB policy rate hike in September 2019 (our previous forecast was for December 2018), after the first ECB depo rate hike the same month. We foresee a 25bp increase in the policy rate by the SNB.