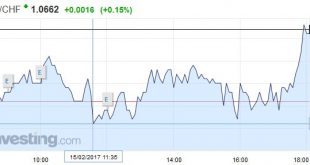

Swiss Franc EUR/CHF - Euro Swiss Franc, February 15(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc exchange rate remains in a volatile position susceptible to risks of deterioration from outside global events. The Franc being a safe haven currency leaves it at the mercy of some international events which can cause a flight to safety as investors use the Franc’s stability and...

Read More »FX Daily, February 14: Markets Showing Little Love on Valentines

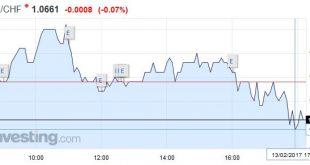

Swiss Franc EUR/CHF - Euro Swiss Franc, February 14(see more posts on EUR/CHF, ) - Click to enlarge The pound has seen a good start to the week making gains against all of the major currencies including the Swiss Franc. One of the reasons why the pound is supported appears to be the shift of attention from Brexit to other global changes to include the new Trump administration and the upcoming European...

Read More »FX Daily, February 13: Quiet Start of Busy Week

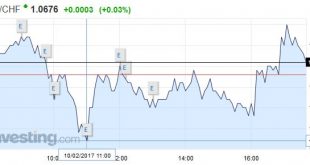

Swiss Franc EUR/CHF - Euro Swiss Franc, February 13(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates provide strong beginning to the week Pound to Swiss Franc exchange rates have enjoyed a strong boost to begin the week, after what had been a disheartening end to the week for many Franc buyers. The Pound has regularly suffered on Friday’s since the Referendum, with...

Read More »The Dollar’s Underlying Trend Resumes

For the last several weeks, we have been looking for the dollar correction that began around the Fed’s rate hike in the middle of December to be completed and for the uptrend to resume. The precise timing of the turn is difficult to get right, but our view is anchored by our macroeconomic assessment and is understanding of the key drivers. Our technical work suggests the dollar indeed has been carving out a bottom, and...

Read More »FX Daily, February 10: US Dollar Holding on to Week’s Gains

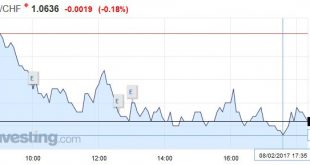

Swiss Franc EUR/CHF - Euro Swiss Franc, February 10(see more posts on EUR/CHF, ) - Click to enlarge Sterling vs the Swiss Franc has been climbing recently as the Brexit talks appear to be going the right way at the moment. The talks are progressing and it has been confirmed that the government will be allowed to vote on the final agreement prior to the triggering of Article 50. The Pound is still under huge...

Read More »FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

Swiss Franc EUR/CHF - Euro Swiss Franc, February 09(see more posts on EUR/CHF, ) - Click to enlarge Currency manipulation is becoming a hot topic now that Donald Trump has been inaugurated as the US President. Followers of his social media accounts will be aware of his criticism’s of a number of countries for artificially weakening their currency’s in order to remain competitive on a global scale, and recently...

Read More »Cool Video: Around the World with Katie Martin of the Financial Times

Katie Martin and Marc Chandler I am in London as part of a larger business trip. I had the chance today to talk to Katie Martin, who runs Fast FT and is often writing about foreign exchange. They show was live on Facebook. It is about a 22 minute interview and although foreign exchange is the key issue, to get to it we end up talking about many things, including US interest rates, Trump, and even cooking frogs. Often I...

Read More »FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

Will EUR/CHF fall to 1.00 The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by...

Read More »Great Graphic: Interesting Sterling Price Action

Sterling is having an interesting day. It fell in the face of the US dollar’s bounce but has recovered fully. It has not yet traded above yesterday’s high (~$1.2510) but it may. It does appear to be tracing out a hammer in Japanese candle stick terms. Demand emerged (support) near the 50% retracement objective of advance off the January 16 dip below $1.20. That retracement was $1.2346 and today’s low was one hundredth...

Read More »FX Weekly Preview: Politics Not Economics is Driving the Markets

Summary: The Fed is more confident this year of stable growth and rising inflation. The new US Administration’s economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy. United States The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org