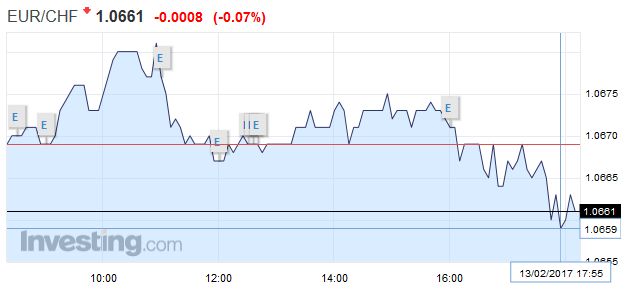

Swiss Franc EUR/CHF - Euro Swiss Franc, February 13(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates provide strong beginning to the week Pound to Swiss Franc exchange rates have enjoyed a strong boost to begin the week, after what had been a disheartening end to the week for many Franc buyers. The Pound has regularly suffered on Friday’s since the Referendum, with Sterling exchange rates falling downwards as we edge closer to the weekend. The reason for these fairly regular movements is due to trading activity, which take an abnormal turn on Friday afternoons. Speculators effectively have to choose a stable currency in which to store their weekly profits in for when they are away from their desks for the weekend. Whilst currency markets do close for the weekend, markets continue to function in other areas of the world from 6-11 on Friday and in the very early morning on Monday in the UK, which is why such action is necessary. Since Sterling is considering anything but stable in recent months for obvious reasons, particularly with many politicians hitting the political talk shows over the weekend whose choice of words could upset things, the Pound is not high on the list to ‘buy up’ during this period – actually quite the opposite.

Topics:

Marc Chandler considers the following as important: EUR/GBP, Featured, FX Trends, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 13(see more posts on EUR/CHF, ) |

GBP/CHFPound to Swiss Franc exchange rates provide strong beginning to the week Pound to Swiss Franc exchange rates have enjoyed a strong boost to begin the week, after what had been a disheartening end to the week for many Franc buyers. The Pound has regularly suffered on Friday’s since the Referendum, with Sterling exchange rates falling downwards as we edge closer to the weekend. The reason for these fairly regular movements is due to trading activity, which take an abnormal turn on Friday afternoons. Speculators effectively have to choose a stable currency in which to store their weekly profits in for when they are away from their desks for the weekend. Whilst currency markets do close for the weekend, markets continue to function in other areas of the world from 6-11 on Friday and in the very early morning on Monday in the UK, which is why such action is necessary. Since Sterling is considering anything but stable in recent months for obvious reasons, particularly with many politicians hitting the political talk shows over the weekend whose choice of words could upset things, the Pound is not high on the list to ‘buy up’ during this period – actually quite the opposite. As such the sell-off of Sterling is why you are seeing a downgrade most Friday afternoon’s on Pound to Swiss Franc exchange rates. However, with normal trading resuming you do see this reversed most Mondays, and in this case the losses were re-cooperated, and then some. Tomorrow we also have UK inflation data set to be released which could continue Sterling’s rally, and should be seen as an opportunity for Swiss Franc buyers. |

GBP/CHF - British Pound Swiss Franc, February 13(see more posts on GBP/CHF, ) |

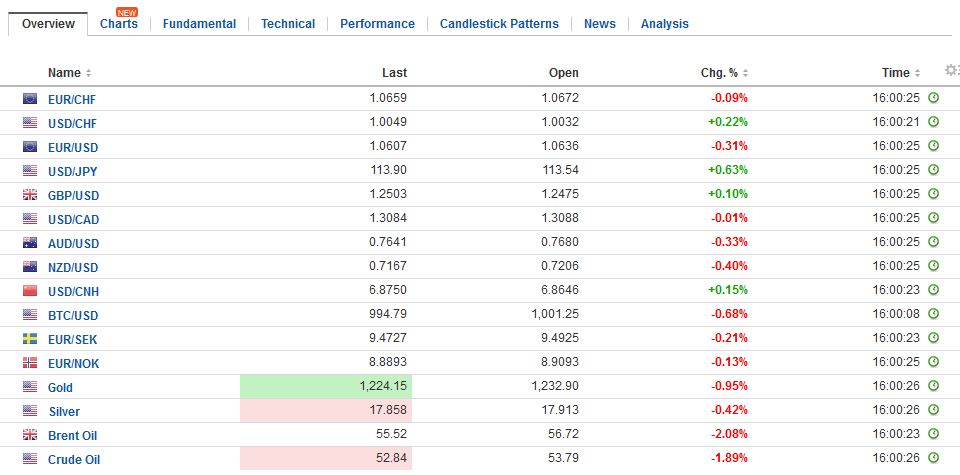

FX RatesWith inflation and growth reports due out this week and Federal Reserve Chair Yellen’s testimony before Congress, it promises to be a busy week for investors. However, the week has begun off fairly quietly, while the recent rally in equities continues. The US dollar is narrowly mixed. The yen is the weakest of the majors, off about 0.5% against the dollar. The greenback reached almost JPY114.20 in Asia as the Trump-Abe meeting was completed without the US raising the issue of currency manipulation. The dollar slipped back to JPY113.40 before the European session. Asia equity markets were higher, and the MSCI Asia-Pacific Index rose 0.4% following last week’s nearly 1.3% gain. The index has risen for three consecutive weeks. The strongest performance has again been turned in by Chinese shares that trade in Hong Kong. Today’s 1.3% rise caps a six-session 6.6% gain, led by utilities and financials. Only real estate was shunned. |

FX Daily Rates, February 13 |

| MSCI Emerging market equity index is up 0.5% to extend its advance for a fourth session and eight of the past nine sessions. It has risen six of the past seven weeks to reach its best level since July 2015. It is about one percent below a key retracement (61.8%) of its decline from mid-2014 (~945).

News from Italy is also worth monitoring. The issue here is whether the PD will support efforts to have an election this year. Former Prime Minister Renzi and his supporters had been advocating quick agreement on the electoral law and then elections. However, opposition to Renzi within the PD has been emboldened and are pressing back to allow the current government to hammer out the electoral reform and hold elections on schedule next year. On the one hand, Renzi may fear that longer he is out of office, the hard it will be to come back. He may be unable to take credit for the modest growth in the economy. On the other hand, there are difficult issues being faced, like the banking system, and fiscal issues that might undermine the government. Better to let Gentiloni take the hit. |

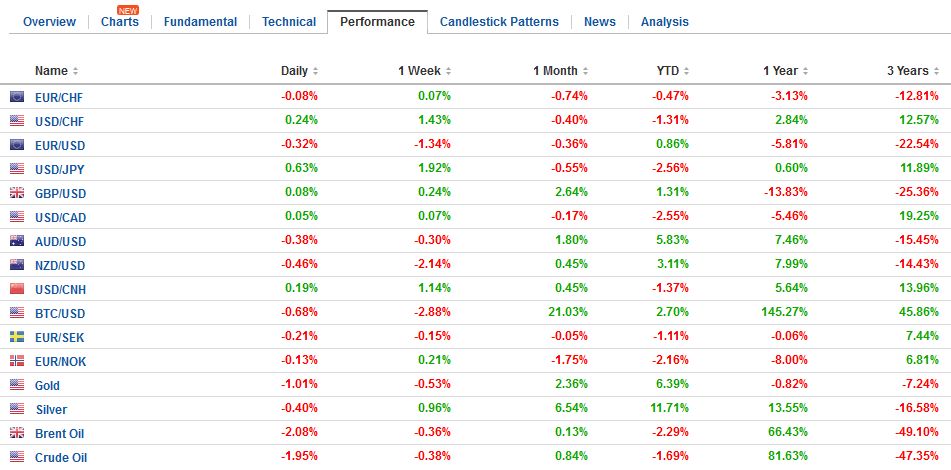

FX Performance, February 13 |

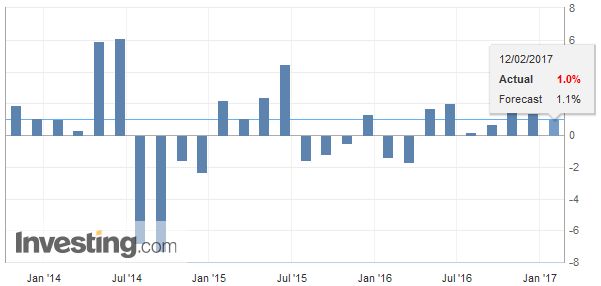

JapanDomestic consumption was flat. Business investment was the main driver of Japanese growth, adding about 0.9% to GDP. Net exports added 0.2%, while inventories were a 0.1% drag. The GDP deflator remained atminus0.1% for the second quarter. |

Japan Gross Domestic Product (GDP) YoY, January 2017(see more posts on Japan Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Eurozone

European shares are extending their rally. The Dow Jones Stoxx 600 is up for the fifth consecutive session. Materials are leading today’s advance. Financials and real estate are barely participating, and telecoms are heavy.

Commodity prices are on a tear. Iron ore prices are surging. Today’s nearly 5% increase brings the five-day advance to nearly 16%. Copper prices are extended the pre-weekend 4.5% gain another percent today. Other industrial metals are also higher. Oil, on the other hand, is trading off around 0.5%, jeopardizing the three-day advance.

Bond yields are firmer. US, UK, and Italian yield 10-year yields are a couple of basis points higher. German and Spanish 10-year benchmark yields are a little more than a single basis point above last week’s close. Greek bonds are heavier still, as a near-term resolution between the government and the official creditors seems unlikely. The creditors want a set of programs (fiscal austerity) that can be implemented if Greece does not achieve a 3.5% primary budget surplus next year. The government, which is seeing its public support slip, is reluctant to impose any more austerity measures (beyond what has already been agreed).

Switzerland

Of note, Swiss stocks are lagging behind the other major markets today. Over the weekend, the government lost a referendum that would have paved the way for corporate tax reform. At issue was the government’s promise to its trading partners to abolish the special tax treatment of multinational companies. Over the overwhelming support by parliament and the government, Social Democrats carried the day. They campaigned on the idea that the proposal would have reduced government revenues and this would have been translated into a cut in government services. It will take some time for Swiss officials to come up with a new scheme that would allow it to remain (tax) competitive while addressing the preferences given to draw multinational companies.

The North American session is likely to be subdued, with no economic reports of consequence from the US or Canada. Nor are Fed officials scheduled to speak. Yellen’s testimony begins tomorrow and is one of the highlights of the week. She is unlikely to go much beyond the recent FOMC statement. While all meetings are theoretically live, the March meeting does not appear to be a particularly likely opportunity.

Bloomberg calculates the odds of a hike at the March meeting at 30%, while the CME estimates the odds at closer to 13%. Our own calculation is nearer the CME. The prospect for details of the Trump Administration’s tax reform proposals in a couple of weeks, which some believe will spur a dramatic appreciation of the dollar, will likely deter serious selling of the greenback, regardless of the Fed not raising rates next month.

Tags: #GBP,#USD,$JPY,$TLT,EUR/GBP,Featured,newsletter