Summary: Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way. The FOMC statement reads very much like the June statement. There were some minor tweaks in the first paragraph that discusses the broad economic performance since the last FOMC statement. There...

Read More »FX Daily, July 26: Quiet Fed Day without Yellen

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet...

Read More »FX Daily, July 25: Summer Markets Ahead of FOMC

Swiss Franc EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are subdued today; a dearth of fresh news and tomorrow’s FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European...

Read More »FX Daily, July 24: Euro Recovers from Softer Flash PMI

Swiss Franc The Euro has fallen by 0.17% to 1.1009 CHF. EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a...

Read More »FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

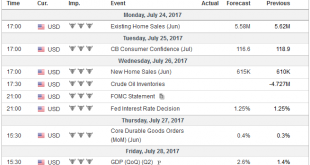

Summary: FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to...

Read More »FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

Swiss Franc The euro has depreciated by 0.13 to 1.1043 CHF. EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is very much unloved. The apparent stabilization of the political situation in Europe and sustained pace of above trend growth contrasts with the US where the political situation leaves much to be desired and the economy is...

Read More »FX Daily, July 20: ECB Game Day

Swiss Franc The euro has appreciated by 0.47% to 1.1051 CHF. EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs,...

Read More »FX Daily, July 19: Dollar Stabilizes on Hump Day, Awaits Thursday’s BOJ and ECB Meetings

Swiss Franc The Euro has fallen by 0.38% to 1.0987 CHF. EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow’s BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a...

Read More »Sterling, McCafferty, and BOE Policy

Summary: BOE hawk is arguing for a sooner unwind of QE. He did not favor the renewed asset purchases after the referendum. Sterling has been meeting resistance near $1.30 for past two months. Sterling’s advance today is being attributed to comments by a member of the Bank of England’s Monetary Policy Committee McCafferty. However, we suspect it was a news item that was used to justify the price gains that was...

Read More »FX Weekly Preview: Focus Shifts from Fed to ECB

Summary: Market has downgraded chances of a September hike from low to lower, but the chances of a December hike are higher than the day after the June hike. ECB meeting is the most important event of the week. A small change in the risk assessment is likely. The US and Europe have been more disruptive to the global capital markets this year than China. The focus shifts in the week ahead from Yellen’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org