Swiss Franc EUR/CHF - Euro Swiss Franc, February 09(see more posts on EUR/CHF, ) - Click to enlarge Currency manipulation is becoming a hot topic now that Donald Trump has been inaugurated as the US President. Followers of his social media accounts will be aware of his criticism’s of a number of countries for artificially weakening their currency’s in order to remain competitive on a global scale, and recently his attention has been on the Eurozone and how Germany is benefiting from the weaker Euro. It likely that sooner or later CHF will hit the headlines the Swiss National Bank works particularly hard to ensure the Swiss Franc doesn’t become vastly overvalued. Due to the Swiss Franc’s status as a safe haven currency the SNB has had some major instances over the year whereby it would of had to ensure the changes within the Swiss Franc’s value we rent too drastic, for example the UK’s Brexit vote and the shock win for President Trump. Investors tend to pile in to the Swiss Franc in times of uncertainty due to the countries political and legal stability, which is why the currency has gained so much value in recent times and why the SNB must manage CHF’s value.

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, FX Trends, GBP, GBP/CHF, Germany Exports, Germany Imports, Germany Trade Balance, Japan Core Machinery Orders, JPY, newsletter, Switzerland Unemployment Rate, U.S. Initial Jobless Claims, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 09(see more posts on EUR/CHF, ) |

|

Currency manipulation is becoming a hot topic now that Donald Trump has been inaugurated as the US President. Followers of his social media accounts will be aware of his criticism’s of a number of countries for artificially weakening their currency’s in order to remain competitive on a global scale, and recently his attention has been on the Eurozone and how Germany is benefiting from the weaker Euro. It likely that sooner or later CHF will hit the headlines the Swiss National Bank works particularly hard to ensure the Swiss Franc doesn’t become vastly overvalued. Due to the Swiss Franc’s status as a safe haven currency the SNB has had some major instances over the year whereby it would of had to ensure the changes within the Swiss Franc’s value we rent too drastic, for example the UK’s Brexit vote and the shock win for President Trump. Investors tend to pile in to the Swiss Franc in times of uncertainty due to the countries political and legal stability, which is why the currency has gained so much value in recent times and why the SNB must manage CHF’s value. There is talk of the SNB spending as much as 9% of the country’s GDP trying to weaken and mange the CHF exchange rate, so any changes to laws surrounding this process would be likely to impact CHF’s value greatly. |

GBP/CHF - British Pound Swiss Franc, February 09(see more posts on GBP/CHF, ) |

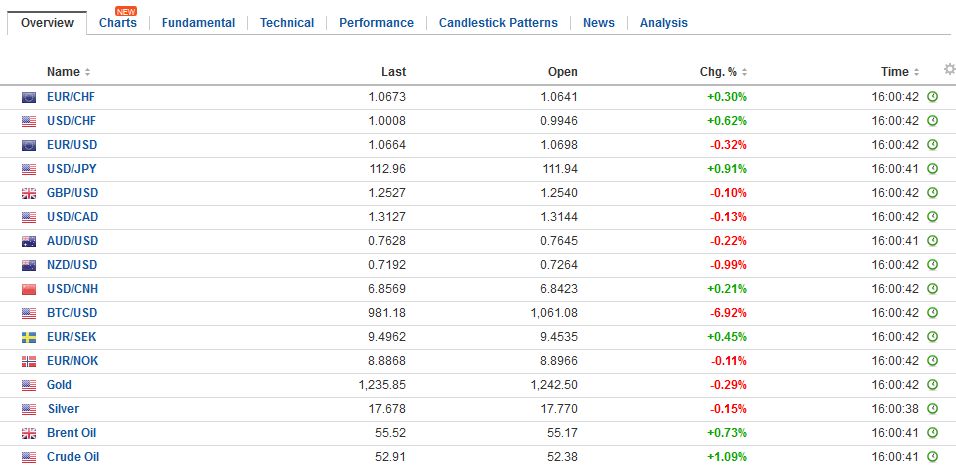

FX RatesThe US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off. Large option expiries today: Euro: $1.06 (570 mln euros), $1.0650 (510 mln euros), $1.07 (929 mln euros): Tomorrow: $1.06 (1.2 bln euros). JPY: 111.15 ($450 mln), 112.35 ($330 mln), 113.00 ($626 mln), 113.50 ($800 mln): Tomorrow: 111.00 ($1.2 bln) 112 ($1.7 bln). The MSCI Asia Pacific shares are off about 0.3%. The Nikkei traded heavily (-0.5%) the auto sector was under pressure, ahead of Abe’s meeting with Trump tomorrow. A good part of the US trade deficit can be traced to autos and auto parts. Japanese companies are thought to be vulnerable to the new America First thrust, even though Japan produce in the US most of the cars it sells to the US. Still, it looks like Japan has surpassed Germany to move in second place of with the largest trade surplus with the US after China. Separately, in the region, we note that China’s shares that trade in Hong Kong were the strongest with the 1.2% rise. It is a 14-month high. |

FX Daily Rates, February 09 |

| Sterling has been pushed to a new high for the week. The $1.2570 in cable that has been tested corresponds with the 61.8% retracement of the drop since the key reversal on Feb 2. A move above $1.26 could spur another cent higher, and several of our technical signals converge near $1.28.

The euro slipped to its lowest level yesterday since January 30 near $1.0640. It is consolidating in a narrow range near $1.07. A move above $1.0720 warns of another run at $1.0800-$1.0830. The dollar is continuing to consolidate against the Japanese yen in narrow ranges. The range was largely established on Monday of roughly JPY111.60 to JPY112.80. The Australian dollar is finding support near $0.7600, while the $0.7700 ceiling remains intact. The US dollar bounced from CAD1.2970 in late January to CAD1.3210 a couple of sessions ago. The CAD1.3120 area is a 38.2% retracement of that bounce. The 50% retracement is found near CAD1.3090. |

FX Performance, February 09 |

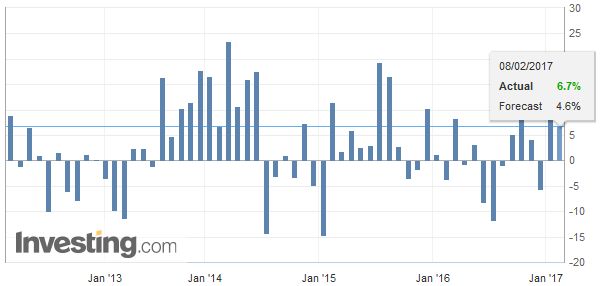

JapanJapan reported stronger core machine orders (6.7%, more than twice the median). |

Japan Core Machinery Orders YoY, January 2017(see more posts on Japan Core Machinery Orders, ) Source: Investing.com - Click to enlarge |

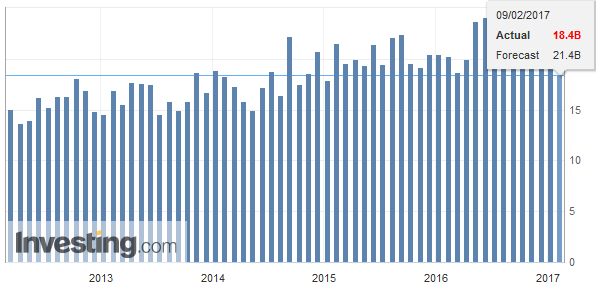

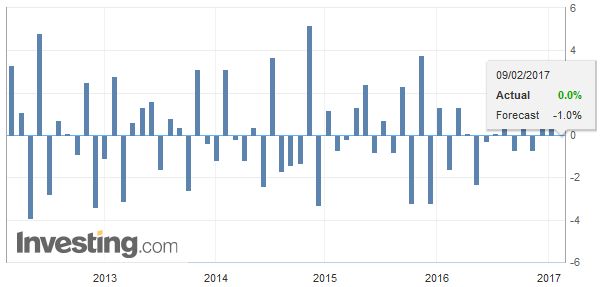

GermanyGerman trade surplus was smaller than expected at 18.7 bln euros rather than 20.5 and 22.7 previously. |

Germany Trade Balance, January 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

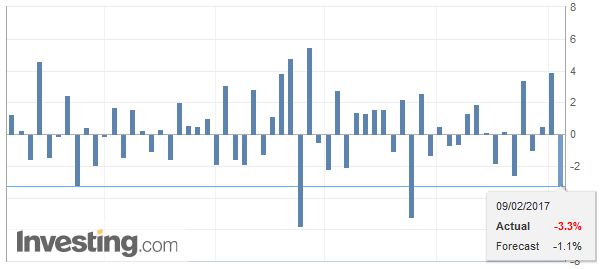

| Exports were off 3.3% in December and follows the disappoint drop in December industrial output reported earlier this week (-3.0% rather than +0.3% as the median would have had it). |

Germany Exports, January 2017(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

| Core bond yields are firmer, including US 10-year yields. Of note, despite the continued political focus, the premiums over Germany are mostly narrowing again. The French premium is smaller for the third consecutive session, for example. The Italian premium pushed through 200 bp at the start of the week, but is now back near 190 bp. |

Germany Imports, January 2017(see more posts on Germany Imports, ) Source: Investing.com - Click to enlarge |

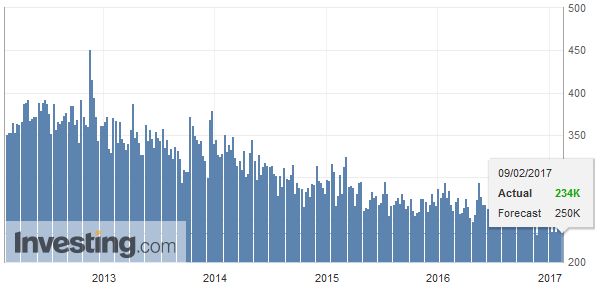

United StatesUS highlights are not very high: weekly initial jobless claims and wholesale sales and inventories, not the stuff that moves the market. Two Fed officials speak: Bullard and Evans. Bullard adopted a new framework last year and his views were a bit of an outlier. Evans has been a dove but most recently he suggested he see scope for two and possibly three hikes this year. |

U.S. Initial Jobless Claims, January 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

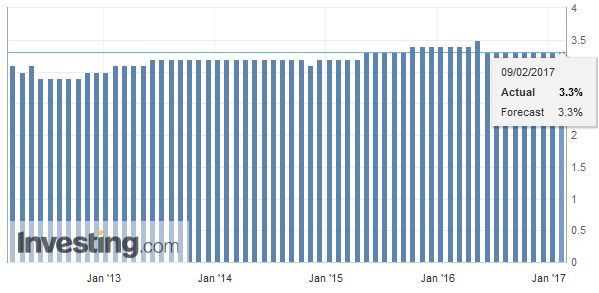

Switzerland |

Switzerland Unemployment Rate Seasonally Adjusted, January 2017(see more posts on Switzerland Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,GBP/CHF,Germany Exports,Germany Imports,Germany Trade Balance,Japan Core Machinery Orders,newsletter,Switzerland Unemployment Rate,U.S. Initial Jobless Claims