Swiss Franc EUR/CHF - Euro Swiss Franc, February 15(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc exchange rate remains in a volatile position susceptible to risks of deterioration from outside global events. The Franc being a safe haven currency leaves it at the mercy of some international events which can cause a flight to safety as investors use the Franc’s stability and strength as a safe haven from risky factors elsewhere. The outlook on the GBPCHF rate for me is likely to see a stronger Franc as the pound whilst more resilient is likely to come under increasing pressures later in the year. If you are buying Francs with the pound then rates above 1.25 are I believe a strong reason to be positive about the current market. With the pound much improved but flirting with 1.20 not so long ago this improvement is I believe well worth taking advantage of since it offers up much better opportunities for clients buying the Franc.

Topics:

Marc Chandler considers the following as important: AUD, EUR, Featured, FX Trends, GBP, JPY, newslettersent, SEK, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 15(see more posts on EUR/CHF, ) |

GBP/CHFThe pound to Swiss Franc exchange rate remains in a volatile position susceptible to risks of deterioration from outside global events. The Franc being a safe haven currency leaves it at the mercy of some international events which can cause a flight to safety as investors use the Franc’s stability and strength as a safe haven from risky factors elsewhere. The outlook on the GBPCHF rate for me is likely to see a stronger Franc as the pound whilst more resilient is likely to come under increasing pressures later in the year. If you are buying Francs with the pound then rates above 1.25 are I believe a strong reason to be positive about the current market. With the pound much improved but flirting with 1.20 not so long ago this improvement is I believe well worth taking advantage of since it offers up much better opportunities for clients buying the Franc. Longer term investor fears over just what is next for Brexit will I believe send the pound lower and the uncertainty present in financial markets over the European elections, Greek debt crisis and also US foreign and trade policy will ultimately cause investors to think twice about where they put their money leaving the Franc high and dry and stronger. |

GBP/CHF - British Pound Swiss Franc, February 15(see more posts on GBP/CHF, ) |

FX RatesThe Dollar Index’s ten-day rally was at risk yesterday, but Yellen’s reiteration of the commitment to continue to lift rates gradually helped extend the streak to eleven sessions. This surpassed the streak around the election (November 7-November 18). With today’s gains, it may draw closer to what appears to be the long streak, 14 sessions between April 30, 2012 and May 17. To put it slightly differently, the Dollar Index has not had a losing session this month. Although Yellen’s comments were seen as dollar-positive, the impact on the outlook for Fed policy did not change very much. Consider that implied yield of the March Fed funds futures slipped half a basis point to 0.69%. The average effective Fed funds rate is steady at 66 bp presently. The implied yield of the June Fed funds futures contract rose to 0.84% from 0.825% while the implied yield of the December contract rose three basis points to 1.13%. In the foreign exchange market, the dollar’s gains are against Europe and the yen, while the dollar-bloc is firm. The Australian and New Zealand dollars are the only majors up against the greenback while the Canadian dollar’s 0.03% loss (at ~CAD1.3080) puts it in third place. The Australian dollar continues to be pinned in a $0.76-$0.77 range. The euro’s losses have been extended. After being sold through $1.06 yesterday, it has been unable to push back above, and instead was sold to almost $1.0540 in the European morning and extended its decline to the fifth consecutive session. The $1.0525 area corresponds to the 61.8% retracement of this year’s short-covering bounce in the euro. A break could spur a move to $1.0450 ahead of the cyclical low near $1.0340. |

FX Daily Rates, February 15 |

| The dollar is advancing against the yen for the third consecutive session. It is approaching the JPY115 area, which may off the first test for the dollar bulls. Above there, a band of resistance extends toward JPY115.50.

Sterling is heavy and is near $1.2420 having peaked last week near $1.2580. A trend line from the flash crash low last month and the February 7 low (~$1.2350) held yesterday but yielded today. Look for another test on that $1.2350 area which corresponds to a 50% retracement of the rally from the flash crash. In terms of the markets, the equity advance in the US yesterday, despite the firmer rates, has carried over into Asia and Europe. The MSCI Asia Pacific Index rose about 0.8%, led by a 1% rally in the Nikkei and a 1.25% rally in Hong Kong. Mainland shares that trade in Hong Kong continue to drive higher. The 1.7% rally today overcomes yesterday’s minor loss (-0.3%) which ended the six-day advance. This year the Hong Kong Enterprise Index is up 11%, with a little less than half being recorded in the last five sessions. |

FX Performance, February 15 |

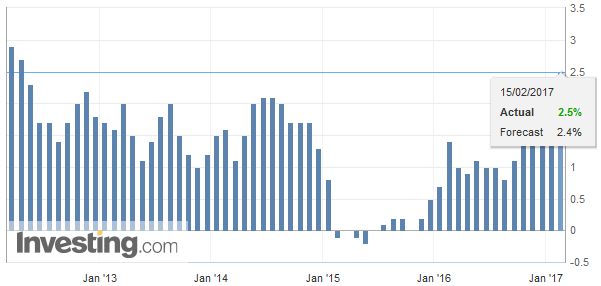

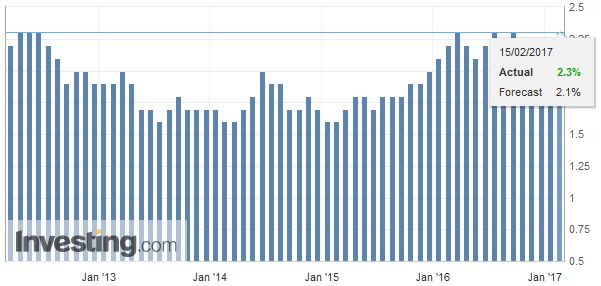

United StatesAfter a quiet few days for key US economic data, the calendar is full today. The US reports January CPI, retail sales and industrial output, and the February Empire survey. The Bloomberg median forecast is for a 0.3% rise in January CPI for a 2.4% year-over-year pace, but for the core rate to slip to 2.1% from 2.2%. We suspect the risk is on the upside. |

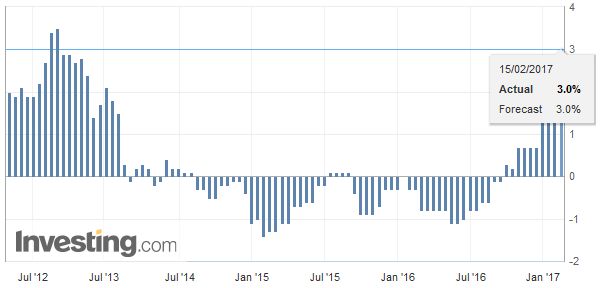

U.S. Consumer Price Index (CPI) YoY, January 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Yellen is delivering the second part of her Congressional testimony. The text is the same; the question will change (though not the answers). Also, after the markets close, the latest Treasury International Capital report (TIC) will be released. Given the talk of that central banks are reducing their holdings, the data may be scrutinized. Note that the Fed’s custody holdings (for foreign central banks) of Treasuries increased by about $55 bln in December (which will be covered by the TIC report later today). |

U.S. Core Consumer Price Index (CPI) YoY, January 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

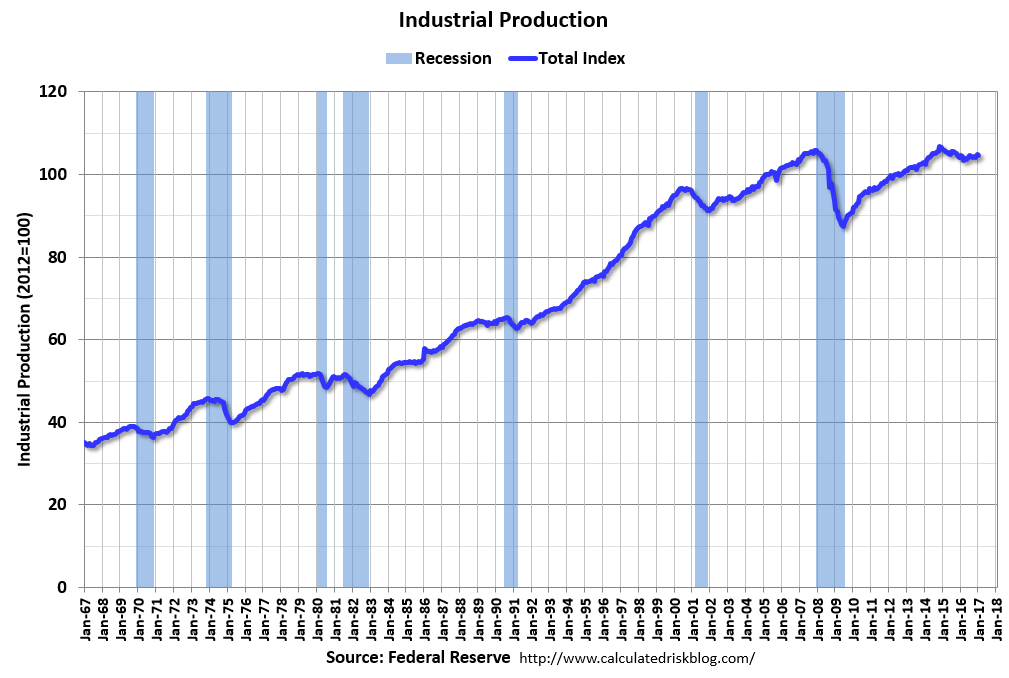

| The 0.8% rise in December industrial production also most likely was not repeated in January, and a flat report is expected. Here we suspect the risk is on the upside, perhaps stemming from the energy sector and increasing rig count. The manufacturing ix expected to expand by 0.2% matching the December gain. Note that the average monthly change in manufacturing last year was nil. |

U.S. Industrial Production, January 2017(see more posts on U.S. Industrial Production, ) Source: macro.ecoblogs.org - Click to enlarge |

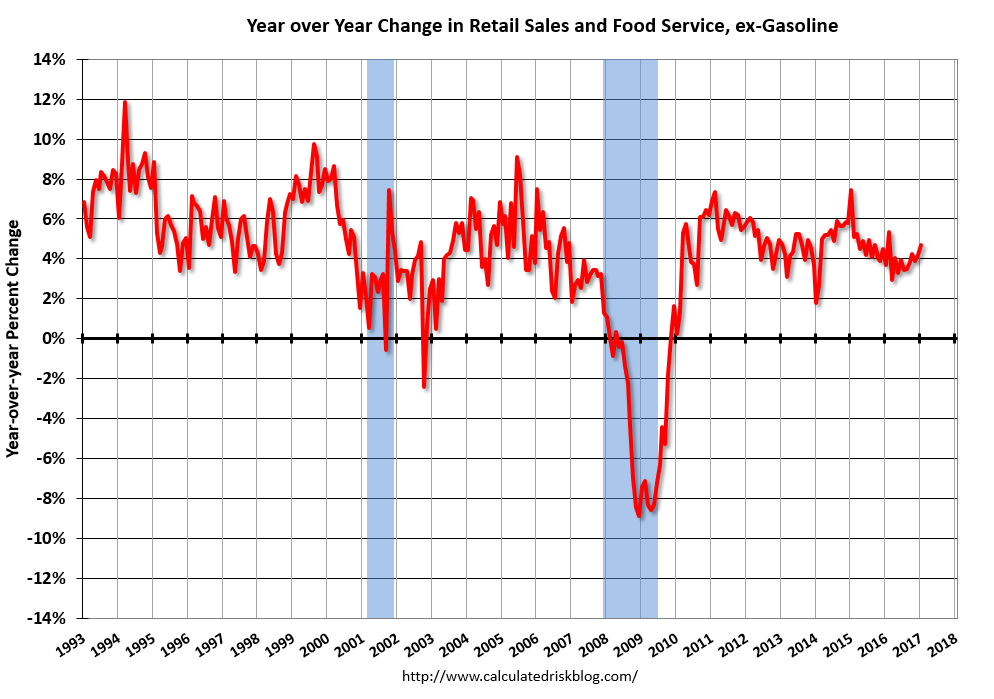

| Retail sales will also be in focus. The 0.6% rise in January will not be repeated, but the GDP component was up 0.2% in December and could improve on that in January. Here we suspect that the markets may be more sensitive to disappointment with consumption than inflation. |

U.S. Retail Sales, January 2017(see more posts on U.S. Retail Sales, ) Source: macro.ecoblogs.org - Click to enlarge |

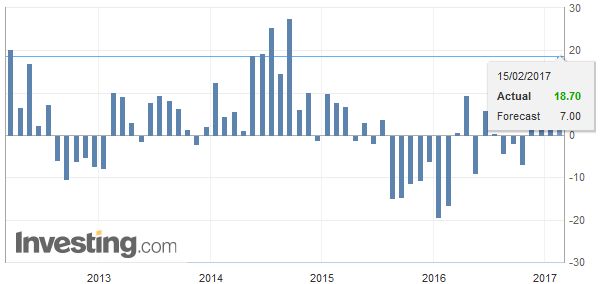

| The Empire survey for February is expected to improve slightly (from 6.5 to 7.0), which would be the fourth month with a positive reading. That would be the longest streak since late 2014. |

U.S. NY Empire State Manufacturing Index, January 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

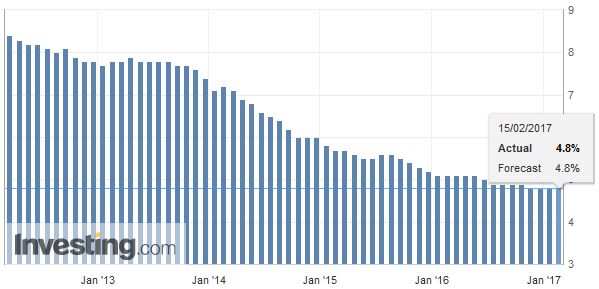

United KingdomElsewhere, the most important economic report came from the UK. Although the labor market had appeared to lose some momentum recently, today’s jobs report was a bit better than expected. Jobless fell 7k in Q4 and employment rose by 37k. |

U.K. Unemployment Rate, January 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

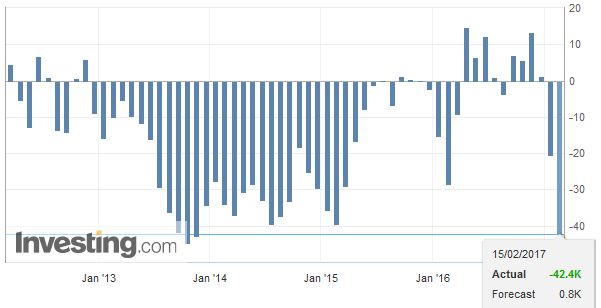

| The claimant rate eased from 2.3% to 2.1%. The claimant count fell a whopping 42.4k in January, following a revised 20.5k fall in December (from an initial estimate of a 10.1k decline). The claimant count has become more volatile due to changes in the Universal Credit benefits that is impacting the seasonal adjustments. |

U.K. Claimant Count Change, January 2017(see more posts on U.K. Claimant Count Change, ) Source: Investing.com - Click to enlarge |

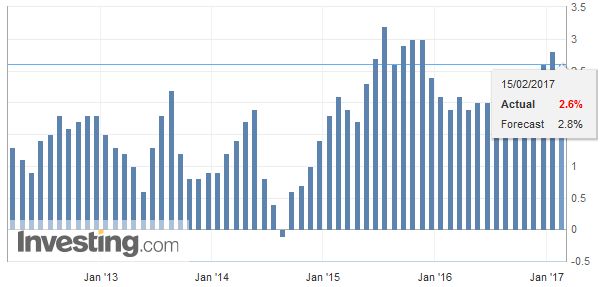

| Disappointment comes from average earnings. Despite what appears to be near full employment, UK wage growth remains lackluster and at risk of being offset in full by rising price pressures. Average wage growth in the three months through December rose 2.6%, unexpectedly weakening from 2.8% overall and 2.7% excluding bonuses. |

U.K. Average Earnings Index +Bonus, January 2017(see more posts on U.K. Average Earnings Index, ) Source: Investing.com - Click to enlarge |

EurozoneSweden’s Riksbank met, and although the policy was unchanged, the central bank expressed concern about the krona’s strength, which it feared could derail progress toward its inflation target. It not only warned that it maintained an easing bias, but it also threatened to intervene in the foreign exchange market. The market took the comments as a green light to sell the currency, and the krona is the weakest of the majors today, off 0.5% against the US dollar and about 0.2% lower against the euro. The euro needs to resurface above SEK9.50 to be important from a technical perspective. It is the upper end of this month’s range. Above there, near-term potential extends toward SEK9.60. In Europe, the Dow Jones Stoxx 600 overcome initial weakness, perhaps helped by the rally in US shares, and close higher yesterday. It is adding another 0.4% today to extend the streak to the seventh session. Today’s advance is being led by financials and real estate. It is at its best level since early December 2015. The US 10-year yield is firm near 2.48%. Most European yields are lower, but Germany is steady. The premiums over Germany continue to drift lower. A notable exception is Greece, where the country report that the harmonized measure of CPI jumped from 0.3% in December to 1.5% in January. Greece and the official creditors do not appear to be moving closer ahead of next week finance ministers meeting, which is thought to be the last opportunity to strike an agreement before the Dutch parliament is dissolved ahead of next month’s election. Greece does not need to funds until July. |

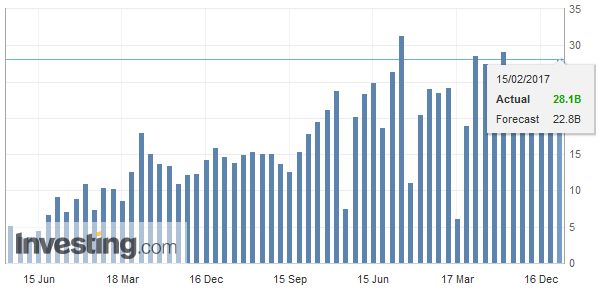

Eurozone Trade Balance, January 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Consumer Price Index (CPI) YoY, January 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Turning the yields into odds of a hike, the Bloomberg’s calculations suggest a 34% chance of a March hike (was 30%) and 73.5% chance of a June move (was 71%). The odds that by the end of the year the Fed would have delivered three hikes this year (lifting the target range to 1.25%-1.50%) is 26.4%, up from 24.4%. The CME’s calculation is less sanguine about the near-term but converges with the Bloomberg calculation of the odds of three hikes before the end of the year.

Yellen did not seem to break fresh ground yesterday.She stuck close to the FOMC statement in her economic assessment. All meetings are live, including March. If there was something new, it might have been that the Chair did not see using the unwinding of the balance sheet as a policy tool, such as to remove accommodation. We thought that it could be used like that. The time frame is not clear, but it appears discussion will begin shortly, and many look for an announcement toward the end of the year, with implementation beginning sometime year.

There are two things to note here. First, the initial steps will likely involve not reinvesting the maturing issues. This has been the basic message for some time. Second, managing of this process will likely not be under Yellen’s watch and has we have discussed, the composition of the Board of Governors will change dramatically over the next eighteen months. President Trump will appoint at least three of the seven governors this year and two next year. During the campaign, Trump was critical of the low interest rates and accused Yellen (sic) of doing so for political purposes. Many think that as President, Trump will favor easy money, but the institutional mandate of the central bank will not change (unless Congress does so and it would take quite some time).

We note too the bipartisan nature of the Fed. Consider Volcker was appointed initially by Carter and reappointed by Reagan. Greenspan was appointed by Reagan and continued through Clinton. Bernanke was appointed by Bush and reappointed by Obama. This does not mean that Trump will renominate Yellen, but the point is the institutional requirements tend to dampen ideological fervor.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Featured,newslettersent,SEK