Will EUR/CHF fall to 1.00 The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by internal demand. This boom phase has already started in the United States, where internal demand (+2.4%) rises more quickly than GDP (+1.9%). What does it mean for EUR/CHF ? Further downside towards 1.00, simply because the boom in the eurozone will start later. High unemployment and weak real estate prices in the periphery do not favor high spending. For Switzerland this is different. High real estate valuations support spending. Will the SNB intervene? When the SNB sees that economic activity is driven by consumption, then the export component is not that important any more. She will let EUR/CHF fall slowly to parity, in the same way she let it fall recently.

Topics:

George Dorgan considers the following as important: AUD, CAD, China Caixin Services PMI, EUR, EUR/CHF, Featured, FX Trends, GBP, GBP/CHF, JPY, newslettersent, Spain Industrial Production, TLT, U.S. Crude Oil Imports, U.S. Crude Oil Inventories, U.S. Trade Balance, U.S. Trade Deficit ex Oil, U.S. Trade Deficit Oil, U.S. Treasuries, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Will EUR/CHF fall to 1.00

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by internal demand. This boom phase has already started in the United States, where internal demand (+2.4%) rises more quickly than GDP (+1.9%). What does it mean for EUR/CHF ? Will the SNB intervene? |

EUR/CHF - Euro Swiss Franc, February 08(see more posts on EUR/CHF, ) |

GBP/CHFThe pound has risen further against the Swiss Franc as expectations over the Brexit and and worries over its outcome subside as the ‘Brexit Bill’ makes its way through parliament. Most analysts are expecting that the market will at some point revert to Brexit jitters and fears but for now we are faced with a situation where the pound is higher which is presenting some much more improved levels to buy at. The Swiss Franc has been benefiting from uncertainty globally over just what is happening in the global economy. This includes the prospect of what we can expect for the UK moving forward as well as fears over Donald Trump and also falling stock markets. Global uncertainty benefits the Swiss Franc which as a safe haven currency strengthens in times of global uncertainty as investors increase their share of percieved safer and less risky assets. |

GBP/CHF - British Pound Swiss Franc, February 08(see more posts on GBP/CHF, ) |

FX RatesThe US dollar is edging higher against most of the major currencies in a session devoid of much news. The Canadian dollar and the Japanese yen are the exceptions. The euro is the weakest of the majors; off about 0.3% near $1.0650. After a strong advance yesterday, sterling just missed recording an outside up day and is consolidating yesterday’s gains in a narrow range. Although the dollar-yen rate is sensitive to US rates and the differential with Japan, the greenback has been resilient in the face of the latest decline in the Treasury yield. The dollar remains within the roughly JPY111.65-JPY112.80 range established on Monday. Still, until the dollar resurfaces above JPY112.80, the technical tone is vulnerable. With today’s slippage, the euro has retraced 38.2% of the rally from the year’s low near $1.0340 at the start of the year. A convincing break of this area (~$1.0645) requires a push below the end of January low near $1.0620 to see a test on $1.0585, the 50% retracement objective and previous congestion area. A move above $1.0665 may help steady the single currency. |

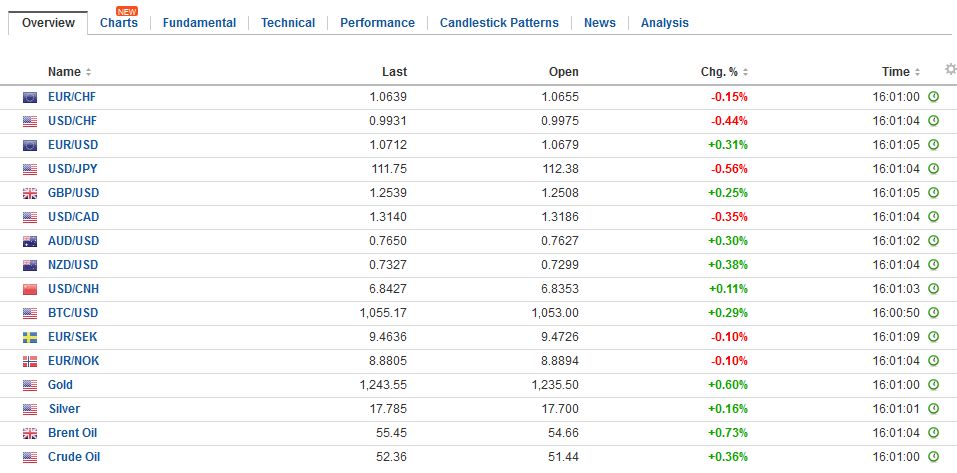

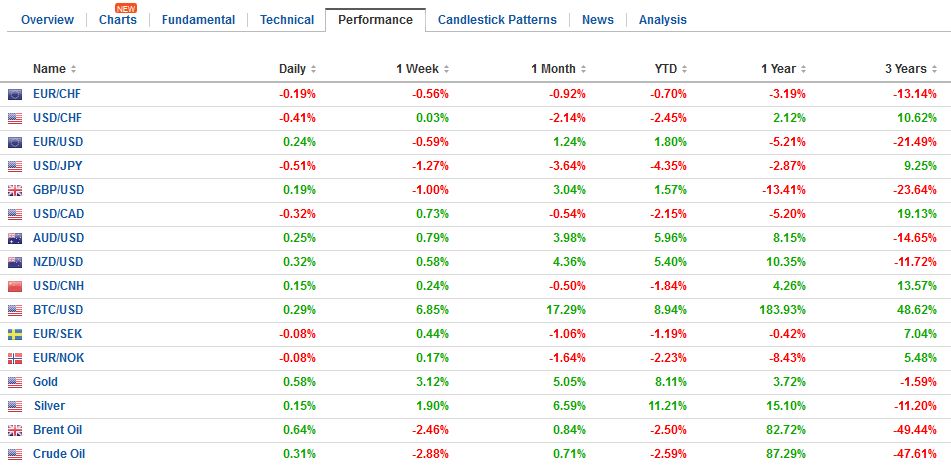

FX Daily Rates, February 08 |

| Sterling has been confined to about a half a cent range at the upper end of yesterday’s range. The strong momentum eased in the US afternoon. A break of the $1.2430- $1.2440 area would suggest that yesterday was a bit a head fake. Rather than a running start at the old highs and perhaps $1.28, it could be a bull trap. |

FX Performance, February 08 |

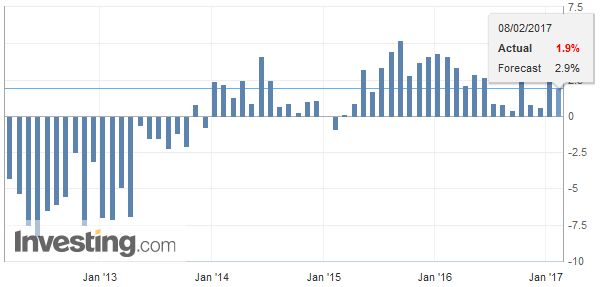

SpainEuropean politics is widely cited as an important driver. The most obvious metric is the premium being paid over Germany. Yet the premiums narrowed a little yesterday and are narrowing a little today. Moreover, on the one hand, some observers argue investors are not taking the political risk seriously enough, and on the other hand, other accounts emphasize how much the spreads have widened already. How can the Stiglitz scenario be discounted? He suggests the monetary union could blow up this year. |

Spain Industrial Production YoY, January 2017(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

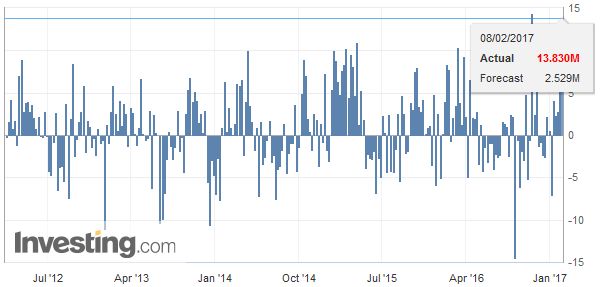

United StatesThe Aussie is holding below $0.7700 but found a good bid ahead of $0.7600. A move above $0.7640-50 would spur another run at $0.7700, which proved a real nemesis last year. The US dollar dipped below CAD1.30 briefly last week, and with the help, softer oil prices (and the API estimate of a large build of US oil inventories) helped the US dollar recover to CAD1.3200 yesterday. It is consolidating yesterday’s gains today. Support is seen in the CAD1.3130-CAD1.3140 area. |

U.S. Crude Oil Inventories, January 2017(see more posts on U.S. Crude Oil Imports, U.S. Trade Deficit Oil, ) Source: Investing.com - Click to enlarge |

| The US 10-year yield is holding below the 2.40% that was breached yesterday. Recall the yield peaked the day after the December 14 FOMC decision to hike rates near 2.64%. It fell to 2.30% on January 17 and recovered over the next week to 2.54%. It has been drifting lower. |

Yield US Treasuries 10 years, March 2016 - February 2017(see more posts on U.S. Treasuries, ) Source: bloomberg.com - Click to enlarge |

| The March 10-year note futures peak on January 17 at 125-13. Yesterday, it reached 125-10. The 125-16 area is the 38.2% retracement of the sell-off since the US election. The BOJ targets the 10-year yield and has had to become more active in defending it as rising global rates exert some upward pressure on Japanese rates. |

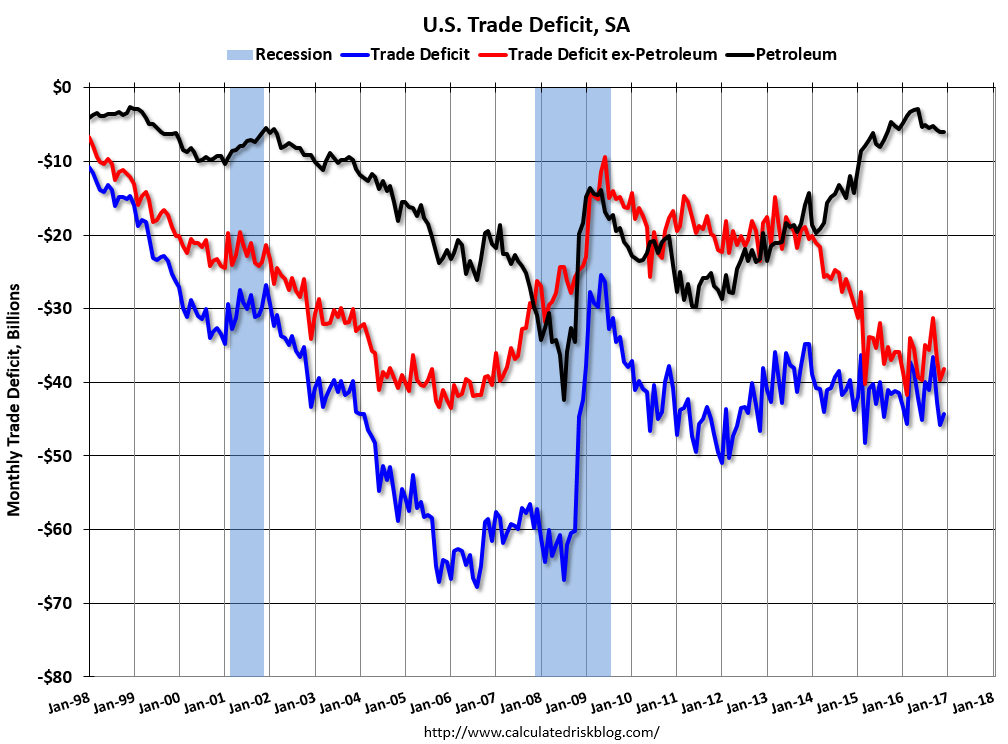

U.S. Trade Deficit, January 2017(see more posts on U.S. Trade Deficit ex Oil, U.S. Trade Deficit Oil, ) Source: macro.ecoblogs.org - Click to enlarge |

| The correlation between the dollar-yen rate and the Topix (percent change, 60-day rolling) is about 0.37, which is the highest since last September. The correlation between dollar-yen and the S&P 500 is has slipped to 0.18. It was above 0.5 for most of the first nine months of 2016. |

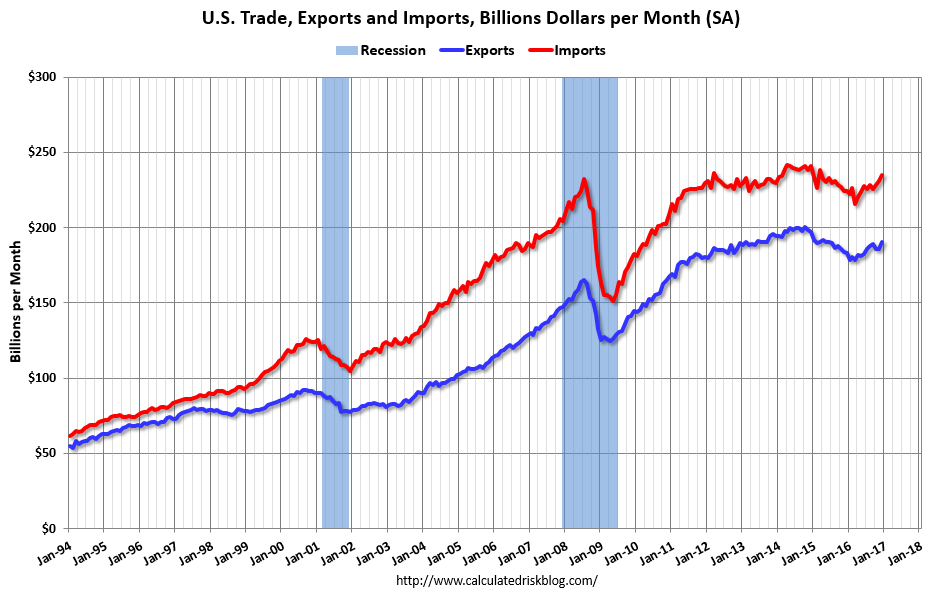

U.S. Trade Balance, January 2017(see more posts on U.S. Trade Balance, ) Source: macro.ecoblogs.org - Click to enlarge |

| Perhaps it is the lack of other substantive news, but many are talking about the decline in China’s reserves below $3 trillion. But there is little here besides the obvious. First, for all practical purposes reserves at $2.9982 is the same thing as $3 trillion. Second, there is nothing critical about $3 trillion. Moreover, we suspect Chinese officials do not simply look at the value of the reserves in dollar terms, but also in SDRs. Third, yes, China is still experiencing capital outflows. However, China is not likely to respond by having a dramatic change to its managed float, as some have suggested.

Instead, China is more likely to use formal and informal controls to limit the capital outflows. Fourth, the yuan appreciated by 0.9% last month and is up nearly 0.2% this month. The stabilization of the currency and the premium of the offshore yuan (CNH) over the onshore yuan (CNY) may suggest that there may be less speculative flows and perhaps more business flows, such as paying back some previously borrowed dollar, tourism (related to the Lunar New Year) and direct investment. |

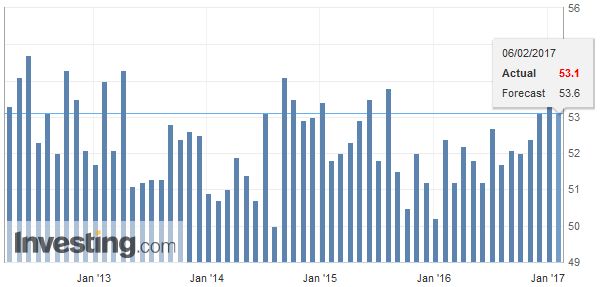

China Caixin Services PMI, January 2017(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,China Caixin Services PMI,EUR/CHF,Featured,GBP/CHF,newslettersent,Spain Industrial Production,U.S. Crude Oil Imports,U.S. Crude Oil Inventories,U.S. Trade Balance,U.S. Trade Deficit ex Oil,U.S. Trade Deficit Oil,U.S. Treasuries