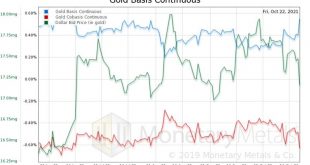

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation—shared by Keynesians, Monetarists, and many Austrians—is that the cause of this skyrocketing is the increase in the quantity of what is called “money”. The price of gold has not been going up. The inference is that it should be going up (note the word “should” is very dangerous in trading). The...

Read More »Doing 90 MPH on Deadman’s Curve: A Few Thoughts on Risk

When the wreck is recovered, witnesses will wonder why they took such heedless, foolish risks.You’re in the back seat wedged between tipsy revelers, the driver is drunk and heading into Deadman’s Curve at 90 miles per hour. Nobody’s worried because the driver has never crashed. Before they slid into euphoric incoherence, the other passengers answered your doubts with statistics and pretty charts showing that the driver had never had an accident, so there was nothing...

Read More »Aktualisierte Sanktionsmeldung

Das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF hat eine Änderung des Anhangs 3 der Verordnung vom 27. August 2014 über Massnahmen zur Vermeidung der Umgehung internationaler Sanktionen im Zusammenhang mit der Situation in der Ukraine (SR 946.231.176.72) publiziert. Am 22. Oktober 2021 hat das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF die Liste der in diesem Kontext sanktionierten Personen, Unternehmen und...

Read More »Surprise! Biden Continues the CIA’s JFK Assassination Cover-Up

Before I address President Biden’s decision last Friday to continue the national-security establishment’s cover-up of its November 22, 1963, regime-change operation in Dallas, I wish to make one thing perfectly clear: I am not Nostradamus. Yes, I fully realize that I repeatedly predicted that Biden would never order the release of those 60-year-old assassination-related records that the CIA has steadfastly been keeping secret from the American people. (See here and...

Read More »1789: The First Thing the New American Government Did Was Impose a Huge Tax Increase

It may come as a surprise—though it should not—that one of the very first acts of the new Congress, under the Constitution, was a tax program at least as great as the one imposed on the colonies by Great Britain. It turned out that taxation with representation could be just as oppressive as taxation without representation or worse. It is supreme irony that the very first major act of the new Congress was taxation at a level that would have made Britain proud. The...

Read More »An Anti-Inflation Trio From Three Years Ago

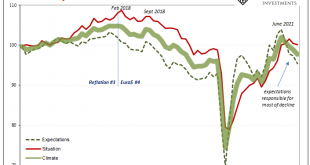

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential. So said all in the media, opinions written for everyone in it by none other than central bank models. It was going to be awesome. Straight away, however,...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

Read More »Swiss companies face severe supply chain bottlenecks

Goods are being delayed in container ports in many parts of the world. Keystone / Neil Hall Four out of five firms surveyed by the Swiss Business Federation (economiesuisse) have complained of problems in getting hold of raw materials and essential parts for their goods. The cost of the worsening supply chain conditions is starting to be passed on to consumers. Some companies are looking into putting staff on shortened hours with economiesuisse warning that the...

Read More »Freiheit ist das Gelbe vom Ei

Wird die deutsche Redewendung „das Gelbe vom Ei“ verwendet, soll damit das Beste, das Vorteilhafteste, das Nonplusultra beschrieben werden. Besser geht es nicht! Ist es vor diesem Hintergrund angemessen, gerade die Freiheit als das Gelbe vom Ei zu bezeichnen? Wäre es nicht passender, zum Beispiel die Marktwirtschaft oder persönliches Wohlergehen so zu benennen? Kämen nicht auch gute Politik oder Gleichheit als Kandidaten in Frage? Ist es nicht Willkür oder einfach...

Read More »Auch Reddit will in NFT Markt einsteigen

Mit Reddit bereitet sich das nächste Social Media Network auf einen Einstieg in den NFT Markt vor. Die Plattform sucht aktuell nach Crypto-Spezialisten, die sich mit NFTs auskennen und eine zentrale Rolle bei der Umsetzung auf einer Reddit-NFT-Plattform spielen sollen. Crypto News: Auch Reddit will in NFT Markt einsteigen In einer offiziellen Job-Ausschreibung (Senior Backend Engineer NFT) von Reddit heißt es: For Reddit, it will always be about community. (…) If...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org