04.10.2021 – Turnover adjusted for sales days and holidays rose in the retail sector by 0.2% in nominal terms in August 2021 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 0.5% in August 2021 compared with the previous year. Real growth takes...

Read More »Swiss Consumer Price Index in September 2021: +0.9 percent YoY, +0.0 percent MoM

04.10.2021 – The consumer price index (CPI) remained stable in September 2021 compared with the previous month, remaining at 101.3 points (December 2020 = 100). Inflation was +0.9%. compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each other overall. Prices for clothing and footwear...

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Is the Dollar’s Rally since the Disappointing August Employment Report Over?

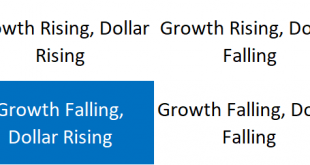

The dollar's strong upside momentum, which accelerated after the FOMC meeting, stalled in recent days. If interest rate considerations were the key driver, the Fed funds futures strip appears to have made the necessary adjustment. By our calculations, the September contract has a 25 bp hike fully discounted, and about a fifth of a second hike priced into the December contract. Meanwhile, the weekly initial jobless claims have risen for three weeks through...

Read More »Innovative Switzerland rolls out red carpet at Expo 2020 Dubai

The Swiss Pavilion has a mirrored front and a 700-square-metre red carpet to welcome visitors Keystone / Sebstien Crettaz After eight years of planning and billions of dollars in spending, the Middle East’s first World Fair has opened in Dubai. Switzerland is participating at Expo 2020 with its own pavilion. This offers visitors “a memorable experience and showcases our country in all its diversity: from the beauty of the Swiss Alps to Switzerland’s role as a leading...

Read More »Currency Debasement and Social Collapse

Knowledge of the effects of government interference with market prices makes us comprehend the economic causes of a momentous historical event, the decline of ancient civilization. It may be left undecided whether or not it is correct to call the economic organization of the Roman Empire capitalism. At any rate it is certain that the Roman Empire in the 2nd century, the age of the Antonines, the “good” emperors, had reached a high stage of the social division of...

Read More »What Is Ethereum Gas Fees # Tips To Reduce Gas Fees In NFT Transactions

Are you looking for information regarding NFT Ethereum Gas Fees? Do you want to know more about Ethereum gas fees hidden costs? Would you like to know how to avoid hidden costs while buying NFTs? Since the inception of NFTs or Non-Fungible Tokens, people are always looking forward to investing in them. Especially, after some celebrity tweets in favour of NFTs, they have got mass popularity in the USA and the other parts of the world. While the artists and collectors...

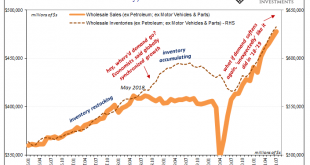

Read More »More About Less New Orders

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”). The worse the shipping snafus, the more was ordered and piled into it – if for no...

Read More »Dubai: Krypto-Handel nach Zustimmung der Regulierungsbehörden offiziell zugelassen

Dubais Behörden haben sich zusammengetan, um die Ausgabe und den Handel von Kryptowährungen in der DWTCA-Freezone zu legalisieren. Die Dubai World Trade Center Authority (DWTCA) gab kürzlich bekannt, dass sie mit der Securities and Commodities Authority (SCA) der VAE zusammengearbeitet hat, um den Handel, die Ausgabe und die Regulierung von Kryptowährungen innerhalb ihres Zuständigkeitsbereichs – der DWTCA-Freezone – vollständig zu legalisieren. l1 DWTCA...

Read More »Covid: non-mRNA vaccine soon available in Switzerland

© Zhukovsky | Dreamstime.com On 29 September 2021, Switzerland’s government announced it had signed a contract with Johnson & Johnson to receive 150,000 doses of its Covid-19 vaccine. The delivery of the doses is expected next week. The viral vector vaccine will be used primarily on people who cannot receive mRNA vaccines for medical reasons. However, it will also be made available to those who prefer such vaccines, said the Federal Office of Public Health...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org