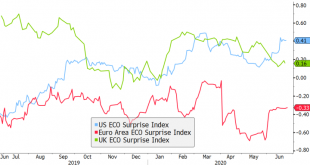

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities. RECENT DEVELOPMENTS Back in April, the WTO set forth two distinct pandemic scenarios for world trade. The “relatively optimistic”...

Read More »Dollar Firm as Risk-Off Sentiment Persists

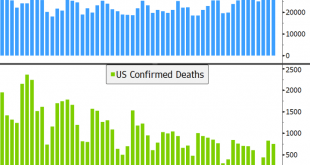

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out Fitch cut Canada’s rating by a notch to AA+ with stable outlook; Mexico is expected to cut rates 50 bp to 5.0%;...

Read More »Is Data Our New False Religion?

In the false religion of data, heresy is asking for data that is not being collected because it might reveal unpalatably unprofitable realities. Here’s how every modern con starts: let’s look at the data. Every modern con starts with an earnest appeal to look at the data because the con artist has assembled the data to grease the slides of the con. We have been indoctrinated into a new and false religion, the faith of data. We’ve been relentlessly indoctrinated with...

Read More »Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works Brazil announced a slew of new easing measures to improve liquidity conditions in local credit markets; Mexico...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below. Bangladesh: Effective June 18, the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) revised their trading hours until further notice. The...

Read More »The Illusion of Control: What If Nobody’s in Charge?

The last shred of power the elites hold is the belief of the masses that the elites are still in control. I understand the natural desire to believe somebody’s in charge: whether it’s the Deep State, the Chinese Communist Party, the Kremlin or Agenda 21 globalists, we’re primed to believe somebody somewhere is controlling events or pursuing agendas that drive global responses to events. I submit whatever control we discern is illusory, as the dynamics unleashed by...

Read More »Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week Eurozone reports preliminary June PMI readings Tuesday; ECB releases its account of the June meeting Thursday All quiet on the Brexit front; UK reports preliminary June PMI readings Tuesday Japan...

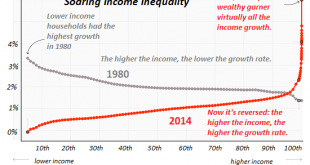

Read More »For the Rich to Keep Getting Richer, We Have to Sacrifice Everything Else

They’re hoping the endless circuses and trails of bread crumbs will forever distract us from their plunder and the inequalities built into America’s financial system.. The primary story of the past 20 years is the already-rich have gotten much richer, with destabilizing economic, social and political consequences. The Federal Reserve and its army of academic / think-tank / financier apologists, lackeys, toadies, apparatchiks and sycophants have several rather thin...

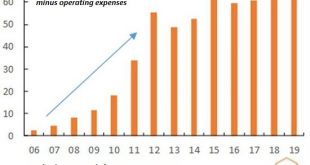

Read More »Our Wile E. Coyote Economy: Nothing But Financial Engineering

Ours is a Wile E. Coyote economy, and now we’re hanging in mid-air, realizing there is nothing solid beneath our feet. The story we’re told about how our “capitalist” economy works is outdated. The story goes like this: companies produce goods and services for a competitive marketplace and earn a profit from this production. These profits are income streams for investors, who buy companies’ stocks based on these profits. As profits rise, so do stock valuations. It’s...

Read More »The Fed’s Grand Bargain Has Finally Imploded

The Fed has backed itself not into a corner but to the edge of a precipice. Though the Federal Reserve never stated its Grand Bargain explicitly, their actions have spoken louder than their predictably self-serving, obfuscatory public pronouncements. Here’s the Grand Bargain they offered institutional investors and speculators alike: We’re taking away your low-risk, high-yield investments by slashing interest rates to near-zero, but we’re giving you endless asset...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org