Clearly, the Fed reckons the public is foolish enough to believe the Fed’s money will actually be “free.” It’s pretty much universally recognized that authorities use crises to impose “emergency powers” that become permanent. This erosion of civil and economic liberties is always sold as “necessary for your own good.” Of course the accretion of ever greater power in the hands of the few is for our own good. How could it be otherwise? (Irony off) In this environment...

Read More »Dollar Soft as Markets Await Fresh News and Rumours

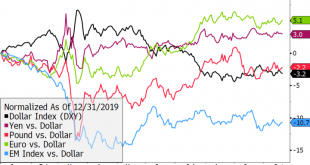

The dollar is coming under pressure again; markets are finally waking up to the fact that a stimulus deal before 2021 is unlikely; 10-year Treasury yields have been trading in a narrow range for months The quiet US data week continues; Ireland broke from the pattern of how other European countries are tightening mobility rules; Hungary is expected to keep the base rate steady at 0.60%. Japan reported September convenience store sales; dovish RBA remains dovish;...

Read More »Will the Stock Market Be Dragged to the Guillotine?

The Fed’s rigged-casino stock market will be dragged to the guillotine by one route or another. The belief that the Federal Reserve and its rigged-casino stock market are permanent and forever is touchingly naive. Never mind the existential crises just ahead; the financial “industry” (heh) projects unending returns of 7% per year, or is it 14% per year? Never mind the details, the Fed has our back and since the Fed is forever, so too will be the gains for everyone...

Read More »Drivers for the Week Ahead

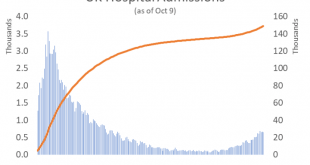

Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday Renewed virus restrictions are weighing on the economic outlook for the eurozone; no wonder ECB officials are sounding very...

Read More »EM Preview for the Week Ahead

Risk assets are coming off a tough week. The dollar was bid across the board except for the yen, which outperformed slightly. The only EM currencies to gain against the dollar were KRW and CLP. The major US equity indices somehow managed to eke out very modest gains but stock markets across Europe sank as the viral spread threatens to slam economic activity again. Yet we have seen time and time again that the safe haven bid for the dollar eventually gives way to...

Read More »Dollar Gains as Market Sentiment Goes South

Virus restrictions across Europe continue to sour sentiment; the dollar is benefiting from the risk-off backdrop The stimulus package is deader than Elvis; Fed manufacturing surveys for October will start to roll out; weekly jobless claims will be reported; Chile is expected to keep rates steady at 0.5% The unofficial deadline for Brexit has likely been extended; the two-day EU summit in Brussels starts today; Israel reports September CPI Australia reported September...

Read More »Why We’re Doomed: Our Delusional Faith in Incremental Change

Better not to risk any radical evolution that might fail, and so failure is thus assured. When times are good, modest reforms are all that’s needed to maintain the ship’s course. By “good times,” I mean eras of rising prosperity which generate bigger budgets, profits, tax revenues, paychecks, etc., eras characterized by high levels of stability and predictability. Since stability has been the norm for 75 years, institutions and conventional thinking have both been...

Read More »Dollar Bounce Remains Modest as Headwinds Build

The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country The EU recovery fund has hit some speed bumps; the Netherlands is the latest country to impose stricter measures; eurozone IP came in slightly lower than expected China reported strong money and...

Read More »Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today UK jobs data came in decidedly downbeat even though the furlough scheme has not yet ended; BOE Governor Bailey said that the bank is not yet ready to implement negative rates Japan will...

Read More »Our Simulacrum Economy

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society. The problem is this word perfectly describes the hollowed-out, rigged economy and social order we inhabit and so synonyms don’t quite cut it: it’s not the same as simulation or imitation or counterfeit. My...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org