Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the first essay, from June 2008. Thank you, Paul, for the suggestion. I’m not trying to be difficult, but I can’t help cutting against the grain on topics like surviving the coming bad times when my experience runs counter to the standard received wisdom. A common thread within most discussions of surviving bad times–especially really bad times–runs more or less...

Read More »Why Assets Will Crash

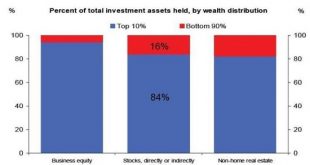

This is how it happens that boats that were once worth tens of thousands of dollars are set adrift by owners who can no longer afford to pay slip fees. The increasing concentration of the ownership of wealth/assets in the top 10% has an under-appreciated consequence: when only the top 10% can afford to buy assets, that unleashes an almost karmic payback for the narrowing of ownership, a.k.a. soaring wealth and income inequality: assets crash. Most of you are aware...

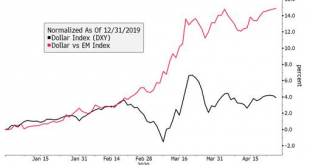

Read More »Dollar Remains Under Pressure as Europe Unveils Some Plans to Reopen

Global equity markets continue to trend higher; the dollar remains under pressure The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed Fitch cut Italy by a notch to BBB- with stable outlook; Germany reports April CPI Reports...

Read More »Some Thoughts on Recent Foreign Exchange Intervention

Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses. As April reserves data...

Read More »Restricted Market Trading Comments

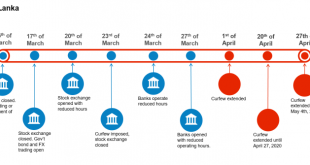

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot As the week commences, a few markets such as Sri Lanka and Philippines are extending their lockdown periods while others such as Nigeria and Kenya continue to experience USD liquidity issues. Please see comments below. Sri Lanka: The Colombo Stock Exchange (CSE) was expected to resume operations on April 27 but, due to an uptick in Covid-19 cases, the exchange remains closed until May 4. Foreign exchange trading is...

Read More »With Superfluous Demand in Free-Fall, What’s the Upside of Re-Opening a Small Business?

Since superfluous demand was the core driver of most consumer spending, and that demand is in free-fall, what’s the upside of re-opening? The mainstream view assumes everyone will be gripped by an absolutely rabid desire to return to their pre-pandemic frenzy of borrowing and spending and consuming, the more the better. While the urge to believe the Titanic scraping the iceberg will have no consequence and the collision was nothing but a spot of bother is compelling...

Read More »Dollar Remains Under Pressure as Risk-on Sentiment Persists

The death toll from the virus continues to trend lower in Europe and the US; the dollar remains under some pressure The Fed announced an expansion of its Municipal Liquidity Facility (MLF); regional Fed manufacturing surveys for April continue to roll out; other data will be reported Sweden kept rates and QE steady, as expected; Hungary is expected to stand pat too Oil prices are tumbling again Japan reported soft March jobs data; HKMA stepped up its intervention...

Read More »The Crash Has Only Just Begun

Everything, including a rational, connected-to-reality, effective financial system, is on back-order and unlikely to ship any time soon. While the stock market euphorically front-runs the Fed and a V-shaped recovery, the reality is the crash has only just begun. To understand why, look at income and debt. Income–earned and unearned–is in free-fall, while debt–which must be serviced by income–is exploding higher. Bailouts are not a permanent substitute for income. In...

Read More »Drivers for the Week Ahead

The FOMC meets Wednesday; first look at Q1 US GDP comes out Wednesday; weekly jobless claims Thursday are expected at 3.5 mln vs. 4.427 mln last week Italy dodged a bullet last Friday; ECB meets Thursday; eurozone reports Q1 GDP and April CPI data ahead of the ECB decision; Sweden’s Riksbank meets Tuesday BOJ meets Monday; Japan has a busy data week after the BOJ meeting The dollar continues to edge higher. On Friday, DXY traded at the highest level since April 6...

Read More »Thoughts on the Potential Market Impact of US Downgrades

Our sovereign rating model suggests the US will lose its AAA/Aaa rating. With fiscal stimulus efforts continuing with this latest $484 bln package, the case for downgrades just keep getting stronger but the timing is unclear. How might markets react? We look back to 2011 for some clues. RECENT DEVELOPMENTS The White House and House Democrats struck a deal on a new aid package worth $484 bln. The extra $500 bln amounts to about 2.5% of GDP. The IMF estimated...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org