Ours is a Wile E. Coyote economy, and now we’re hanging in mid-air, realizing there is nothing solid beneath our feet. The story we’re told about how our “capitalist” economy works is outdated. The story goes like this: companies produce goods and services for a competitive marketplace and earn a profit from this production. These profits are income streams for investors, who buy companies’ stocks based on these profits. As profits rise, so do stock valuations. It’s all win-win: consumers get competitively priced goods and services, workers have jobs producing goods and services and investors earn a return on their capital. Sadly, this is a fairy tale that no longer aligns with the reality that the U.S. economy is now a decaying billboard of “producing goods and

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Ours is a Wile E. Coyote economy, and now we’re hanging in mid-air, realizing there is nothing solid beneath our feet.

The story we’re told about how our “capitalist” economy works is outdated. The story goes like this: companies produce goods and services for a competitive marketplace and earn a profit from this production. These profits are income streams for investors, who buy companies’ stocks based on these profits. As profits rise, so do stock valuations.

It’s all win-win: consumers get competitively priced goods and services, workers have jobs producing goods and services and investors earn a return on their capital.

Sadly, this is a fairy tale that no longer aligns with the reality that the U.S. economy is now a decaying billboard of “producing goods and services” behind which the real money is made in financial engineering, a.k.a. legalized fraud. Take everyone’s favorite stock, Apple. The fairy tale is that Apple is in the business of making mobile phones and providing services to this customer base.

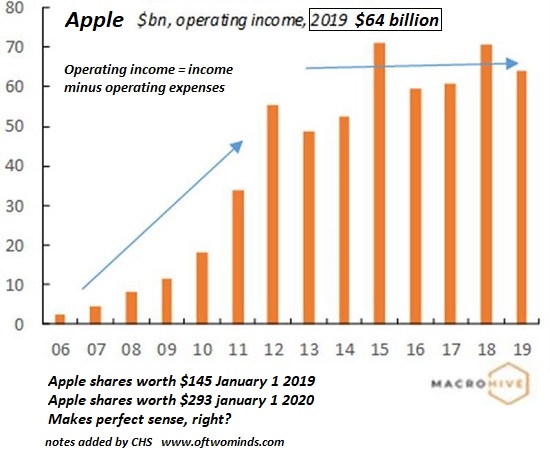

According to the fairy tale, Apple’s rise in value from $400 billion to $1.4 trillion is based on higher operating earnings, i.e. profits. But if we look at Apple’s operating earnings (see chart below), we see that they’ve been flat for years. So why is Apple worth $1 trillion more than it was a few years ago if profits haven’t risen, much less tripled?

The answer is financial engineering: Apple sells bonds that pay a paltry rate of return and then uses the proceeds from this debt (and most of its actual profits) to buy back its own shares–an astounding $338 billion over the past 7 years.

But look at the return on this legalized fraud: $338 billion added $1 trillion in “value” which can be sold by insiders to greater fools who believe the fairy tale.

All the “wealth” created by financial engineering / legalized fraud is fictitious, i.e. phantom. It’s based on leveraging debt and trickery, not on profits earned from producing goods and services. Virtually every “success” in America is not from producing goods and services; it’s based on leveraging debt, stock buybacks, asset bubbles, marketing (Facebook and Google) or skimming the thin layer of cream off the global supply chain (Walmart and Amazon).

Correspondent A.P. explained how the economy actually works in the following essay.

We humans don’t have the brain power to figure out the cause and effect of everything we do.

So, we create stories, shorthand rules of thumb that allow us, based on our previous observations, to predict how the world works.

When the predictive power of one of our stories fail, humans, being emotional rather than rational creatures, will bend over backward to make excuses for the story rather than telling ourselves that, in constructing the story, we ourselves were wrong.

Consistency bias is blindingly powerful.

* * *

I’m a physician.

When I quit my employer, I had certain knowledge that I was the highest producing employee of my class across five states.

Yet when I gave my notice, they didn’t bat an eye.

I also have certain knowledge that one year later my resignation led to a loss of $2 million of direct revenue from my labor that my employer would have otherwise captured.

That’s when I changed my paradigm.

I had been telling myself that my employer had wanted to purchase my labor.

What it turns out they wanted to purchase was my credibility.

Something they could get from anyone with an MD.

They wanted to use the foot traffic generated by the patients coming to see me to appreciate their real estate values.

They wanted to use my relationships to extract patient information for re-sale.

They wanted to use my name on the door to create the impression they were a healthcare company– tax exempt benefits and all.

The $2 million drop in their revenue meant nothing to them.

When I left, they simply shared my responsibilities among the remaining doctors, who in aggregate possessed enough credibility that the appreciation of commercial real estate, the sale of patient information, and the benefits of tax exemption continued unabated—dwarfing any revenue my labor could generate.

Then I realized that my former employer wasn’t special.

Today, virtually any public concern uses their ‘products’ as a similar ‘front.’

They’re not in the business of selling shoes, or oil changes, or makeup any more than banks are in the business of serving depositors or making loans.

They’re all in the business of financial engineering.

And because this business model requires access to capital markets, their ‘products’ are only there to create an impression that they’re actual businesses—enough so they can be plausibly sell their debt.

That’s why they don’t care if their stores get looted, or if they de-platform their most profitable users, the merchandise and revenue are nothing to them.

Being able to sell debt instruments and distribute the proceeds to the organization’s ‘keys to power’ (see The Rules for Rulers 18 min.) is the only thing that matters (and maybe some government subsidies on top).

These companies will borrow and distribute, borrow and distribute until there is nothing left to leverage and the last holders of debt are left holding the bag—usually to be bailed out by Federal Reserve-printed dollars.

Then the leadership will move on to the next business, rewarded not for being shrewd businessmen but for being excellent wealth extractors and financial engineers.

When money is created without the creation of value, the financial reward of building a business by selling something for a profit is nothing compared to the rewards of using that same business to extract wealth through selling debt until nothing is left.

One could argue, in fact, that the virtue signaling we’re now seeing actually improves corporate access to the tools of financialization.

That’s why these public companies will definitely rebuild in the affected cities, though their efforts will be carried under their marketing budgets.

Debt vehicles with the aura of social approval command a premium.

The same paradigm can be applied to government at all levels, right down to school boards.

These organizations function as a front for the skim.

Public service unions, individual office holders, regulators waiting for their turn at getting hired by those whom they regulate . . .

All are in on it.

They all dip their beaks in the stream of confiscated money while generating no value in return.

The edifice of government simply provides just enough of a front so taxes can be collected to fund the skim without effective push back from the tax donkeys who pay.

This paradigm can be viewed as terribly cynical, but it does seem to explain everything that’s happening, and it hasn’t failed me yet.

Dollars have no value therefore value creation is not needed to gain them.

What’s needed is access to the system through which the printed dollars flow, while not being so blatant that folks have to tell themselves a new story—one in which real value is actually needed if one wants to acquire currency.

|

Current events are testing the limits people can be pushed to gaslight themselves. Why pay taxes if the police won’t protect your business? Why purchase a product whose manufacturer hectors you before you buy? Is it because of a personal failing I wasn’t aware of? Or is it because the world doesn’t work the way I’ve been telling myself it does? Experience teaches that while the limits of human self-delusion are immense, they’re still finite. Experience also teaches that when those limits are reached, the transition to a new story can be politely described as harsh. Plan accordingly. Cultivate what creates real value in your life. Invest in your own social capital. And remember: The bad chases out the good. First in money . . . |

Apple operating income, 2006-2019 |

| Then in everything else.

Thank you, A.P. for explaining how “business” is just a front for the sausage-making of debt, fraud and bailouts when the fraud unravels. Ours is a Wile E. Coyote economy, and now we’re hanging in mid-air, realizing there is nothing solid beneath our feet. Gravity is about to take control, regardless of whatever fraud the Federal Reserve bails out and papers over. It’s wrenching and painful to accept this reality; the fairy tale was so much more Hollywood. But there can’t be a Hollywood ending for an economy based on the phantom “wealth” of debt, leverage, Fed free money for financiers, stock buybacks, collateralization scams and marketing skims. When all the skims, scams and frauds crash to Earth, it won’t be a cartoon. It’s all fun and games until the phantom capital evaporates; please review The Looming Bank Collapse The U.S. financial system could be on the cusp of calamity. This time, we might not be able to save it. |

|

Tags: Featured,newsletter