There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities. RECENT DEVELOPMENTS Back in April, the WTO set forth two distinct pandemic scenarios for world trade. The “relatively optimistic” scenario sees a sharp -12.9% decline in trade volume this year followed by a recovery starting in H2 that leads to 21.3% growth in trade volume next year. The “more pessimistic” scenario sees an even steeper -31.9% drop this year followed by a more prolonged and incomplete recovery that leads to 24.0%

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

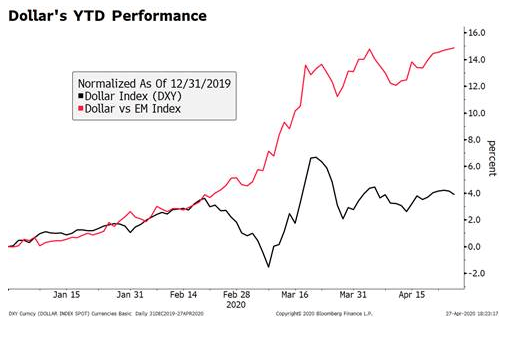

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities.

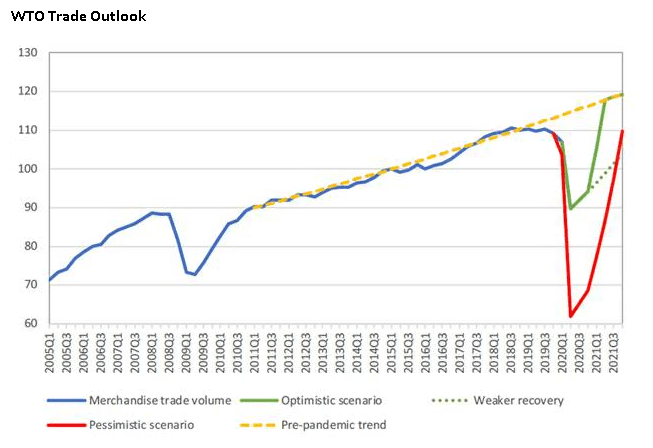

RECENT DEVELOPMENTSBack in April, the WTO set forth two distinct pandemic scenarios for world trade. The “relatively optimistic” scenario sees a sharp -12.9% decline in trade volume this year followed by a recovery starting in H2 that leads to 21.3% growth in trade volume next year. The “more pessimistic” scenario sees an even steeper -31.9% drop this year followed by a more prolonged and incomplete recovery that leads to 24.0% growth next year. It’s worth noting that global trade volume was already slowing before the pandemic, declining -0.1% in 2019 following 2.9% growth in 2018. The WTO recently updated its global trade outlook. It reported that world trade contracted -3% y/y in Q1, while initial estimates for Q2 indicate trade contracted -18.5% y/y. The WTO noted that “In light of available trade data for the second quarter, the April forecast’s pessimistic scenario, which assumed even greater health and economic costs than what had transpired, appears less likely, since it implied sharper declines in the first and second quarters.” Furthermore, the WTO added that “As things currently stand, trade would only need to grow by 2.5% per quarter for the remainder of the year to meet the optimistic projection.” So much for the good news. |

WTO Trade Outlook, 2005-2021 |

| The bad news is that the WTO warned of significant risks ahead. It noted that “looking ahead to 2021, adverse developments, including a second wave of COVID‑19 outbreaks, weaker than expected economic growth, or widespread recourse to trade restrictions, could see trade expansion fall short of earlier projections.” This possibility is illustrated by the dotted green line in the chart, which would see trade growth come in at closer to 5% in 2021 compared to the 21.3% seen in the optimistic scenario. This would leave global trade volumes below the pre-pandemic trajectory for a much longer time. Recent viral outbreaks suggest that this in-between scenario is becoming more likely.

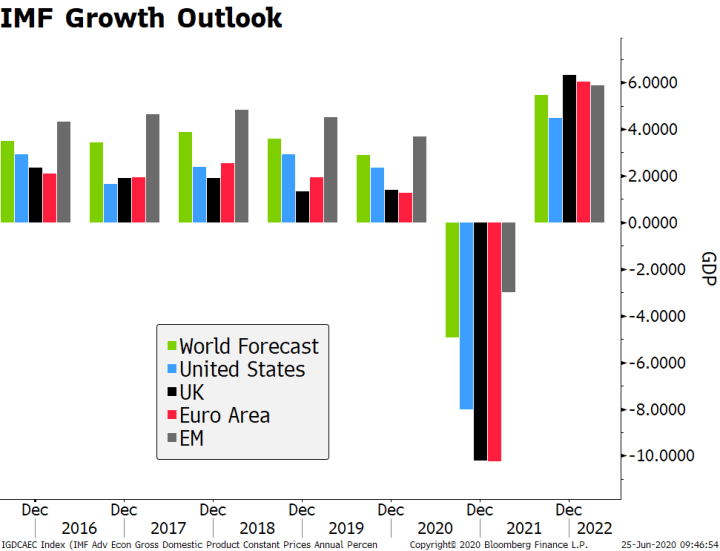

The IMF released more pessimistic global growth forecasts this week. The agency now sees a global contraction of -4.9% this year vs. its forecast of -3% contraction back in April. The IMF now sees 5.4% growth next year vs. 5.8% previously. As we expected, the IMF moved closer to the OECD, which sees -6% global contraction this year and 5.2% growth next year. Chief Economist Gopinath stressed there is a high degree of uncertainty in both directions. The US is forecast to have a shallower decline this year (-8.0%) compared to the UK and euro area but increase by less next year (4.5%). One of fund’s key message was that “in the absence of a medical solution, the strength of the recovery is highly uncertain and the impact on sectors and countries uneven.” Reports suggest the US is preparing to impose new tariffs against the EU. The proposed tariffs are to the tune of $3.1 bln that target exports from France, Germany, Spain, and the UK across a range of products. It is related to the longstanding US-EU fight over aircraft subsidies that began with a US complaint back in (believe it or not) 2004. The EU quickly filed a counter-claim that the US engaged in similar activity with Boeing. After a long and convoluted path, the WTO last fall authorized the US to retaliate against $7.5 bln of EU exports annually (vs. $11 bln requested by the US). The WTO also ruled last year that the US also engaged in unfair subsidies to Boeing. It is expected to authorize a similar retaliation for the EU on $11.2 bln of US exports annually. The two sides signaled a willingness to reach a negotiated settlement but talks broke down and now here we are facing a tit-for-tat tariff situation. |

IMF Growth Outlook, 2016-2022 |

INVESTMENT OUTLOOK

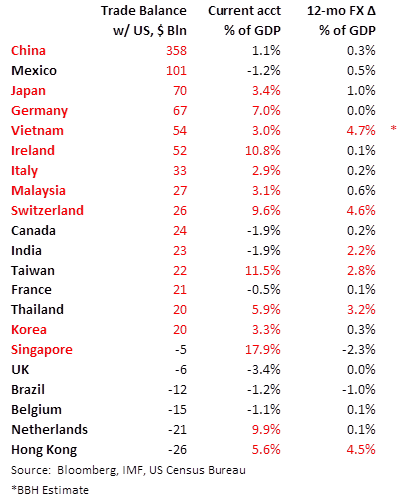

Rising trade tensions and a more uncertain economic outlook warrant some caution on the part of investors. The huge liquidity story and some improving economic data have fed into quite a nice little risk rally this month. EM equities in particular did well in June after stalling out in April and May. However, it’s clear that H2 will be more difficult. Texas has had to halt its phased reopening as virus numbers in the state spike. Many other states and countries are also grappling with renewed outbreaks and so the global economy is unlikely to return to normal anytime soon, making the WTO’s warning about 2021 even more prescient. Export-oriented countries would suffer more in this scenario, to state the obvious. This includes much of EM, as well as DM exporters such as Germany, Hong Kong, and Singapore.

A BRIEF HISTORY LESSON

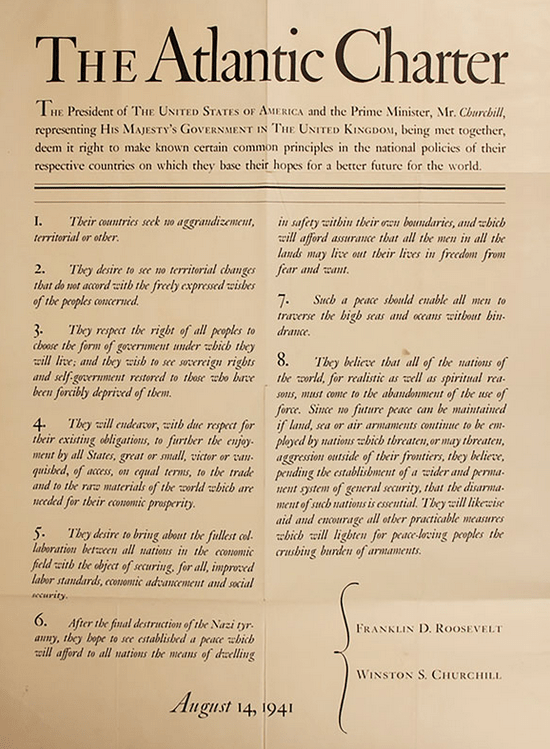

On August 4, 1941, Winston Churchill and Franklin Delano Roosevelt held a secret meeting off the coast of Newfoundland, Canada. WWII was raging, with Russia having invaded Russia just six weeks earlier but and Churchill risking attacks by German U-boats as he sailed their on the battleship HMS Prince of Wales. FDR arrived on the heavy cruiser USS Augusta. The US had yet to enter the war, but the two leaders agreed on the so-called Atlantic Charter at that meeting. Clauses 1, 6, and 8 refer to the immediate wartime goals of establishing peace and defeating Nazi tyranny.

However, Clauses 4 and 5 were focused purely on economic goals. Clause 4 sought “to further the enjoyment by all States, great or small, victor or vanquished, of access on equal terms, to the trade and to the raw materials of the world which are needed for their economic prosperity.” Clause 5 sought “the fullest collaboration between all nations in the economic field with the object of securing, for all, improved labour standards, economic advancement and social security.”

It was clear that Churchill and FDR saw the importance of economic collaboration in helping to maintain an enduring peace. Churchill explicitly stated later that “instead of trying to ruin German trade by all kinds of additional trade barriers and hindrances, as was the mood in 1917, we have definitely adopted the view that it is not in interests of the world” that any “nation should be unprosperous or shut out from the means of making a decent living for itself and its people by industry and enterprise.”

We saw a similar focus on economic integration in postwar Europe. The European Coal and Steel Community was created by the Treaty of Paris in 1951. Original member states Belgium, France, Italy, Luxembourg, and West Germany sought to create a common market for coal and steel amongst its members to minimize the competition for natural resources. The ECSC was the first step to regional integration, which in the immediate postwar was meant primarily to prevent further wars in Europe by increasing economic interdependence. The ECSC morphed into the European Economic Community (EEC) in 1957 with the passage of the Treaty of Rome that created a customs union. The European Union was created in 1993 by the Maastricht Treaty. This regional integration was complemented by greater global integration as well.

Most observers know of the Bretton Woods Conference of July 1944. Even though WWII was still raging, forward-looking policymakers were already trying to set forth a postwar international monetary system. The International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD and later part of the World Bank group) were created at Bretton Woods. What gets less attention is the General Agreement on Tariffs and Trade (GATT), which came in 1947 at a conference in Geneva. It was signed by 23 nations in October and went into effect on January 1, 1948. This initial agreement contained 45,000 tariff concessions affecting $10 bln worth of trade. In the decades since, subsequent rounds led to further tariff reductions.

The World Trade Organization (WTO) replaced the GATT effective January 1, 1995. 123 nations signed the so-called Marrakesh Agreement that ended the 8-year long Uruguay Round. This round covered wider aspects of trade, including trade in services, intellectual property, and technical barriers to trade. Perhaps most importantly, the WTO was created with a more efficient and legally binding mechanism to resolve trade disputes. And that is where we stand now.

Tags: Articles,developed markets,Emerging Markets,Featured,newsletter