Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works Brazil announced a slew of new easing measures to improve liquidity conditions in local credit markets; Mexico reports mid-June CPI Germany’s June IFO survey came in on the stronger side of forecasts; Austria issued the second 100-year bond in its history and it was very well received Czech Republic is expected to keep rates steady at 0.25%; Hungary surprised with a 15 bp cut yesterday The BOJ’s initial emergency

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US

- The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works

- Brazil announced a slew of new easing measures to improve liquidity conditions in local credit markets; Mexico reports mid-June CPI

- Germany’s June IFO survey came in on the stronger side of forecasts; Austria issued the second 100-year bond in its history and it was very well received

- Czech Republic is expected to keep rates steady at 0.25%; Hungary surprised with a 15 bp cut yesterday

- The BOJ’s initial emergency response to the pandemic appears to be over; RBNZ delivered a dovish hold; Thailand kept rates steady at 0.5%, as expected

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU. The proposed tariffs are to the tune of $3.1 bln targeting exports from France, Germany, Spain and the UK, in a range of products. It is related to the ongoing US-EU fight over aircraft subsidies, which the WTO said both engage in. Last fall, the WTO authorized the US to retaliate against $7.5 bln of EU exports due to what it ruled as illegal subsidies to Airbus. The WTO is expected to authorize a similar retaliation for the EU on $11.2 bln of US exports in a separate but related case over US subsidies to Boeing. As we’ve noted many times before, this is not the time to engage in a trade war and simply cannot believe that the WTO can’t come up with a better solution.

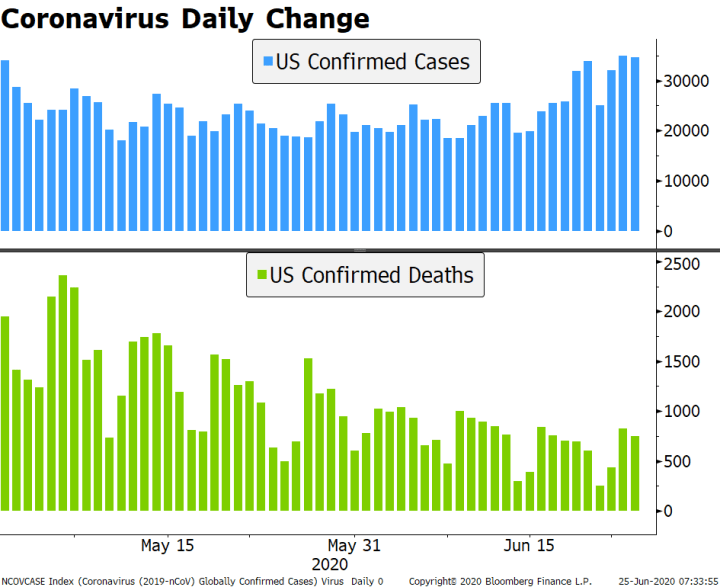

| There’s also been a messy set of headlines regarding the virus contagion outlook in the US. The country’s top health official, Anthony Fauci, sounded cautious as numbers worsen in several states – specifically Arizona, Texas, California, and Florida. The governor of Texas, however, reversed his previous position by suggesting the state won’t reimpose lockdown. In the UK, meanwhile, a large group of medical professionals wrote an open letter to the government warning that “the available evidence indicates that local flare-ups are increasingly likely and a second wave a real risk.”

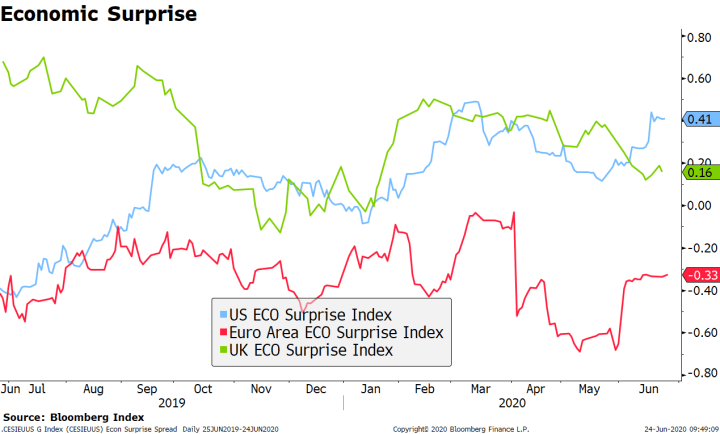

On the other hand, economic data has come in on the stronger side of expectations, at least in the US and the euro area (though not so much in the UK). This suggests that some of the pessimism built in during the depths of the pandemic was overdone. It is also a testament to the vigor with which governments and central banks around the world have reacted. But most importantly, we expect the recovery to continue because we believe that the balance of risks between economic and medical priorities has shifted in favor of the former. This means that despite the localized resurgence of Covid-19 case, the bar is very high for widespread lockdowns to be re-instated. However, if virus numbers deteriorate significantly, we would expect to see self-imposed lockdowns that would likely lead to pockets of dampened economic activity. |

Economic Surprise, 2019-2020 |

The IMF will release updated global growth forecasts today. The agency has already signaled that its view will be downgraded again from its April global forecast of -3% contraction this year and 5.8% growth next year. We expect it will move closer to the OECD, which sees -6% global contraction this year and 5.2% growth next year.

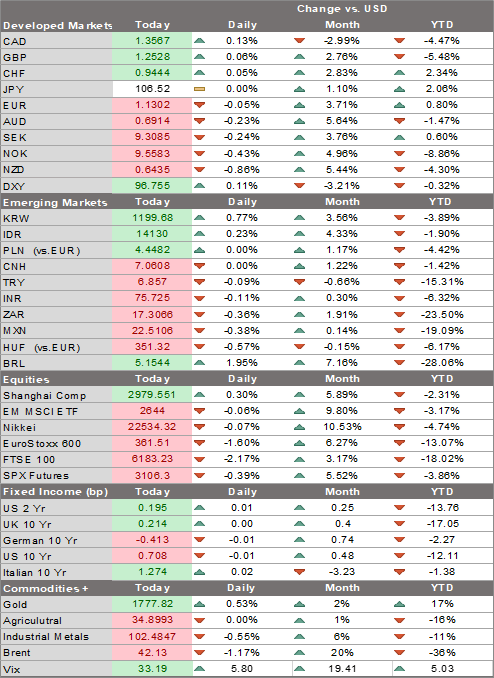

The dollar is benefiting from risk-off sentiment. DXY traded yesterday at the lowest level since June 11 but has since recovered. The euro is trading heavy near $1.13, while sterling is holding above $1.25 and so the EUR/GBP cross is soft and approaching the 0.90 level. With risk-off sentiment prevailing USD/JPY remains heavy after it traded yesterday at the lowest level since May 7 near 106.

AMERICAS

Another round of fiscal stimulus in the US is in the works. Treasury Secretary Mnuchin said the next package could be passed in July. He met with Republican Senators yesterday. Senate Majority Leader McConnell has indicated that the matter will be addressed when Congress returns from its recess in late July. Reports suggest Republicans remain split on the need for more stimulus and so negotiations may stretch into August. Any hint of delay would hurt market sentiment, as expectations have priced in more stimulus. There are no US data reports today. Bullard and Evans speak.

The Brazilian Central Bank (BCB) announced a slew of new easing measures to improve liquidity conditions in local credit markets. This includes lowering the reserve requirement on savings deposits conditional on using the funds towards SME, along with specific capital requirement reductions for smaller banks. The BCB estimated this could lead to up to 2.1% of GDP in credit expansion. In addition, the bank announced a line of credit to help home owners and provided more details on its secondary market bond purchase program. Like the case of other EM central bank purchases, these are liquidity-focused programs to help iron out distortions that may appear along the curve.

Mexico reports mid-June CPI. Headline inflation is expected at 3.06% y/y vs. 2.83% y/y in mid-May. If so, inflation would be the highest since March and back in the top half of the 2-4% target range. There appears to be some inflation pass-through from the weak peso. Banco de Mexico then meets Thursday and is expected to cut rates 50 bp to 5.0%, as the focus remains on boosting the economy.

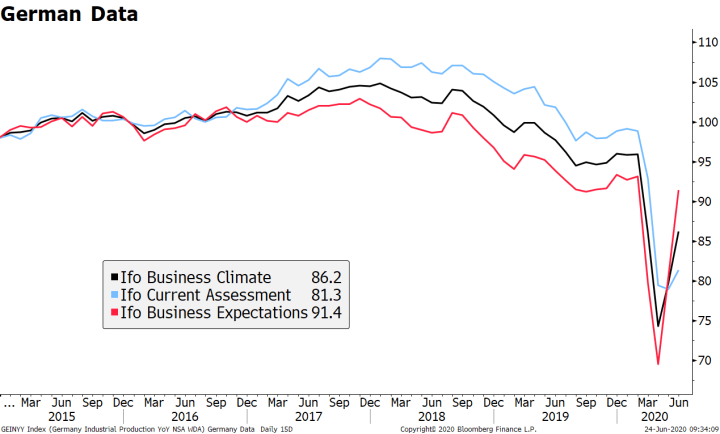

EUROPE/MIDDLE EAST/AFRICAGermany’s June IFO survey came in on the stronger side of forecasts. The key expectations component bounced back to 91.4 compared to 87.0 expected and 80.1 in May. The overall business climate and current assessment components also improved to 86.2 and 81.3, respectively. This reinforces our view that the German government’s response, including a material easing of fiscal restraint, has been effective and will continue to support the economy. Austria issued the second 100-year bond in its history and it was very well received. The €2 bln issues received over €13 bln in orders and came in with a yield of just under 1.0%. Whatever the outlook for the economy and fixed income markets, this is a remarkable feat. |

German Data, 2015-2020 |

| Czech National Bank is expected to keep rates steady at 0.25%. The bank last cut rates 75 bp to 0.25% in early May. Governor Rusnok signaled no urgent need for further easing after that cut, but also acknowledged that low rates will be maintained “for a long time.” Since that last cut, the koruna has strengthened around 2.5%, which takes back much of the impact of that last cut. The bank’s models suggest that a 1% move in the currency is equivalent to a 25 bp move in interest rates.

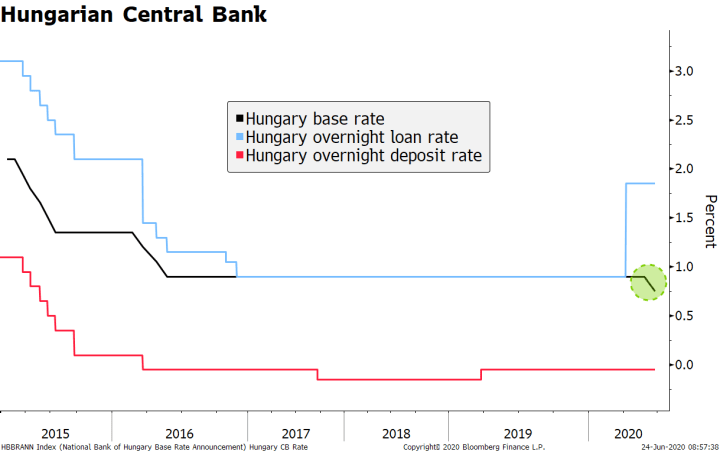

Hungary central bank (NBH) surprised markets with a 15 bp cut to the base rate yesterday to 0.75%. This was the first in four years, and this fine-tuning move was designed to bring rates “a step closer towards” to the levels of its neighbors. Recall that the NBH kept the base rate on hold during the pandemic, though it did engage in several other easing measures, including a bond purchase program. This probably implies a re-balancing of the government’s strategy to start moving closer to conventional tools and reducing emphasis on QE. As such, we should expect more easing ahead, possibly in the bank’s other rates. But for now, the deposit rate remains at -0.05%, while the overnight and one-week collateralized lending were left at 1.85%. South Africa will present its emergency budget today. Yields have been climbing this month on expectations that the fiscal trajectory will worsen further as the result of the pandemic. Government forecasts are widely expected to reflect this new reality. Earlier, South Africa May CPI came in as expected with headline inflation falling to 3.0% y/y from 4.1% in April. This was the lowest since September 2010 and right the bottom of the 3-6% target range. March retail sales will be reported shortly and are expected to rise 1.9% y/y vs. +2.0% in February. Next SARB policy meeting is July 23 and another rate cut is expected then. |

Hungarian Central Bank, 2015-2020 |

ASIAThe summary from last week’s Bank of Japan meeting suggests that the initial emergency response to the pandemic is over. However, policymakers stand ready to do more as needed. Many board members felt it was time to pause and gauge the impact of measures taken by the bank since March. Yet several pointed to ongoing deflation risks, while others were concerned about a possible rise in business bankruptcies that “may have a negative impact on employment, prices, and finance.” Next policy meting is July 15 and no change in policy is expected then. The RBNZ kept rates steady at 0.25%, as expected. Here too, the bank is clearly on hold for now. However, the bank said it was ready to provide more stimulus “as necessary.” It noted that besides possibly expanding its asset purchases, “it continues to prepare for the use of additional monetary policy tools as needed.” Furthermore, the bank did not reaffirm its previous guidance that the policy rates would remain at current levels until at least March 2021. Lastly, the RBNZ said that recent NZD appreciation has placed further pressure on exports and damped the outlook for inflation. May trade data will be reported Thursday. Bank of Thailand kept rates steady at 0.5%, as expected. It last cut rates 25 bp to 0.5% in late May but signaled steady rates were now likely for the time being. The bank cut its GDP forecast for this year to -8.1% from -5.3% in March but raised its forecast for next year to 5% from 3% previously. It again expressed concern about the strong baht. As such, the bank is likely to continue jawboning the exchange rate and perhaps take some action to weaken the baht in the coming weeks. |

Tags: Articles,Daily News,Featured,newsletter