The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient “saves” of a system that is unraveling due to its fragility and brittleness. There are two standard-issue narratives about the Federal Reserve’s agenda: the Fed’s official narrative is that the Fed’s mandate is to keep inflation under control while promoting full employment. The unofficial mandate that’s obvious to...

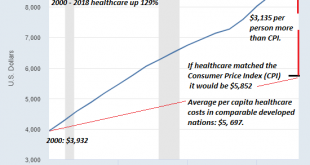

Read More »Sickcare is the Knife in the Heart of Employment–and the Economy

We need to change the incentives of the entire system, not just healthcare, but if we don’t start with healthcare, that financial cancer will drag us into national insolvency all by itself. American Healthcare is a growth industry in the same way cancer is a growth industry: both keep growing until they kill the host, which in the case of healthcare is the U.S. economy. While a great many individuals in the system care about improving the health of their patients,...

Read More »Why Wage Inflation Will Accelerate

The Fed has created trillions out of thin air to boost the speculative wealth of Wall Street, but it can’t print experienced workers willing to work for low wages. The Federal Reserve is reassuring us daily that inflation is temporary, but allow me to assure you that wage inflation is just getting started and will accelerate rapidly. As I noted yesterday, the Fed can create currency out of thin and funnel it to financiers, but the Fed can’t create experienced,...

Read More »The ‘Take This Job and Shove It’ Recession

So hey there Corporate America, the Fed and your neofeudal cronies: take this job and shove it. This time it really is different, but not in the way the Wall Street shucksters are claiming. Conventional economists, politicos and pundits are completely clueless about the unraveling that’s gathering momentum beneath the superficial surface of “reflation” because they don’t yet grasp we’re entering an unprecedented new type of recession: a ‘Take This Job and Shove...

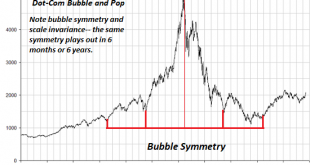

Read More »Here’s How ‘Everything Bubbles’ Pop

But weirdly, and irrationally, bubbles pop anyway. At long last, the moment you’ve been hoping for has arrived: you’re pitching your screenplay to a producer. Your agent is cautious but you’re confident nobody else has concocted a story as outlandish as yours. Your agent gives you the nod and you’re off and running: Writer: Two guys start a cryptocurrency as a joke to parody the crypto craze, and they name it KittyCoin. It goes nowhere but then the greatest...

Read More »Hey Fed, Explain Again How Making Billionaires Richer Creates Jobs

Despite their hollow bleatings about ‘doing all we can to achieve full employment’, the Fed’s policies has been Kryptonite to employment, labor and the bottom 90%–and most especially to the bottom 50%, the working poor that one might imagine most deserve a leg up. As wealth and income inequality soar to new heights thanks to the Federal Reserve’s policies of zero interest rates, money-printing and financial stimulus, the Fed says its goal is to create more jobs....

Read More »What’s Yours Is Now Mine: America’s Era of Accelerating Expropriation

The takeaway here is obvious: earn as little money as possible and invest your surplus labor in assets that can’t be expropriated. Expropriation: dispossessing the populace of property and property rights, via the legal and financial over-reach of monetary and political authorities. All expropriations are pernicious, but the most destructive is the expropriation of labor’s value while the excessive gains of unproductive speculation accrue to the elite that owns...

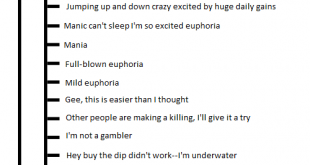

Read More »The Only Way to Get Ahead Now Is Crazy-Risky Speculation

It’s all so pathetic, isn’t it? The only way left to get ahead in America is to leverage up the riskiest gambles. It’s painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin? The obvious answer is because others have reaped a decade or two of wages in a few weeks, and...

Read More »If You Don’t See Any Risk, Ask Who Will “Buy the Dip” in a Freefall?

Nobody thinks a euphoric rally could ever go bidless, but as Greenspan belatedly admitted, liquidity is not guaranteed. The current market melt-up is taken as nearly risk-free because the Fed has our back, i.e. the Federal Reserve will intervene long before any market decline does any damage. It’s assumed the Fed or its proxies, i.e. the Plunge Protection Team, will be the buyer in any freefall sell-off: no matter how many punters are selling, the PPT will keep...

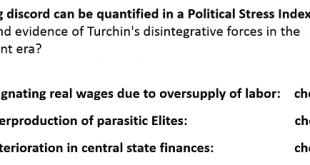

Read More »America’s Fatal Synergies

America’s financial system and state are themselves the problems, yet neither system is capable of recognizing this or unwinding their fatal synergies. why do some systems/states emerge from crises stronger while similar systems/states collapse? Put another way: take two very similar political-social-economic systems/nation-states and two very similar crises, and why does one system not just survive but emerge better adapted while the other system/state fails? The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org