Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out Fitch cut Canada’s rating by a notch to AA+ with stable outlook; Mexico is expected to cut rates 50 bp to 5.0%; Brazil central bank releases its quarterly inflation report The ECB announced a new euro liquidity facility for central banks outside the euro area; its account of the June meeting will be released Turkey is expected to cut rates 25 bp to 8.0%; Philippine central bank unexpectedly cut rates 50 bp to

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

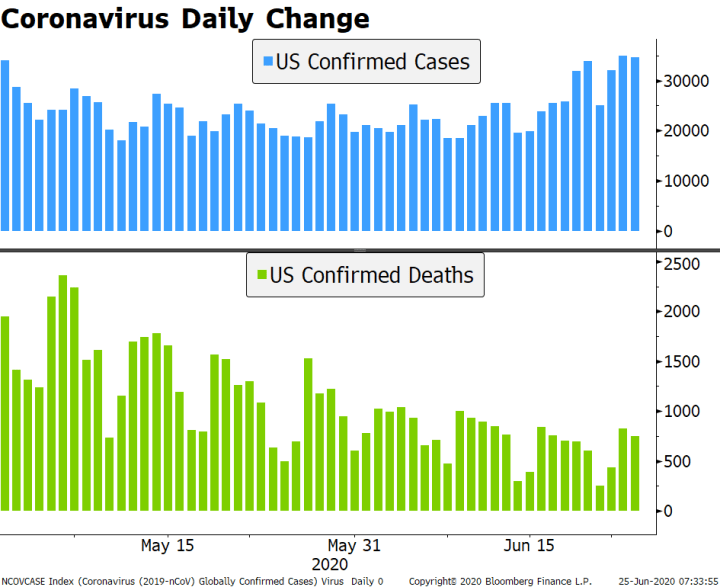

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets. Texas, California, and Florida recorded record daily increases. Hospital occupancy in some areas (especially in Texas) continue to increase, but we haven’t yet got a similar increase in death rates from this recent spike. There has also been a flareup in new daily cases in Australia, but the numbers (sub-40 in total) are comparatively small. Increased infections in India also looks worrying. |

Coronavirus Daily Change, 2020 |

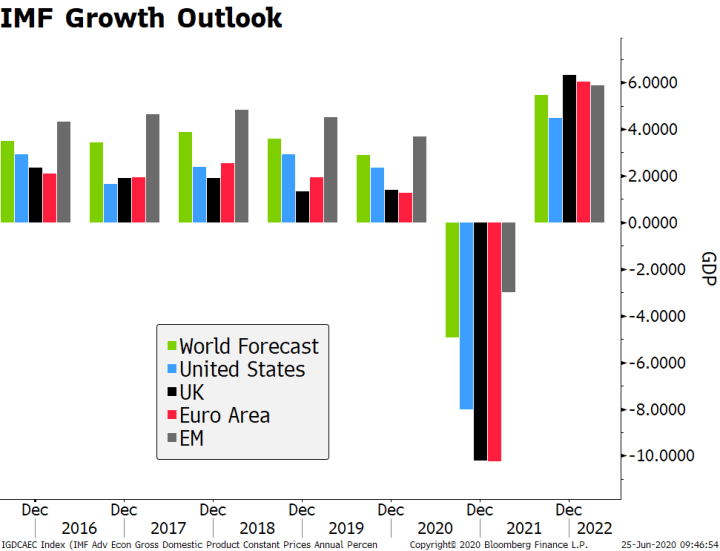

| The IMF released more pessimistic global growth forecasts yesterday. The agency now sees a global contraction of -4.9% this year vs. its forecast of -3% contraction back in April. The IMF now sees 5.4% growth next year vs. 5.8% previously. As we expected, the IMF moved closer to the OECD, which sees -6% global contraction this year and 5.2% growth next year. Chief Economist Gopinath stressed there is a high degree of uncertainty in both directions. The US is forecast to have a shallower decline this year (-8.0%) compared to the UK and euro area but increase by less next year (4.5%). One of fund’s key message was that “in the absence of a medical solution, the strength of the recovery is highly uncertain and the impact on sectors and countries uneven.” |

IMF Growth Outlook, 2016-2022 |

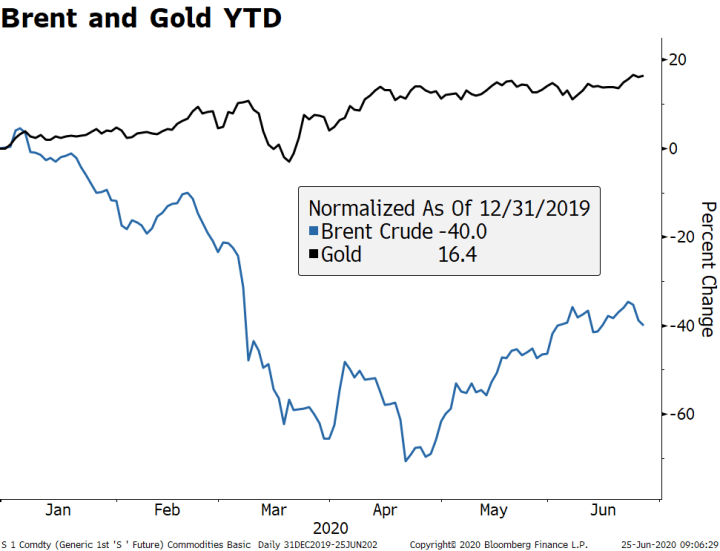

| Commodity markets saw a significant divergence in the fortunes of crude and gold over the last few days, and this year. Gold is up about 1.5% on the week and over 15% on the year. Even with no inflation in sight, the unprecedented monetary stimulus supports the bullish case for gold as an inflation hedge, especially with Treasury yields so low. Elsewhere, Brent oil has fallen nearly 7% on the week and remains 40% lower on the year, despite the strong bounce from the April lows. The move seems to be mostly due to the resurfacing economic concerns from increased infection rates but has also been weighed down by rising US inventories.

The dollar continues to edge higher, helped by risk-off sentiment despite improving US data. DXY is trading at the highest level since Monday and is on track to test that day’s high near 97.739. DXY has retraced over a third of its May-June drop and a break of the 98.348 area is needed to set up a test of the May 25 high near 99.975. The euro remains heavy and is likely to test Monday’s low near $1.1170. Sterling is struggling to stay above $1.25, while risk-off sentiment has not prevented USD/JPY from trading at the highest level since June 17 near 107.30. |

Brent and Gold YTD, 2020 |

AMERICAS

The US has rekindled trade provocations against China through Huawei. The Pentagon placed the company, along with technology manufacturer Hangzhou Hikvision, on a list of companies linked to China’s military.

The move seems mostly symbolic but might be seen a preliminary step for more sanctions. This follows yesterday’s sanctions spat with the EU. It’s hard to believe President Trump will escalate trade conflicts much further from here, given the already negative backdrop. It’s still quite possible that he becomes even more confrontational in the coming months in an effort to boost his support, but if markets react badly, this strategy will have to be rethought.

Weekly jobless claims will be reported. Initial claims are expected at 1.32 mln vs. 1.508 mln last week. Continuing claims are reported with a one-week lag. This week’s reading for the survey week containing the 12th of the month is expected at 20 mln vs. 20.544 last week. Continuing claims fell -4.1 mln during May’s survey week, which suggested that markets were being too pessimistic about May jobs data. With current consensus for June nonfarm payrolls at 3.0 mln vs. 2.509 mln in May, today’s continuing claims data may suggest that markets are being too optimistic about June.

The regional Fed manufacturing surveys for June will continue to roll out. Kansas City reports today and is expected at -3 vs. -19 in May. Earlier this week, Richmond Fed came in at 0 vs. -2 expected and -27 in May while last week, the Philly Fed survey came in at +27.5 vs. -21.4 expected and -43.1 in May while the Empire survey came in at -0.2 vs. -29.6 expected and -48.5 in May. Today also sees May advance goods trade (-$68.1 bln expected), wholesale (0.4% mm expected) and retail inventories (-2.8% m/m expected), and durable goods orders (10.5% m/m expected). Another revision to Q1 GDP (seen steady at -5.0% SAAR) will also be reported. Kaplan and Bostic speak.

Fitch cut Canada’s rating by a notch to AA+ with stable outlook. The agency said the move “reflects the deterioration of Canada’s public finances in 2020 resulting from the coronavirus pandemic.” The loss of AAA status (granted in August 2004) is a huge blow but not entirely surprising. As we noted in our DM Sovereign Rating Model For Q2 2020, “Australia’s implied rating is right on the cusp of moving into AA+ territory, whilst Canada’s is getting somewhat close to that threshold. There are no ratings implications here yet, but bears watching.” More sovereign downgrades are expected across both DM and EM as the costs of fighting the pandemic mount.

Banco de Mexico is expected to cut rates 50 bp to 5.0%. Mid-June CPI came in higher than expected yesterday, with headline inflation at 3.17% y/y vs. 3.06% expected and 2.83% y/y in mid-May. This is the highest since March and back in the top half of the 2-4% target range, as there appears to be some inflation pass-through from the weak peso. Despite rising inflation, we believe the bank remains on its easing path as the focus remains on boosting the economy.

Brazil central bank releases its quarterly inflation report. COPOM cut rates 75 bp to 2.25% last week and has signaled potential for one last cut. CDI market is pricing in decent odds of a 25 bp cut to 2.0% at the next policy meeting August 5. Mid-June IPCA inflation will also be reported today and is expected at 1.85% y/y vs. 1.96% in mid-May. If so, inflation would be the lowest since January 1999 and further below the 2.5-5.5% target band.

EUROPE/MIDDLE EAST/AFRICA

The ECB announced a new euro liquidity facility for central banks outside the euro area. The press statement described it as a “precautionary” line for “a broad set of central banks against adequate collateral, consisting of euro-denominated marketable debt securities issued by euro area central governments and supranational institutions.” We have not seen any significant euro funding issues to date but commend the ECB for taking a pre-emptive approach.

The ECB releases its account of the June meeting. At that meeting, the bank boosted its PEPP by EUR600 bln. Reports suggest that this account will also contain a defense of its asset purchase program in response to the recent German court ruling. In addition, the ECB will also hand over redacted documents that it had already provided to the European Court of Justice in 2018 justifying the program. In related news, the German constitutional court just rejected another challenge to asset purchases, on the grounds that the lawsuit directly targeted the ECB instead of the Bundesbank and that the arguments were not sufficiently substantial.

Turkey central bank is expected to cut rates 25 bp to 8.0%. However, the market is split as a couple of analysts see no cut and several see a 50 bp cut. CPI rose 11.39% y/y, well above the 3-7% target range. However, this shouldn’t prevent another cut as inflation has remained above target for this entire easing cycle. Policymakers remain solely focused on boosting growth.

ASIA

Philippine central bank unexpectedly cut rates 50 bp to 2.25%. The market was looking for a 25 bp cut but was split as many analysts saw no cut and only one saw a 50 bp cut. It raised its 2020 and 2021 inflation forecasts both by a tick to 2.3% and 2.6%, respectively. Note CPI rose 2.1% y/y in May vs. 2.2% in April, the lowest since November and nearing the bottom of the 2-4% target range. The bank last cut rates 50 bp to 2.75% back in April. Given the strong peso and disinflationary forces in play, we understand why the bank delivered a dovish surprise. Further easing is likely in H2, but the bulk of the cuts are likely behind us.

Tags: Articles,Daily News,Featured,newsletter